IT innovation for small businesses: An overview

Small and medium-sized enterprises (SMEs) are typically defined as having up to 250 employees, and can be subdivided into 'micro' (0-9), 'small' (10-49) and 'medium' (50-249) sizes. Whichever way you cut the numbers, SMEs cover a multitude of business categories, are qualitatively as well as quantitatively different from large publicly quoted enterprises (although departments in some large enterprises may have SME-like features) and are extremely numerous.

SMEs form the bedrock of the private sector in most economies, and so the effectiveness with which they implement IT becomes an important issue — not only to the SMEs themselves, but also to the many hardware, software and services vendors seeking to exploit this potentially lucrative market.

Because they're such a heterogeneous bunch, SMEs will inevitably exhibit a diversity of approaches to IT deployment, ranging from neo-Luddism to untrammelled enthusiasm for the cutting edge. However, it's arguable that, because SMEs — particularly startups and growing businesses in the 'micro' and 'small' subcategories — are unlikely to be encumbered with legacy IT systems, they should have more freedom to deploy innovative solutions that deliver added business benefits.

How many SMEs are there?

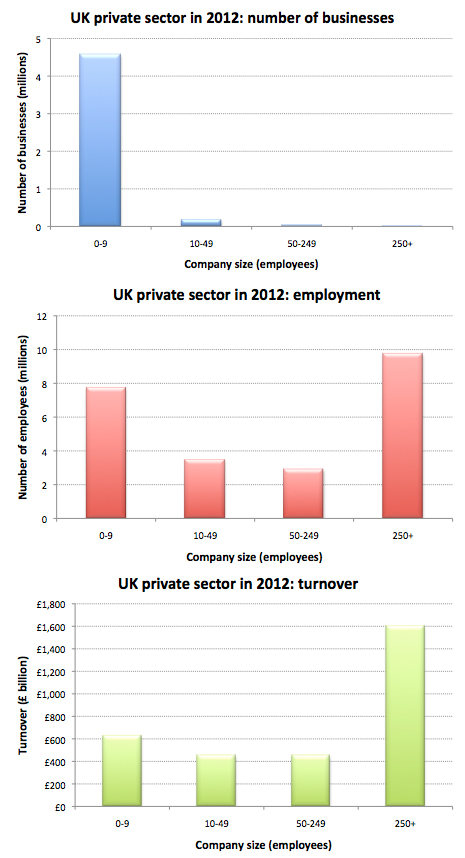

The most recent analysis from the UK's Department for Business Innovation & Skills, covering the start of 2012, puts the number of private-sector businesses in the UK at 4.8 million. These companies employ some 23.9 million people and generate £3,131 billion in turnover. The vast majority (99.2 percent) of the UK's private sector comprises small or micro businesses employing less than 50 people. Only 29,750 (0.6 percent) companies are medium-sized, while larger businesses with 250 or more employees form just 0.1 percent of the total. SMEs contribute over half the employment (59.1 percent) and just under half the turnover (48.8 percent) in the private sector. Once again, small and micro businesses (0-49 employees) account for the lion's share of this contribution — 47 percent of employment and 34.4 percent of turnover:

The UK private sector encompasses a wide range of business categories. At the start of 2012 it was dominated by the construction industry with 907,480 businesses or 18.9 percent of the total. Along with Professional, scientific and technical activities (665,265/13.9 percent) and Wholesale and retail trade and repair (515,805/10.7 percent), the top three categories account for 43.5 percent of the entire private sector:

The pattern in the EU is very similar, with the European Commission reporting that, at the start of 2012, there were 20.8 million non-financial private-sector enterprises, the majority (92.2 percent) of which were micro businesses (0-9 employees). Small (10-49 employees) and medium-sized (50-249 employees) businesses comprised just 6.5 and 1.1 percent of the total respectively, while large businesses (250+ employees) accounted for a minuscule 0.2 percent.

The EU distributions for SME employment and finances (Gross Value Added, or GVA, in this case) also look very similar to the UK's, with SMEs accounting for 87.5 million out of 129.8 million private-sector employees and generating €3,587.5 billion out of €6,179.3 billion GVA.

In the US, whose SME population is similar in size to the EU's, the most recent comparable figures from the US Census Bureau relate to 2008. At that time, there were 29.2 million private sector enterprises, of which 94.6 percent were micro businesses (0-9 employees). Small (10-49) and medium-sized businesses (50-299 employees) comprised just 3.8 percent and 1.5 percent of the total respectively, with large businesses (300+ employees) accounting for a minuscule 0.1 percent.

The US distributions for SME employment and finances (payroll in this case) also look very similar to the EU's, with SMEs accounting for 78.2 million out of 139.6 million private-sector employees and generating $2,858.0 billion out of $5,891.8 billion in payroll.

