Infosys: Moving up the consulting food chain

An Infosys executive reiterated that the offshore outsourcing business is holding up amid an economic slowdown and outlined plans to continue to move up the technology food chain to offer consulting services.

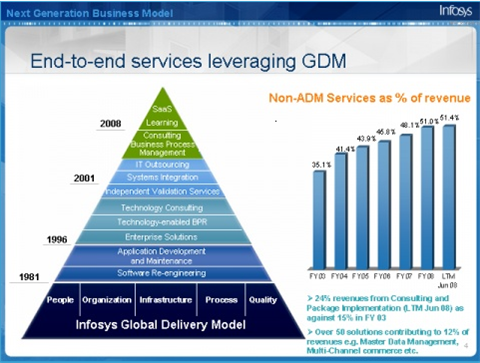

Speaking at the Citigroup Technology Conference in New York, Ashok Vemuri, head of banking and capital markets at Infosys, said the company plans to advance its GDM (global delivery model), which highlights new capabilities such as software as a service and consulting engagements instead of the previous core business of delivering applications and code.

The comments come a week after Infosys announced plans to buy Axon Group, a London based consulting firm, for $753.1 million. The deal, which is expected to close by November, bolsters Infosys' SAP consulting business. Axon has almost 2,000 employees that specialize in SAP implementations. Vemuri said Infosys pulled the trigger on the Axon deal after shopping around for a while.

Also see: Offshore outsourcers turn cautious

"We took the plunge when we found the right partner," said Vemuri, noting Infosys' plan to grow into consulting. "The client base is fairly distinct. We plan to combine Axon with our global delivery model."

Here's a look at Infosys' pyramid of services and where it's heading. The game plan is to improve profit margins amid wage inflation, a stronger Rupee and competition from other locations.

Analysts have been generally upbeat on the Axon purchase. Pacific Crest analyst Kanchana Vydianathan said:

We view the deal as positive for several reasons: (1) the merger would strengthen Infosys’ SAP practice by 1,881 employees and should increase revenue contribution from SAP-related business in Infosys’ consulting and package implementation business to 50% from the current level of 33%; (2) Infosys will gain greater exposure to Europe, especially the United Kingdom, and large clients in the region; (3) Infosys and Axon have complementary industry strengths that should provide cross-selling opportunities for revenue growth.

It's also likely that Axon can help Infosys raise its revenue per client, which currently stands at $7.8 million.

With the deal it's pretty clear that Infosys is targeting larger players such as IBM and Accenture. Whether it is successful remains to be seen, but Infosys and others of its ilk could be disruptive on the pricing front.

However, Infosys is facing economic headwinds as Vemuri said he expects technology spending to be fluid with a flat to upside bias.

Other odds and ends from Vemuri's talk:

- Infosys is looking to expand its business in Latin America, "an area whose time has come," said Vemuri.

- The company is seeing strong demand in the United Kingdom and finding interest from the manufacturing, energy and telecom sectors throughout Europe.

- Infosys is expanding in China and seeing interest in outsourcing services from American customers moving to China. Infosys is actively recruiting workers in China for global service delivery as well local clients.