Business

Icahn averages down on Yahoo; Searches for break even

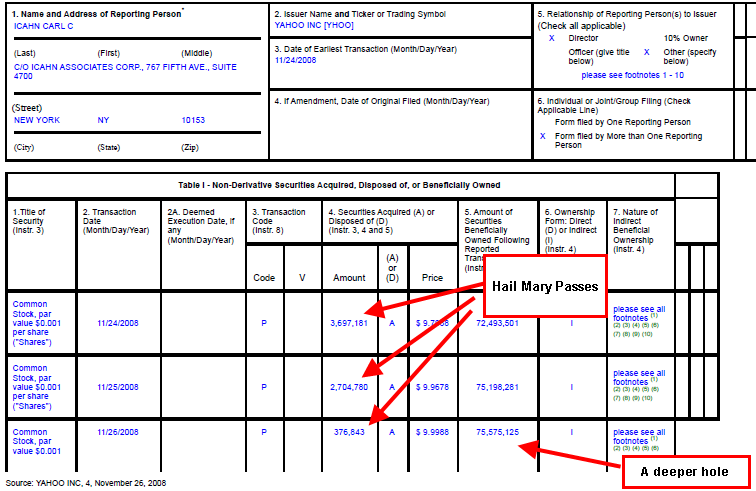

Carl Icahn added to his stake in Yahoo just before Thanksgiving and bought more than 6.77 million shares.

Carl Icahn added to his stake in Yahoo just before Thanksgiving and bought more than 6.77 million shares. Naturally, folks need to find the meaning in Icahn's move.

Kara Swisher notes that Icahn may have upped his investment because Jerry Yang's replacement is about to be named sooner than later. Kara floats a few more names to ponder. I'd propose that Icahn is doing something much more simple: He made a bad investment. He's averaging down in hopes of at least breaking even. And the decision to throw good money after bad probably isn't rooted in logic. You may even recognize a little of your own investment prowess in Icahn.

Let's recap:

- Icahn is averaging down because he has to. He's so far underwater on his Yahoo investment--he needs roughly $23 to break even--that he could stub his toe on the wreckage of the Titanic.

- Icahn is deploying the old "hope as an investment strategy" trick.

- Icahn is on Yahoo's board so he can't exactly dump his stake, which is now 5.4 percent of the company or more than 75.5 million shares. He probably asks "Why didn't I just short this pig?" every night before bedtime.

- Icahn is like the rest of us investing fools who sometimes don't use stop losses and find ourselves in a big hole. And more often than that we toss more good money after bad in the hope of at least breaking even...someday. Icahn has been shellacked by the market too. Should Icahn stop digging this Yahoo hole? Sure. But he can't resist. When Yahoo hits $5 he'll probably average down again. Repeat after me: Icahn isn't an investing Brainiac. He just has more money to lose.

Let's go to the SEC filing Telestrator (click to enlarge):