SME approaches to IT

SolarWinds survey

How are today's SMEs actually approaching IT decision making, budgeting, prioritisation and technology adoption? A recent (March 2013) survey from SolarWinds addresses this question, with 500 responses from IT decision-makers — 250 in the UK and 250 in Germany. The survey population includes a good spread of company sizes and business sectors, headed by IT & telecoms:

As you'd expect, most IT decision-makers agree that technology is a key business enabler in their organisations. However, a puzzling 34 percent in the UK and 31 percent in Germany are either neutral or in disagreement with this view:

When asked about their top IT priority for 2013, improving efficiency to enable better business results heads the IT decision-makers' list, with more emphasis on this in Germany than in the UK. Generally speaking, the top priorities are on the 'defensive' side (as you might expect in the wake of a recession): maintaining existing IT infrastructure is particularly important in the UK, followed by improving the management of existing infrastructure; in Germany, there is more emphasis on improving security:

Broadening the question to include the top three IT priorities doesn't greatly alter the nature of the responses. Mobile and cloud computing, in particular, both remain low down the ranking.

Examining these more innovative technologies further, 63 percent of UK SMEs and 56 percent of German SMEs report that they have a BYOD policy or are in the process of developing one:

Among the BYOD refuseniks, the most common reason cited in both countries is that it's "not necessary for our business", followed inevitably by security concerns:

Private cloud adoption is reasonably popular in Germany, and slightly less so in the UK. However, in both countries the prevalent response is a lack of enthusiasm for public and hybrid cloud solutions. The main reason given in Germany is irrelevance to the business, while in the UK a lack of knowledge heads the list:

The overall impression from the SolarWinds survey is of caution among IT decision-makers as SMEs emerge from recession, with actual deployments of 'innovative' solutions such as mobile and cloud computing lagging some way behind the marketing from vendors and coverage in the media.

SpiceWorks survey

For another take, let's examine a recent survey from Spiceworks — SMB IT Spending: How IT Pros are Creating and Managing 2013 Budgets. This Voice of IT report canvasses 942 IT professionals worldwide from companies with less than 1,000 employees. North America is the predominant region represented, with 63 percent of the companies, followed by EMEA (23%), Asia Pacific (11%) and Latin America (4%). Over half (54%) of the companies surveyed have less than 100 employees:

The Spiceworks survey shows annual SME IT budgets continuing to increase, slowly, from a worldwide average of $122,000 in H2 2010 to $162,000 in H2 2012 (the EMEA average is slightly less at $151,000). IT pros expect to use just just over half (52%) of their 2013 budget for existing projects and the remainder (48%) for new initiatives, which gives the average SME an estimated $77,760 to spend on IT innovation this year.

Asked to name the top three focuses for their 2013 IT budgets, IT pros flagged up client devices (laptops and desktops), servers and software, with virtualisation and networking close behind. As in the SolarWinds survey, cloud-based services and mobile are surprisingly low down the priority list:

Despite the low ranking of cloud-based services and mobile, the survey found that spending in these areas is on the increase — up from 14 percent and 15 percent of the IT budget in 2012 respectively to 18 percent each in 2013. The signs are, then, that as economic conditions improve, SMEs will look to spend more of their budget on innovative solutions such as cloud and mobile.

Symantec survey

Our final survey is Symantec's 2013 Global SMB IT Confidence Index, which canvassed IT managers in 2,452 small businesses with 10-250 employees from 20 countries worldwide (regions represented were the Americas, Western Europe/Middle East and Asia/Pacific).

Symantec's IT Confidence Index is based on responses to 17 survey questions; this index is then used to define three 'tiers' of SMEs (top, middle and bottom), corresponding to the confidence of their approach to IT.

On this basis, 'top tier' SMEs are more likely to rate IT as strategically important to advance the business than 'bottom tier' ones (84% versus 44%) and more likely to invest in high-quality IT infrastructure to exploit advanced computing platforms (51% versus 36%).

Interestingly, Symantec's survey found that top-tier SMEs typically spend 7 percent less on computing than bottom-tier ones. This may reflect the fact that IT-confident businesses tend to invest in the right technology to allow them to grow, avoiding the need for costly replacement of mistaken choices.

The survey concludes: "The key is to map IT initiatives to corresponding business goals. If, for instance, you have a goal to increase business innovation — like most of the businesses we surveyed — you should look at the advanced IT initiatives top-tier companies are more involved in, including cloud, virtualization and mobility". More than three-quarters of the top-tier SMEs rate mobility as important for driving business innovation, for example. These companies also tend to focus on efficiency, delpoying tools such as online collaboration and video conferencing to reduce travel costs.

Does IT innovation boost SME performance?

Although the 2008 financial crisis and subsequent economic downturn had a severe impact on economies, businesses, families and individuals, it did provide a useful 'natural experiment' for economists to analyse the factors affecting the resilience of SMEs under challenging conditions.

