Intel reports mixed Q1 results with revenue falling short

Intel on Thursday reported first quarter results approximately in line market expectations. Even though the chipmaker posted record-setting Q1 revenues, it still fell slightly short of consensus estimates.

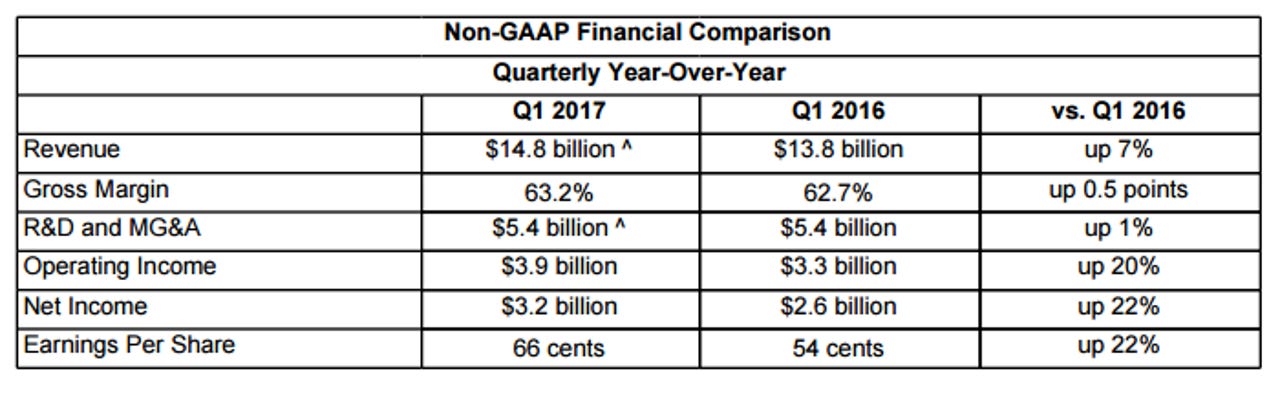

The company reported non-GAAP earnings of 66 cents a share on revenue of $14.8 billion.

Wall Street was looking for earnings of 65 cents a share on revenue of $14.81 billion.

Intel stressed the performance of its memory segment, which had record quarterly revenue after shipping the first Intel Optane products.

"The first quarter was another record quarter, coming off a record 2016. We continued to grow our company, shipped our disruptive new Optane memory technology, and positioned Intel to lead in new areas like artificial intelligence and autonomous driving," CEO Brian Krzanich said in a statement. "The ASP strength we saw across nearly every segment of the business demonstrates continued demand for high-performance computing, which will only increase with the explosion of data."

While its memory business is growing especially quickly, Intel saw year-over-year growth in all segments except the Security Group:

- Client Computing Group revenue of $8.0 billion, up 6 percent

- Data Center Group revenue of $4.2 billion, up 6 percent

- Internet of Things Group revenue of $721 million, up 11 percent

- Non-Volatile Memory Solutions Group revenue of $866 million, up 55 percent

- Intel Security Group revenue of $534 million, down 1 percent

- Programmable Solutions Group revenue of $425 million, up 18 percent

The client business is benefitting from Intel's "thoughtful segmentation strategy," Krzanich said on a conference call Thursday.

That said, Intel isn't changing its expectations for the PC unit, the CEO said. The company still expects to see a mid-single digit decline in the segement for the year.

Intel is in the process of transforming itself from a PC business "to one that powers the cloud and billions of smart and connected devices," Krzanich said.

As for the data center group, though growth was only around 6 percent for the quarter, Intel is "absolutely still committed to high single-digit growth for the year," Krzanich said. He noted that the first quarter tends to be Intel's weakest in general. Meanwhile, the data center group has solid momentum heading into the rest of the year, given that the mid-summer launch of the next-generation Skylake processor is on track.

For the full 2017 fiscal year, Intel raised its outlook to earnings of $2.85 per share on revenue $60 billion.

Krzanich also announced that the company is establishing a spending target of approximately 30 percent of revenues, which it expects to reach no later than 2020. The target was set with "efficiency in mind," he said.