How Oracle has made Sun rise again

Changes in the Sun Microsystems hardware business are reaping rewards

It's been six months since Oracle finalised its acquisition of Sun Microsystems and with the latest quarterly results showing that Sun turned a profit for the first time in more than a year, Oracle appears to breathing new life into the company.

Oracle first announced its intention to buy Sun for $7.4bn back in April 2009 but it wasn't until the European Commission gave the go-ahead in January 2010 that the deal was completed.

Through the deal, Oracle acquired the Java software language that underpins its Fusion middleware, as well as the Solaris open source operating system and open source database technology MySQL. The deal also saw Oracle acquire Sun's hardware business including servers, storage and desktop workstations.

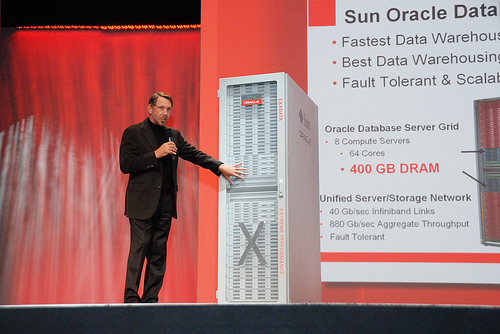

Oracle's CEO Larry Ellison shows off the Exadata Database Machine, one of the first fruits of Oracle's acquisition of Sun

(Photo credit: Oracle)

According to Oracle's latest quarterly results - the first full quarter with Sun on board - Sun's hardware business contributed around $1.2bn in revenue to the company coffers, equating to around $400m of profit.

The results prompted Oracle president Safra Catz to say that the company has "increased confidence" that Oracle's objective of Sun contributing $1.5bn to operating income by the end of the 2011 fiscal year can be met.

TechMarketView analyst Philip Carnelly said it's now clear that Oracle is serious about exploiting Sun's hardware business, especially with its CEO Larry Ellison announcing plans to more than double Sun's salesforce.

Carnelly told silicon.com: "Speculation that Oracle would soon hive off the hardware business because it only wanted Sun for its Java software was clearly way off the beam."

He said in a research note that Oracle's results represent "a pretty spectacular turnaround given Sun's massive losses in the period before its acquisition".

According to Jessica Breen, analyst with tech researchers TBR, although Oracle initially had its sights set on using the Sun-developed Java programming language, it soon realised that it could get value out of Sun's hardware business.

"I think Oracle got into the hardware business hesitantly, but once they realised that hardware could really support a strong value proposition, it made it worthwhile to keep that portion of Sun's business," she said.

Breen added that to make the hardware business more viable, Oracle has worked to eliminate commodity technology - such as X86 servers - from the Sun portfolio and focus instead on higher performance hardware such as Sparc servers (which TBR estimates the combined company has a 75 per cent market share in) and Sun Fire servers.

In addition, Oracle has also reduced Sun's operating expenses by hiring direct sales staff and making redundancies where needed elsewhere.

President of the UK Oracle User Group Ronan Miles told silicon.com that Oracle has achieved much more on the hardware side of things than many expected through the rationalisation of the Sun business.

"I think it is fair to say that Oracle has pulled a rabbit out of the hat on this one and surprised us all," he said.

Oracle's commitment to Sun hardware appears to be as strong as originally stated according to Miles, who predicted there will be more hardware like the Exadata Database Machine which Oracle and Sun developed before the acquisition of Sun was finalised.

Such bespoke hardware and software combinations could allow Oracle to strengthen its position in different vertical industries by providing customers with technology that has been developed specifically for their industry.

As for Sun's future, TBR's Breen predicted that Oracle will continue to drive down the costs of its hardware business in 2011 as it learns more about the company and how efficiencies can be found.

TechMarketView's Carnelly added: "If [Oracle] can maintain the current cost control and grow revenues at the same margins, it'll get increased economies of scale so things will get even better."