HTC: Challenges going into 2012 mount as Q4 unit outlook weakens

HTC reported strong third quarter results, but the company's outlook for the fourth quarter was light on units---a sequential decline during the holiday shopping season---and analysts expect challenges to mount in the first quarter. The problem: HTC is going to have to fight for shelf space at carriers in the U.S. and Europe and may not have the smartphones to compete.

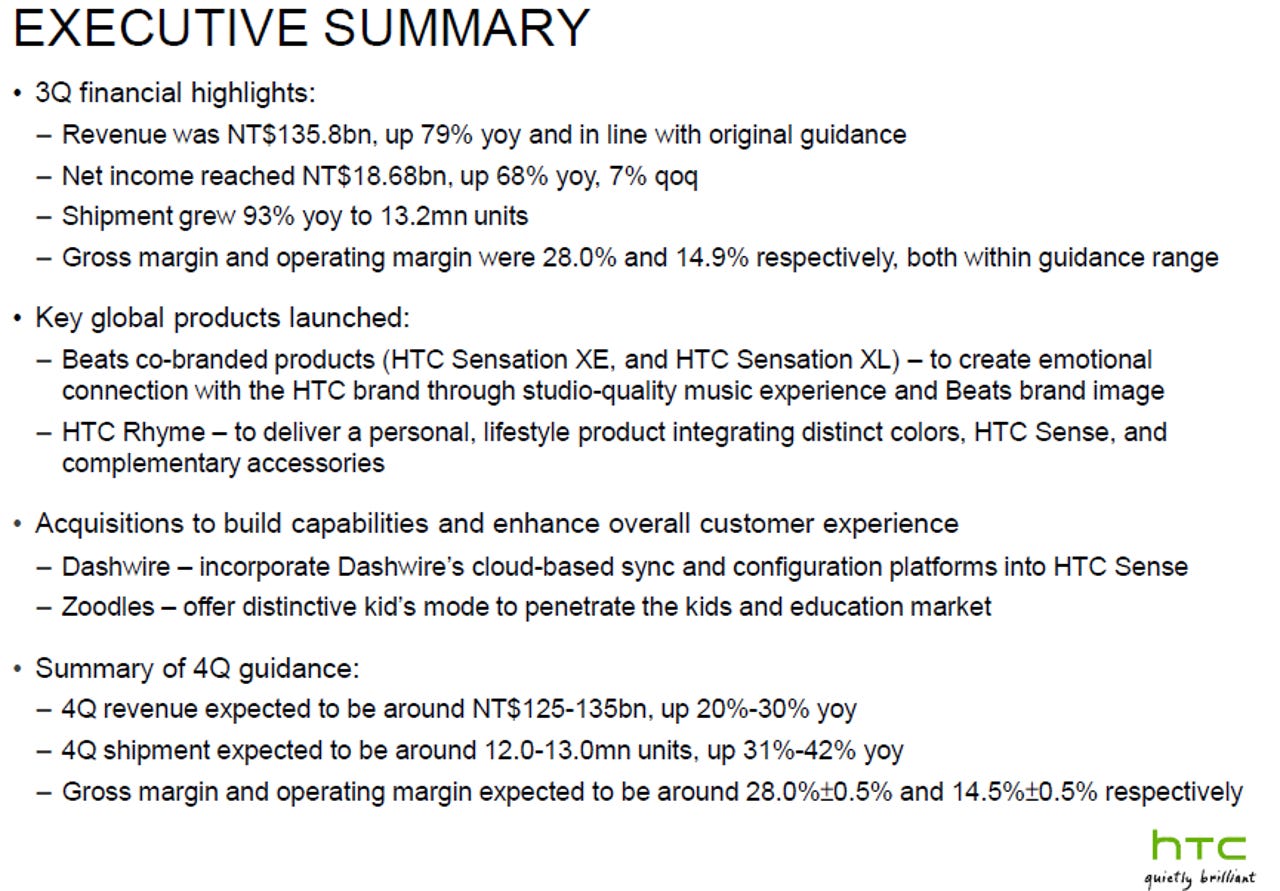

The company reported a solid third quarter with earnings of NT$18.68 billion ($625 million) on revenue of NT$135.82 billion ($4.54 billion), up 79 percent from a year ago. Handset units were 13.2 million, up 93 percent from a year ago, and average selling prices were steady at $344.

Sales in China powered HTC in the third quarter. Here's the rundown from HTC presentation to analysts.

So what's the problem? Notice the bottom of that slide above. For starters, HTC's fourth quarter shipment guidance was light. In a seasonally strong fourth quarter, HTC is forecasting that unit shipments will be flat and possibly lower. Few smartphone players are predicting a sequential unit decline going into a seasonally strong quarter.

HTC obviously can't depend on China to carry the fourth quarter like it did the third quarter. Meanwhile, HTC's prospects in the U.S. and Europe aren't looking so hot. HTC is likely to be squeezed from the bottom and top of the smartphone food chain. Macquarie Research analyst Daniel Chang laid it out in a research note. The key points:

- HTC was the top dog at Sprint, which has moved aggressively to Apple's iPhone.

- HTC's LTE position is at risk at Verizon. Why? HTC is lacking the form factor to compete with Samsung and Motorola. The Samsung Galaxy Nexus and Motorola Droid Razr are thin, carry Android 4.0 and feature a longer battery life.

- On the low end of the market, Pantech's LTE phone will squeeze HTC pricing at Verizon.

- In Europe, HTC faces Nokia's aggressive Windows Phone rollout.

Chang reckons that HTC's prospects will only get worse going into the first quarter. Chang elaborates.

For the US, while the risk to HTC from Sprint’s aggressive move to iPhone is well-flagged, we see growing risk to HTC’s LTE position at Verizon. Both Samsung Galaxy Nexus and Motorola’s Droid Razr are ultra-thin devices with powerful CPUs, have been earlier to adopt the Ice Cream OS (Android 4.0), offer longer battery life, have lighter weight, and are very competitive vs HTC’s LTE phones. We believe thinness and battery life are important factors influencing customers’ choice, and we are not confident of the prospects of HTC’s new LTE phone. At the low end, Pantech’s LTE phone (Breakout) is selling at only US$99 vs high-end phones’ US$299. Our checks also show that Huawei and ZTE plan to launch LTE phones at similar or cheaper prices in 1H12. For the EU market, we believe HTC is still struggling to grow its business in Europe. With both Samsung and Apple’s strong outlook, we see market share risk for HTC. In fact, Nokia’s aggressive launches of WP7 models would be another risk for HTC in EU.

Morgan Stanley analyst Jasmine Lu sees the same risk. In a recent research note she said:

We are mindful of downside risks to pricing if low-priced mix shifts and subsidy pool saturation take place faster than expected. HTC appears unable to defend ASP in its high-end smartphones, since hardware differentiation is becoming limited beyond 2011.

Add it up and China sales have to carry HTC in the short term, but that country is only a small part of the company's sales. HTC just doesn't have the phones to do battle.