Intel's ambition: Be everywhere, do everything

As Intel's developer forum wound down this week it became increasingly clear that the company has two big ambitions. First, Intel wants a processor in every device on the planet. And it wants to be viewed as a "solution" provider, one of those outfits that sell you an entire stack of IT.

What's unclear at this juncture is what big hairy goal is more reasonable. Can Intel realistically be in every device ranging from your phone to your PC to the treadmill? And can Intel be viewed as a software and ecosystem provider?

Now Intel isn't exactly Oracle, Hewlett-Packard or IBM, but the chip giant is putting its own spin on the stack of IT concept. The catch: Intel, like other tech giants ranging from Google to Microsoft, may find that being all things to all people is a tough gig.

Intel CEO Paul Otellini didn't spend too much time at IDF talking about McAfee or other recent moves into software, but it's obvious that he thinks there's a merger between software and silicon that's going to happen. "We're trying to deliver a full computing-solutions stack to our customers and developers around the world," he said in his keynote at IDF. And increasingly that stack will be on a single chip. Perhaps the most notable item this week was Intel's outline of its roadmap and a single chip that provides graphics, CPU and other goodies. One chip will equal one computer (statement).

Here's a look at Intel's two big goals and a reality check on them.

Be everywhere

The easiest goal to understand is Intel's ambition to be everywhere. Intel has a lineup of processors, a "tick tock" roadmap and market share to venture into new embedded markets. As for mobile devices, Intel has a shot to be a player too, but first it has to bump ARM-based chips out of the way. In PCs, Intel faces primarily AMD. In mobile devices, Intel faces Qualcomm, Texas Instruments and a bevy of others. Intel just bought Infineon's mobile chip unit so that's a nice base, but smart devices aren't PCs.Related: IDF Intel 2010: Intel overclocks Sandy Bridge CPU to 4.9GHz, outpaces 12-core AMD Opteron

Simply put, Intel has a tougher road on smart devices. Otellini isn't going to worry about the competition though. He said:

The total base of installed PCs today is 1.4 billion. That still leaves billions of people around the planet that don't own a computer. But much of the energy in the industry is about the spread of computing beyond the PC. And this is about the proliferation of smart devices.

The tally: There will be 5 billion devices on the Internet and 2.8 billion are smart. By 2014, smart devices will hit the 5 billion mark. Intel has to ride that growth wave.

Intel's Atom chip has been positioned as the meal ticket for these smart devices (statement). Doug Davis, vice president of Intel's embedded and communications group, hinted at what's next.

Where will the Atom go? Well in the future, it'll end up in an electric motorcycle going 130 miles an hour down a racetrack, while sending information back to the pit crew about the diagnostics. We'll have treadmills at the gym that can connect to the Internet, so while you're slogging away you can connect to the Internet, get that TV show you missed or stream your favorite Internet radio station. Atom will go in digital signs on taxicabs...Atom will allow us to take terabytes of information, videos, photos, our important information and safely store them on a home storage network powered by Atom.

Naturally, Davis's take emerged after Intel announced another round of Atom chips, which are really becoming the company's multi-purpose workhorse. The code names may change---and frankly who can keep up with the Tunnel Creeks and Grovelands---but Intel generally is ramping the performance benchmarks on servers (Xeon), PCs (Core) and every device down the food chain (Atom).

Overall, analysts think Intel has a decent shot of cracking embedded devices and smartphones. Really though, Intel has no choice.

Wells Fargo analyst David Wong wrote in a research note:

