HP vs. Dell: Showdown at the Windows 7 upgrade corral

Here's a tale of two PC titans: HP and Dell. One executes well every quarter. The other doesn't. Both see big PC upgrade cycles ahead. Both are looking to ride a bump in enterprise spending courtesy of Windows 7.

Place your bets.

As enterprises ponder the PC upgrade cycle and a move to Windows 7 tech executives are likely to have two primary vendors pitted against each other: HP and Dell.

The earnings conference calls from HP and Dell were very similar. Both talked services. Both talked upgrade cycles. And both talked up Windows 7 (see HP and Dell's financial results).

HP CEO Mark Hurd said Monday on the company's fiscal fourth quarter conference call:

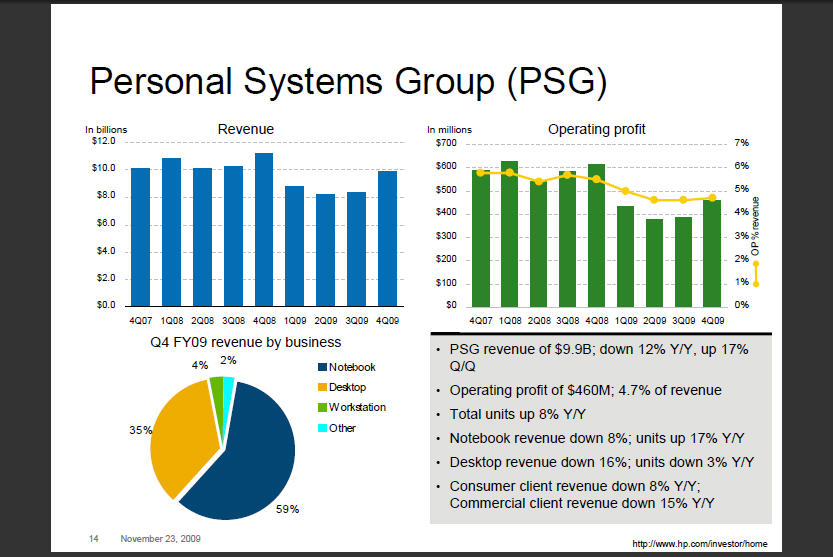

The personal systems group also delivered in Q4, extending its market leadership by more than a full point yet again. We saw good consumer acceptance of Windows 7, particularly in the U.S. Given that we gained double-digit points of market share in U.S. enterprise and have claimed the top market position, we are well-positioned to win when corporations upgrade to Windows 7. PSG delivered healthy operating margins despite increasing commodity costs.

Dell CEO Michael Dell also was bullish about Windows 7---and also saw component costs rise. He said a week ago that PC growth could be in the mid-teens:

I think there is an aging installed base for sure. You just have an accumulation of new technologies at the hardware, software, virtualized client and these IT managers really know they cannot extend the life of these client assets forever. While I don’t think it is all going to occur at once, I think it will be a rolling refresh that occurs over perhaps 18 months, I can’t remember a time when a very high percentage of them skipped an entire operating system.

And Hurd and Dell sounded like long-lost twins about the corporate upgrade cycle too. Here's Dell:

We think we are holding or gaining share in the right kind of price points. Our efforts on the cost side should expand our ability to profitably compete in a larger portion of the price points. What I would also tell you is that the pipeline of client opportunities we are already seeing more client activity in the last 30-60 days than we have in a long time and the pipeline for client activity kind of going forward into next year is the strongest it has been in a long time as well. So if I look at our commercial businesses the second quarter was kind of a bottom. The third quarter was certainly better. October was the best and November will be better than October.

Here's Hurd's at bat as he references HP's share gains and the corporate upgrade cycle:

I think it is important to note we don’t usually start with an objective of gaining share. It's more the result of us just trying to do the right work for the customer and I think as we mentioned a couple of times, we have increased our sales coverage, which we think is part of the reason that you have seen this performance occur as it has. Second, we've worked really hard to work on our service experience and the service experience is a really big deal, So it's a combination of trying to get more at bats and frankly in the U.S., this is the place that we haven’t had as many at bats as we'd like to have and we have increased sales coverage there. Secondly, trying to continue to focus on service, so yeah, we feel pretty well-positioned that as long as we can maintain the at-bat level and with the service experience that we are delivering now, that we think we will be in pretty good shape. I think you couple that with the product line-up that we have just announced and Windows 7, we think we've got a pretty compelling offer so yeah, we're optimistic about it.

Now it's possible that this Windows 7 upgrade cycle will be big enough to lift all PC players, but ultimately it's death match with Dell and HP---especially in the enterprise. The rub: Dell's financial performance is spotty and that reflects what could be a vicious crunch. HP squeezes Dell from above and Acer hurts the PC maker from below.

Chris Whitmore, an analyst at Deutsche Bank, said that HP gained share at the expense of profit margins. Whitmore wrote:

Although HP's PC units grew 8% year over year, we estimate HP's operating profit per unit dropped 30% year over year as ASPs were down about 20% year over year and commodities tightened.

That fact could mean some bad news for Dell. HP is diversified enough to squeeze Dell with minimal impact on its overall profitability. Meanwhile, HP's scale means it can weather component pricing fluctuations better.

No matter how you slice it HP has Dell outgunned with a larger services unit (acquiring EDS was the best move HP ever made), more foot soldiers and more momentum. Simply put, HP has the arsenal to squeeze Dell in the critical PC business. Dell may be optimistic about the PC buying cycle, but that doesn't necessarily mean it will harvest all the rewards.