Intel launches Xeon E7 V4 processors, eyes analytics workloads

Intel has launched its latest Xeon processors and has positioned them at the core of enterprise analytics. What remains to be seen is whether Intel's latest chips can bolster a waning server market.

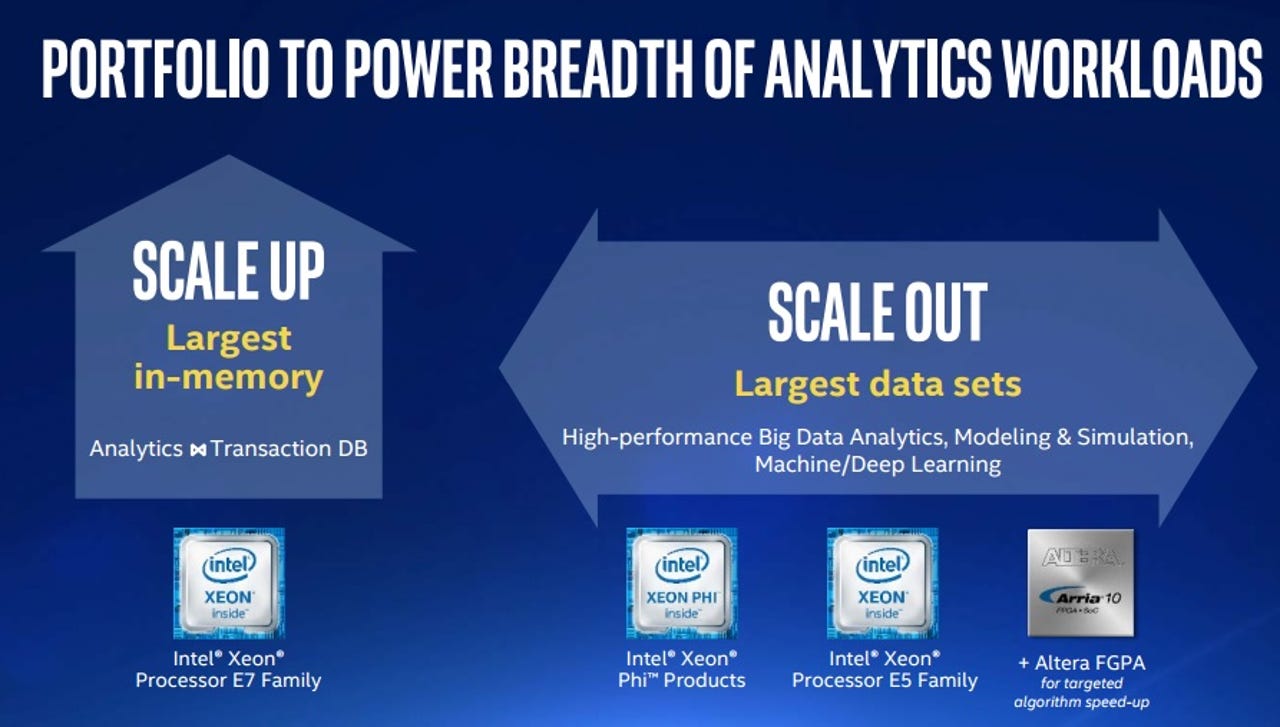

Patrick Buddenbaum, general manager of Intel's Enterprise IT Solutions, Data Center Group, said the company's Xeon Processor E7 V4 family is aimed at advancing real-time analytics and mission critical computing for a host of industries.

From drones to VR to machine learning: Intel moves beyond the PC | Hyperscale is where the growth is: Cloud and virtualisation ravage enterprise server demand

The general theme is that analytics is everywhere and embedded in every function--marketing, finance, sales, IT, customer service, manufacturing, supply chain etc. Intel's core pitch is that its new Xeons can turn data into insights faster. The catch is that analytics are being built into multiple software services such as Salesforce and Workday. As those services gain, the need to run your own infrastructure dwindles.

Intel's new Xeons offer twice the memory support over its previous generation with up to 24TB of memory. There's also support for up to 64 sockets and that leap equates to twice as many analytics queries. With partners, Intel's new Xeons are gunning for more SAP, big data and high performance computing workloads.

Dell and other Intel partners are either rolling out new systems based on the latest Xeon or plan to offer them in the weeks ahead.

In a presentation, Intel took aim at its performance and cost ratios relative to IBM Power 8. Keep in mind that IBM has made a big analytics push and has tailored Power8 for that use case.

What's unclear is whether enterprises will upgrade and use servers for analytics. After all, more analytics workloads are being moved to the cloud. IDC's server data for the first quarter tells the tale.

According to IDC, total revenue in the first quarter for the server market fell 3.6 percent to $12.4 billion. Server shipments fell 3 percent to 2.2 million units.

IDC said server growth slowed due to "a clear end to the Intel-led enterprise refresh," as well as a pause in hyperscale data center investments.

Analytics workloads are critical, but it's unclear whether Intel can juice another server upgrade cycle when one just finished.