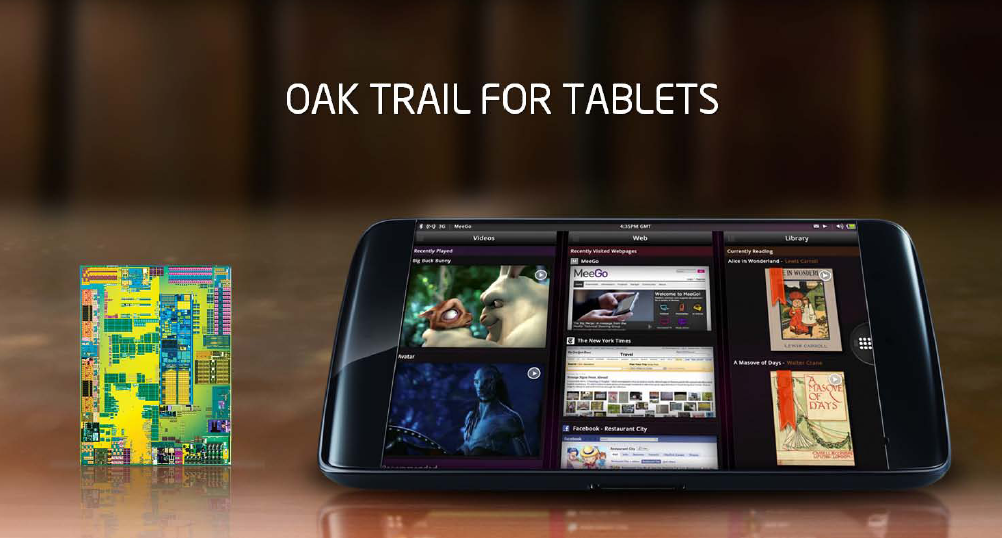

We believe Atom offers Intel many interesting opportunities to address new areas of computing--tablets, smartphones, consumer electronics and embedded devices. We think that security technology and Intel’s efforts to promote various operating systems and develop an applications ecosystem may help Atom penetrate the smartphone and tablet segments.

Fortunately for Intel it has a meal ticket that can fund its encroachment on new areas. Intel unveiled "Sandy Bridge," a second generation of Core processors due in late 2010 and early 2011. Built-in graphics, faster speeds and lower power are the goodies on deck. Intel continues to dominate its home turf even as new ventures are developing.

Do everything

What's unclear is whether Intel's second big aim: To do everything including software will work. Wong argues focusing on security and operating systems may boost Atom's smartphone and tablet mojo, but that's a bit of a tough sell. The track record of hardware companies doing software has been spotty. Ask Research in Motion and Nokia. Coming at software from a hardware perspective---unless you're Apple---has historically been a sketchy proposition.The crux of Intel's do everything push will largely depend on software. Things like MeeBo, McAfee and Wind River will have to pull the Intel brand into the realm of software. Can Intel get the software thing down?

In a few years, we'll get a definitive answer on Intel's software push. It's telling how much time Intel spent on smart TV systems. Intel is obviously preparing for a day where the PC is an afterthought, but if the chip giant doesn't become a success in new markets (smartphones, TVs embedded devices) demonstrations of WiDi and neat TV guides are going to look like pure folly.

Wedbush analyst Patrick Wang said:

Intel highlighted steps taken to transition itself from a chip company to a complete solutions provider, addressing silicon, platform, software, and services. In addition to the Wind acquisition, management highlighted their view of future computing which includes efficient performance (Sandy Bridge), security (MFE), and connectivity (WiDi, IFX WLS, TXN cable modem). While a work in progress, Intel is clearly positioning itself for growth outside of core PC.

Related: Three Questions About Intel's WiDi Streaming For Tablets

- IDF 2010: Acer Revo 2, Asus Companion Box sport Intel Atom CE4100 processors, Windows Media Center Embedded

- Intel Classmate announcements from IDF

However, there were moments when there were stark reminders that Intel isn't quite there yet. A Dell demonstration of a netbook/tablet hybrid was a bit of a laugher. That demonstration wasn't an Intel thing, but still was a curve ball relative to the smooth Google TV talk. Intel's best friends---Dell, HP, Lenovo---are still companies that don't have a design answer for Apple.

For Intel to do everything it needs to foster a developer ecosystem. It has a strong base for sure, but the real test will be the integration of these new businesses.

Barclays Capital Tim Luke recaps:

At IDF, CEO Otellini provided commentary around Intel’s recent M&A activity. In an effort to diversify outside the core PC market, Intel has made several larger than expected acquisitions spending approximately $10B over the last year starting with Wind River and adding most recently McAfee and WLS (Infineon’s Wireless Business). CEO Otellini believes McAfee and WLS may help to extend Intel’s leadership in chip design, manufacturing and software expertise to offer more complete platform offerings across a range of devices. In general, the CEO highlights that Intel is generating ample free cash flow to handle additional M&A opportunities but notes that the company is likely to focus on integration for the near-to-medium term. CEO Otellini notes that Intel’s recent acquisition of McAfee and the wireless baseband business of Infineon at $7.68B and $1.4B, respectively, are larger than Intel’s benchmark for small tuck-in acquisitions (which range from $20M to $50M), which are expected to continue.

So the big question for Intel is this: Can it integrate these acquisitions well and then set out to create unique "solutions." The jury is still out on that one. There's little doubt that Intel can be everywhere, but the do everything part is a work in progress that could take years.