Is it time for an eBay renaissance?

For a company with more $2.3 billion in annual earnings and $9.1 billion in revenue, it has been shockingly fashionable to write off eBay. The common refrain: eBay is losing marketplace share. It's so Web 1.0. And eBay can't hang with Amazon.

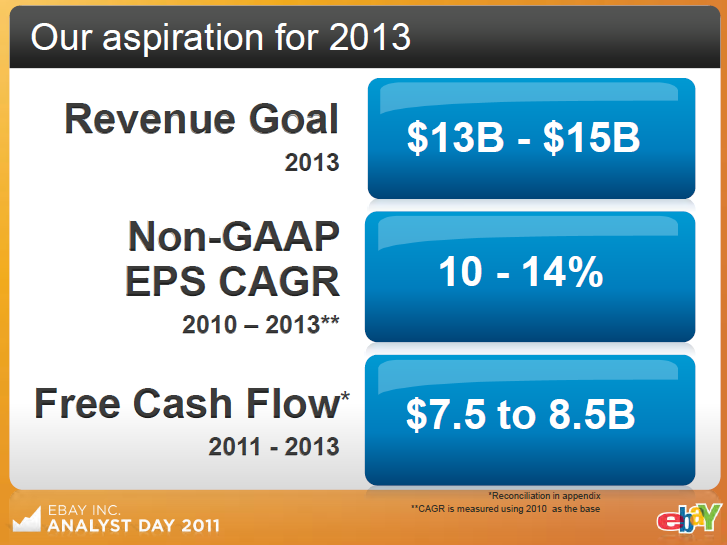

However, eBay has quietly been turning around a few analysts on Wall Street and its powwow Wednesday won a few over. Simply put, eBay has some heady goals between now and 2013. Here's the bottom line outlook:

How will eBay get to that revenue goal? PayPal will carry the company.

But eBay CEO John Donahoe's vision goes beyond riding PayPal's coattails. In a chat with analysts, Donahoe said eBay can be a bridge between offline and online commerce. He wants to ditch the "e" in e-commerce. The argument in a nutshell looks like this:

Mobile apps are bringing coupons, checkout, payments and price comparisons to brick and mortar retailers. EBay has some early leadership in mobile apps and has bought companies like Milo, an early shopping tool, and Brands4Friends, a German social shopping site.

eBay's mobile apps are backed by PayPal.

The company aims to sit in the middle of the transaction and shopping experience as it connects buyers, sellers and developers.

If that plan works out, eBay's addressable market balloons.

The big question here is whether folks will buy eBay's master plan. Barclays analyst Douglas Anmuth writes:

eBay’s investor meeting was upbeat and it’s clear that this is a very different company from 2 years ago. PayPal has a long runway for growth and the Marketplaces business has stabilized. Importantly, we believe the culture and execution at eBay has changed as the company is now infused with technology, focused on the customer experience, and is more nimble than in the past.

Others aren't so sure. The skeptics note that eBay's marketplace business is likely to continue to lose share. In other words, eBay hasn't quite turned the corner. Piper Jaffray analyst Gene Munster writes:

The bottom line is we believe eBay's marketplace business will continue to lose share in FY11 and FY12, inhibiting earnings growth for the overall company.

Ultimately shoppers will decide eBay's fate, but Donahoe was convincing in putting a new spin on the auction leader.