IT budgets: Shifting by the week?

The technology earnings season kicks off in earnest Tuesday when Intel reports its second quarter results, but the outlook for the sector may sound like a broken record: Visibility is low and IT budgets fluctuate with everything from CEO mood swings to the stock market.

A handful of companies---Dell, Infosys, Red Hat, Oracle, and Lawson---have already riffed on technology budgets amid a volatile economic picture. The common thread: IT budgets are just as jumpy as your friendly neighborhood stock, but there are signs of stabilization.

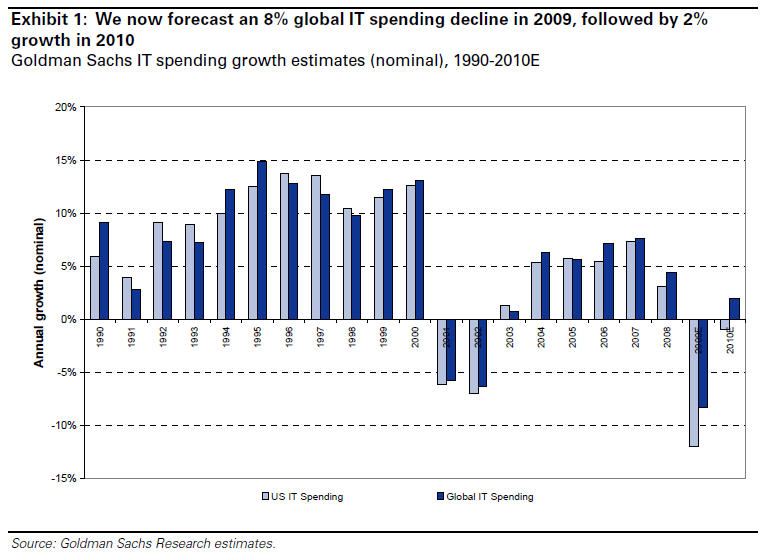

Goldman Sachs expects an 8 percent decline of global IT spending followed by a 2 percent gain in 2010. Other research outlets such as Forrester and Gartner have been cutting their spending projections, but remain more optimistic than Goldman Sachs. To say these projections are moving targets is quite the understatement. Why? Execs appear to be changing their minds each week.

Here's a quick tour of the current state of IT spending and what you are likely to hear in the next few weeks:

Dell CFO Brian Gladden said the IT picture has stabilized, but gross margins will be pinched by business demand, component costs and pricing pressure. Nevertheless, Dell continues "to believe that customers are deferring IT purchases," said Gladden.

Infosys CEO S. Gopalakrishnan said on the company's fiscal first quarter earnings conference call:

When we discuss with our clients, they were actually probably more upbeat a couple of weeks back. In the last two weeks, sentiment may have become a little bit negative. They also tell us that recovery will be sometime in 2010, beyond this fiscal for us.

Clearly the ability of clients to forecast and control their own revenues, that’s what drives it. It’s all driven from the CEO downward. If the CEO sees revenue drop by 20%, there is an immediate cut on expenses by 20%. This is in US of course. In Europe, the way they handle these things is slightly different. So, it is CEO down, it is their ability to forecast their revenues, it is the growth or the impact on their own business, so it’s really driven top down, and the IT departments and various business functions react to that actually. We’ve had clients tell us that in March, April, etc., their ability to forecast was one of the lowest in recent memory. They had absolutely no way to forecast their revenues. In May-June, we got the feedback saying that we’re feeling slightly better, but in the last two weeks there is some slight tentativeness again. So this is the uncertainty we are faced with today, and nobody is able to give the comfort level.

That take was echoed by other technology execs. Red Hat CFO Charlie Peters said on the company's first quarter conference call:

At this point I would say we have not seen any recovery and we’re not trying to call the timing of the recovery, the timing on the basis that the economic environment is going to stay fairly similar to what it is for the balance of the year. I would say this, like others that have recently reported, we see a longer sales cycle and in some cases additional levels of approval in sale cycle. But that’s kind of the way it’s been for the last couple quarters. Our expectation is that’s going to continue for at least a few more quarters.

Red Hat CEO Jim Whitehurst said that budgets are still tight and everyone is waiting to see a bottom before moving.

And then there's Lawson CEO Harry Debes. He has "no idea" if the Feds' stimulus package will do any good. Like the other executives, Debes is hearing the same song and dance from customers. Debes' money quote:

"We have customers that have laid off 30% to 40% of their staff in the last 12 months. I certainly don't feel good about asking them to spend $2.0 million or $3.0 million at this time. I think we want to work with those customers because we want them for the longer term."

Oracle co-president Charles Phillips, who happens to work at one of the companies weathering the downturn best, acknowledges that "it's hard to call the environment."

The larger question amid all of this uncertainty is this: If tech budgets are shifting by the week how can enterprises innovate over the long run?