HP's printing business: Will ink spending be questioned in the long run?

From a business model perspective I often marvel at Hewlett-Packard's printer business. Sell printers at a loss. Milk customers for recurring revenue. Make money from the ink. It's a work of art.

But it really sucks on the consumer side of the equation. Case in point: My multifunction HP printer refuses to print in grayscale because I'm out of magenta ink.

Nevermind that I set the preferences for black ink only. What does magenta ink have to do with grayscale printing? The implication: HP wants---and will heavily prod you---to buy more ink repeatedly. Another $70 or so in ink purchases later I've already eclipsed the value of this multipurpose printer after a year.

That little tale was in the back of my head as I listened to HP CEO Mark Hurd talk about whether the downturn in imaging and printing revenue was a cyclical or secular trend. The printing business is cyclical. In a downturn, folks buy fewer supplies and printers, a largely discretionary expense.

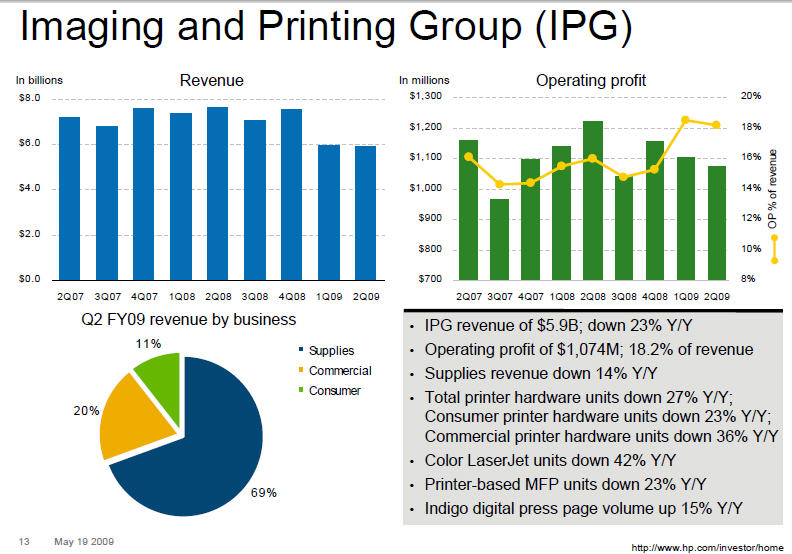

You can see the results in HP's second quarter:

Some items to note:

- HP's printing unit, known as IPG is a cash cow;

- Profitability was helped because HP sold fewer printers at a loss;

- Supplies were down as channel inventory was worked off.

Overall, Hurd said there was nothing to worry about. In the long run, IPG should show revenue growth in the mid-single digits with healthy profit margins. Hurd's biggest point on the conference call: There's no evidence that the printing business is on the wane. He said:

Our view is the base business is slightly up over the long-term. Flat to slightly up would be the way I think about the entire printing segment. Digital printing content is growing. So the cyclical stuff we are seeing right now as we have talked about before is based on GDP and unemployment but secular changes that occur in printing which I have heard from several people which is there some big secular change in printing. Secular changes occur over years and decades and over very long periods.

Home photo printing, for example, is less than 10% of our supplies revenue. It is shifting to the web and it is shifting to retail locations as well as the home which is one of the reasons why you see HP investing in Snap Fish. It is one of the reasons why you see HP investing in retail photo kiosks. When things go to Snap Fish at Photobook, for example, is printed on an Indigo printer using HP intellectual property and HP ink.

When you go to a retailer and see an HP photo kiosk you are printing that on HP ink and HP intellectual property.

Hurd's point is well taken, but it only goes so far. The big question is whether consumers have permanently changed behavior. A downturn makes you question a lot of expenses and silly things like ink is one of them. Will my future printer be made by HP? I'm not so sure after my magenta ink incident. Rest assured I'll be paying a lot closer attention to ink costs once the printer is purchased.

Hurd is correct when he notes that secular trends play out over decades, but perhaps we're just at the beginning of a supplies revenue squeeze.

Deutsche Bank analyst Chris Whitmore writes:

As in the prior quarter, weak printer hardware results supported near-term IPG profitability, but over time will likely translate into further deterioration in cartridge demand.

It's too early for any definitive calls, but watch how this plays out in the future. HP's IPG unit accounts for a third of the company's profit.