Intel-McAfee deal signals mobile, tablet and cloud security moves

How Intel is likely to take advantage of its $7.68bn security acquisition - and where the pitfalls might be

Following the news that Intel is to buy security software maker McAfee for $7.68bn, analysts and industry watchers have been busy trying to work out the chip maker's strategy.

In McAfee, Intel is acquiring a company that makes and sells antivirus, encryption, firewalls and email security for home and business use - and which has itself acquired mobile security companies Trust Digital and TenCube in recent months.

Below, analysts run through the possible opportunities - and potential complications - of the Intel-McAfee deal.

Intel and McAfee: Building more security onto chips

The most obvious benefit that Intel gets from buying McAfee is the opportunity to tap its security know-how for its new products, perhaps preparing for a future when the security threats that are now mostly focused on PCs spread to a greater range of devices such as mobile phones and other consumer electronics.

Clive Longbottom, service director at analysts Quocirca, told silicon.com he believes Intel may have made a sensible decision with the acquisition, with the development of security built into hardware likely to be an important future avenue of opportunity for the chipmaker.

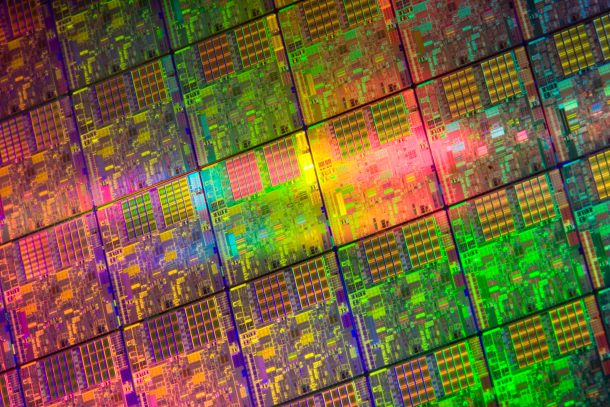

With McAfee technology, Intel could potentially bring security functionality down to silicon level on its microprocessors

(Photo credit: Intel)

Intel could bring McAfee's security functionality down to the level of silicon - as Intel chairman and CEO Paul Otellini has suggested the company does indeed intend to do - with new security technology built directly onto the chip, rather than running on an operating system.

"As we move into a more virtualised environment should every single image in that virtual environment have to have its own security built into it to cover the whole stack? Or should somebody be able to say 'Actually, what I want is a secure platform and then I can put all of these virtual images on top' - essentially sandboxing them and you don't have to bother about certain types of security because the platform will provide that?" Longbottom said.

Although Intel has already added some security to its chips with its vPro technology, Longbottom said there hasn't been a huge take-up due as users are cautious due to Intel's lack of security background. McAfee may provide the higher profile brand needed to drive uptake of chip-based security.

According to Gartner rsearch director Bob Walder, as well as wanting to improve its standing around security, Intel is seeking to exploit the R&D capability that McAfee can provide for its chips and sub-tablet devices.

However, he's less sure how Intel can incorporate security technology into the silicon of its chips. "How feasible this is - given that...

...silicon is relatively fixed and security products need to be able to change on almost a daily basis - remains to be seen," he said.

Intel and McAfee: Security for mobile devices, tablets and clouds

Gartner's Walder said Intel's recent acquisition of mobile software maker Wind River suggests it's looking at the embedded and mobile market, with which the McAfee acquisition could dovetail nicely.

Jessica Breen, analysts at researchers TBR, said that the rise of "demand for embedded mobile security that has a minimal impact on device performance" could play into Intel's hands - if it can push development of security onto the chip with the McAfee acquisition.

Mobile device security is an area in which Intel could expand with its acquisition of McAfee

(Photo credit: Shutterstock)

"The prevalent model is to load software on a finished product, a model that does not give much advantage to a Intel-McAfee combination. However, with the rise of tablets and mobile phone-based computing will bring with it increased demand for software intelligence that is embedded at the hardware level," Breen said.

Cloud computing could be another area that Intel is targeting with the deal.

"Given all Intel's recent talk about cloud security and the fact that McAfee has a SaaS business it could be that the first integrated products touted for release next year could be in that area," Gartner's Walder said.

Intel and McAfee: Taking on McAfee's software sales business

While the deal may allow Intel to take its security offerings in new directions, analysts also point to a number of unresolved questions around the deal - such as what Intel intends to do with the part of the McAfee business that sells software to consumers and small to medium-sized businesses.

Intel will be taking on McAfee's sales channel that it will need to invest in and millions of users it will need to market and sell to, and Gartner's Walder said there appears to be "little synergy between the two companies", pointing out that Intel and McAfee have different customers and routes to market and different planning cycles.

"Intel is a dominant player in their market and driven by staid engineering culture, while McAfee is a West Coast sales driven company," Walder said.

Quocirca's Longbottom added: "I think the smarts that there are within McAfee helps [Intel] but it's the rest of McAfee and what they do with it which I think will...

...end up costing a lot of time, effort and focus... which worries me," he said.

Getting value out of the investment

Analysts are also questioning why Intel paid such a premium for McAfee.

"This seems to be massively overpaying for certain core technologies, which they'd have done much better in buying up the technology rather than buying up the technology with a completely different user base," Quocirca's Longbottom said.

While Gartner's Walder said that the IP and R&D McAfee can deliver will be useful in Intel's aim to offer more security features in its technology, he added that there is no obvious reason why it should own the company to do so, saying the acquisition could be a defensive - if expensive - move to prevent rival companies getting hold of one of its key partner.

Did Intel really have to acquire a security company?

(Photo credit: Shutterstock)

Kapil Dev Singh, strategic business advisor at analysts IDC, also argued it would have been better for Intel to develop security jointly with another company rather than acquiring one.

"The acquisition seems to be more of a futuristic move as mobile non-PC devices, automobile gadgets, and consumer electronics products hardly face security threats of the kind and order faced by PCs and this is hardly a key criterion for justifying the current move," he said.

As things stand, despite the potential benefits, not all analysts are sold on the deal - yet.

"I think the jury will have to remain out for a minimum of six months, maybe a year, but my gut feeling is that this is not the best thing that Intel has ever done," Quocirca's Longbottom said.