With this in mind, a section of the European Commission's recent study, EU SMEs in 2012: at the crossroads, focused on the performance of the high-tech and 'knowledge-intensive service' (KIS) sectors between 2008 and 2011. The study found that countries with a high share of their SME employment in high-tech sectors showed higher real value-added growth. However, the correlation is weak (significant at the 10 percent level), and mostly shows mitigation of the effects of recession rather than positive growth:

The correlation is stronger (significant at the 5 percent level) when growth is plotted against the incidence of knowledge-intensive SMEs — although, as the UK figure shows, a high knowledge intensity ranking doesn't deliver guaranteed recession-proofing:

The EC study also found that, within the KIS sector, SMEs deemed to be 'innovative' — including film and TV production, sound recording and music publishing, telecommunications, computer programming, consultancy, architecture & engineering, technical testing & analysis, scientific research & development — experienced higher-than-average growth in both GVA and employment.

These results suggest that, if you're an SME, being in an innovative, high-tech and/or knowledge-intensive sector seems to offer some protection against the bad times — and, hopefully, allows you to exploit the good times when they return. Clearly, part of this advantage derives from the economic environments in which these particular classes of SME operate. However, it's arguable that companies in high-tech and knowledge-intensive sectors are also more likely to deploy leading-edge line-of-business IT systems, which must also have a bearing on their economic resilience.

Innovative technologies for SMEs

What technologies should an innovative SME be using, in order to 'punch above its weight' in the economy? Broadly, this means using modern 'cloud-era' solutions that deliver enterprise-grade IT without the associated cost, management overhead and lock-in risk that typify traditional enterprise tools. Here are a few pointers:

Agile, small-footprint IT

If you're a small business, and particularly a startup, it can make a lot of sense to outsource your software (SaaS) and IT infrastructure (IaaS) to the cloud, converting the upfront capital expense and ongoing management costs of running your own IT operation into a set of cloud-service subscriptions. You can get up and running quickly, and scale easily as the business expands. There are downsides to outsourcing your IT, of course (for more detail, see our special feature on SaaS), but this is still a strategy that forward-looking SMEs should be considering.

Next-generation networks

If you do choose to retain some or all of your IT infrastructure in-house, keep an eye on the latest development in networking — SDN, or Software-Defined Networking. SDN is the natural progression from server and storage virtualisation, and moves the decision-making over network traffic flow from the hardware to a software-based control plane. Theoretically, SDN holds the promise of interoperability (via vendor support for open-source initiatives such as OpenFlow), agility (simplifying the process of connecting to different cloud-based services in a hybrid cloud environment, or optimising network performance for particular applications), and efficiency (allowing IT managers to accomplish tasks via software that were previously manual operations).

Although SDN should make it easier to manage your IT infrastructure and align it to the needs of a growing or evolving business, it's an immature technology. It should certainly be on the roadmap of all 'innovative' SMEs, but implementation right now will only be for the most determined of early adopters. For more detail, see our special feature on next-generation networks.

The extended enterprise

In traditional enterprises, the majority of employees are office-bound, mostly using client-server applications running on in-house IT infrastructure. Forward-looking enterprises tend to support more flexible working practices, offering secure access to network resources from outside the company firewall — catering for home-based workers and mobile professionals, for example. Increasingly this means formulating and implementing a Bring Your Own Device (BYOD) policy, overseen by Mobile Device Management (MDM) or Enterprise Mobility Management (EMM) software.

Startups and SMEs looking to minimise the cost of office space and provide employees with the tools with which they can be most productive are a particularly good fit for this flexible approach to IT purchase, provisioning, management and security. For more detail, see our special feature on BYOD and the consumerization of IT.

The social enterprise

An aspect of the consumerisation of IT is the widespread use by employees of social media networks and tools, both to communicate with one another and to engage with the business's customers. This double-headed 'social enterprise' trend is a rapidly-developing area, and is particularly suitable for SMEs: there is obvious 'punch above your weight' value in tools that allow everyone in the organisation to easily access relevant information and expertise, and collaborate flexibly on projects, and also to gather and analyse information from public social networks about the business and its perception among actual and potential customers. For more detail, see our special feature on the evolution of enterprise software.

Conclusion

SMEs are a numerous and diverse group of businesses that form the bedrock of the private sector in most economies. Recent surveys of SME approaches to IT innovation reveal a 'defensive' outlook, focusing on managing existing infrastructure more efficiently rather than deploying cutting-edge solutions. This is only to be expected following a prolonged period of challenging economic conditions. However, there is evidence that SMEs in high-tech and 'knowledge-intensive' sectors fare better (or less badly) in these conditions than other businesses. We can expect these SMEs, which tend to deploy more innovative IT solutions, to reap the benefits quicker when economic conditions improve.