HP Enterprise: Can it overcome layoffs, split growing pains, and FUD?

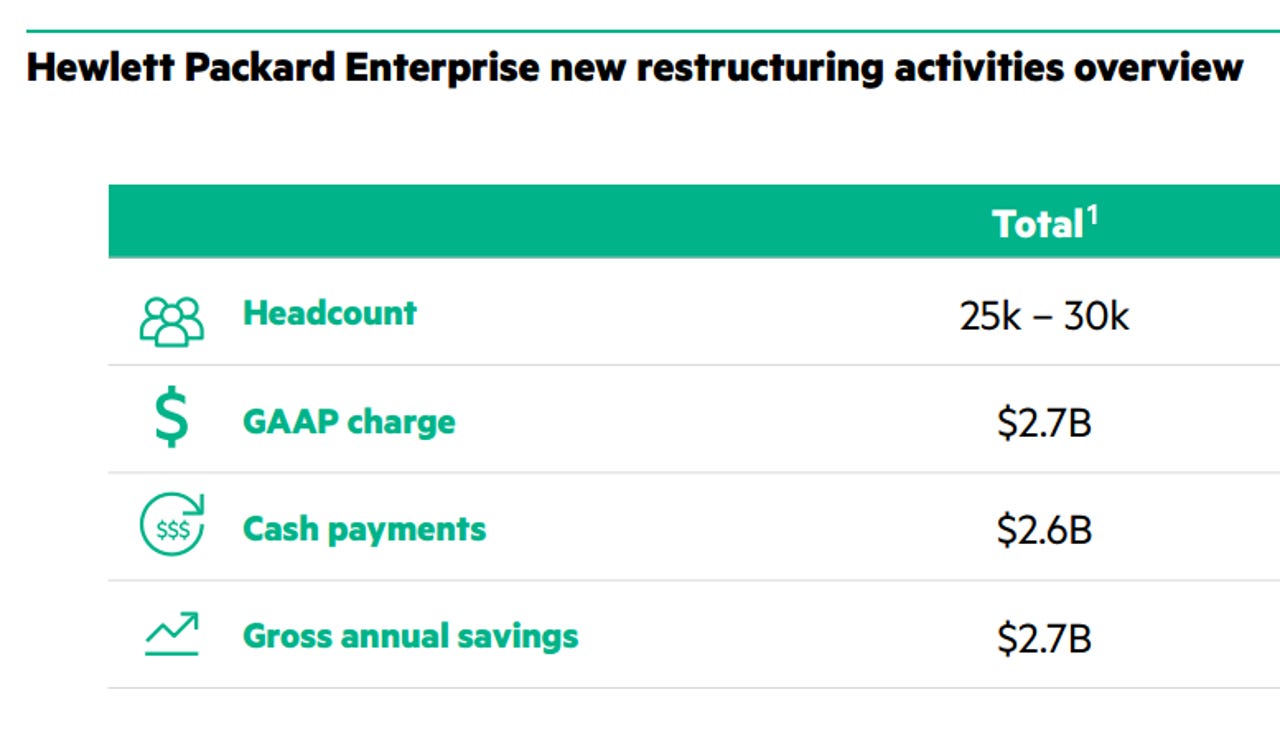

Hewlett-Packard's corporate split and transformation is going to cost the enterprise side of the company 25,000 to 30,000 jobs.

On the bright side, HP Enterprise is planning to have $3 billion in annual cloud revenue in 2015. Nevertheless, HP Enterprise may have a tough ride out of the gate as rivals tee up fear, uncertainty, and doubt (FUD) -- an enterprise technology staple.

The company outlined its post-split financials and detailed layoffs, as well as the prospects for both sides of the business.

HP Enterprise made the following moves:

- The company expects 25,000 to 30,000 people to leave the company due to "transformation" efforts.

- HP Enterprise is looking to cut $2.7 billion in annual cost savings. On an ongoing basis, the enterprise unit will save about $700 million a year.

- HP Enterprise needs to have a "more competitive, sustainable cost structure."

Add it up, and HP Enterprise is going to be much slimmer.

Meanwhile, HP Enterprise outlined its cloud strategy, which revolves around hybrid cloud and migrating customers from the datacenter over time.

HP Enterprise projected cloud revenue to be about $3 billion in 2015 with annual revenue growth of 20 percent. That sum is sizeable, but would put it behind the likes of Amazon Web Services, Microsoft Azure, and IBM.

Meg Whitman, current CEO of HP and soon-to-be CEO of HP Enterprise, outlined the company's grand plan for investors. The gist:

- HP will focus on hybrid cloud.

- The aim is to be a security leader.

- I will pitch big data products.

- And optimize enterprises.

Lost in the translation is HP Enterprise's services business. However, HP Enterprise in its presentations noted that services will be the crown jewel.

Rest assured that rivals ranging from Dell to IBM to even Lenovo may pounce.

HP Enterprise will have more than $50 billion in annual revenue, but the catch is that the company, under ticker HPE, will have to convince enterprise customers that it won't merely be sold to a larger player like EMC.

Whitman noted that HP Enterprise will be "be smaller and more focused than HP is today."

As for the outlook, HP Enterprise will see fiscal 2016 non-GAAP profits to be $1.85 to $1.95. GAAP earnings will be 75 cents a share to 85 cents a share.

HP executives reiterated that HP Enterprise will remain disciplined and return cash to shareholders. What remains to be seen is whether HP Enterprise will invest enough in research and development.

There were also a host of executive shifts, but the big picture is this:

- HP Enterprise will get 37 percent of its revenue from services with flat to down 2 percent revenue.

- Software boosts cash flow for HP Enterprise, but will still represent only 7 percent of revenue.

- The company sees about half of its revenue from services, storage, networking, and the services that go with it.

Here's a look at the key slides as you evaluate HP Enterprise's prospects. The main takeaway is that HP Enterprise will be profitable and sustainable, but the innovation question will linger.

The portfolio also remains extensive. Bottom line: HP Enterprise has all the key parts to make a run, but has to convince IT buyers that there won't be disruption as the company restructures and revamps.