HP earnings: Solid quarter and better full-year outlook

Hewlett Packard today reported strong earnings for its second quarter, coming in with a net profit of $3.5 billion, or $1.09 per share, a 27 percent increase over the same quarter a year ago. Revenue for the quarter was $30.8 billion, a 13 percent increase over the year-ago quarter. (Statement, Preview)

Wall Street had been expecting earnings of $1.05 per share on revenue of $29.8 billion. In addition, the company raised its outlook for full-year earnings, taking into account the expenses associated with the Palm acquisition but not counting in any potential revenue from Palm.

For the third quarter, the company expects earnings per share of $1.05 to $1.07 on revenue of $29.7 billion to $30 billion. For the full year, the company said revenue would increase 8-9 percent and raised its eps outlook to $4.45 to $4.50 per share, up from the previous $4.37 to $4.44 eps.

In a call with analysts, chairman and CEO Mark Hurd was bullish on the future of HP. The company, he said, has successfully transformed itself to capitalize on changing consumer and business habits and is still working hard. He specifically noted the bid to acquire Palm, a move that will carry the company into the "connected mobility space." After the close of the deal, expected later this year, the HP will leverage Palm's WebOS.

Specifically, he told analysts that the acquisition of Palm was mostly about intellectual property. The smartphone business is a big one but "for us, it's systematically broader than that." The company has a large family of connected products, he said. Printers, for example, are increasingly Web connected and, as such, needs an OS. "We prefer to have that OS in our IP, where we can control the customer experience as we always have in the printing business. It's always been a big deal to us." Likewise, the OS would benefit the company's push into tablet computing, as well, he said.

As for 3Com, the company said it closed the acquisition on April 12 and Hurd said it contributed $50 million in revenue for the quarter. HP is in the process of integrating 3Com into HP's networking business. For the remainder of the year, the company will report the performance of that business as part of its "corporate investment segment." Beginning in fiscal year 2011, the company will move that business under the Enterprise Storage and Servers (ESS) umbrella.

The company said there was strong performance across every region and Hurd paused to highlight Europe, which he said performed better than its historical seasonality. In response to further questions about Europe economic turmoil, Hurd somewhat downplayed concerns about the region, noting that recent performance has been strong "across all regions, not just 4 or 5 countries," as well as across product segments. In considering its outlook, the company has factored in currency adjustments. Hurd, whose tone indicated that problems in Europe are not keeping him awake at night, said that he had been more worried about Europe in past quarters.

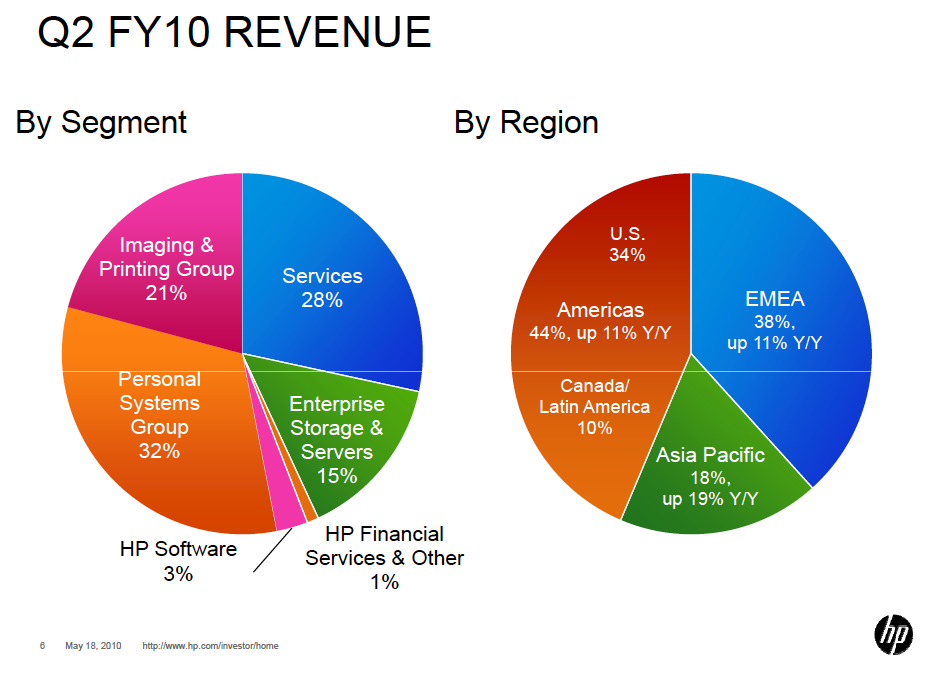

By region, revenue was up 11 percent in the Americas, 11 percent in Europe, the Middle East and Africa and up 19 percent in Asia Pacific, all before being adjusted for currency effects.

By category, the Enterprises Services and Storage division saw revenue gains of 31 percent. Personal Systems Group was up 21 percent and Imaging and Printing Group was up 8 percent. Financial Services revenue was up 18 percent.

Shares of HP were down slightly in regular trading, closing at $46.79. Shares recovered the day's loss and were climbing in the after-hours after news of the quarter and full-year forecast.

The company will discuss the results with analysts in a conference call today. We'll update this post with details.