March of the Chinese smartphones gathers pace

Wherever you live on this planet, if you are considering picking up a new smartphone, chances are that you're looking more kindly towards Chinese manufacturers, especially Huawei, than you were a year ago.

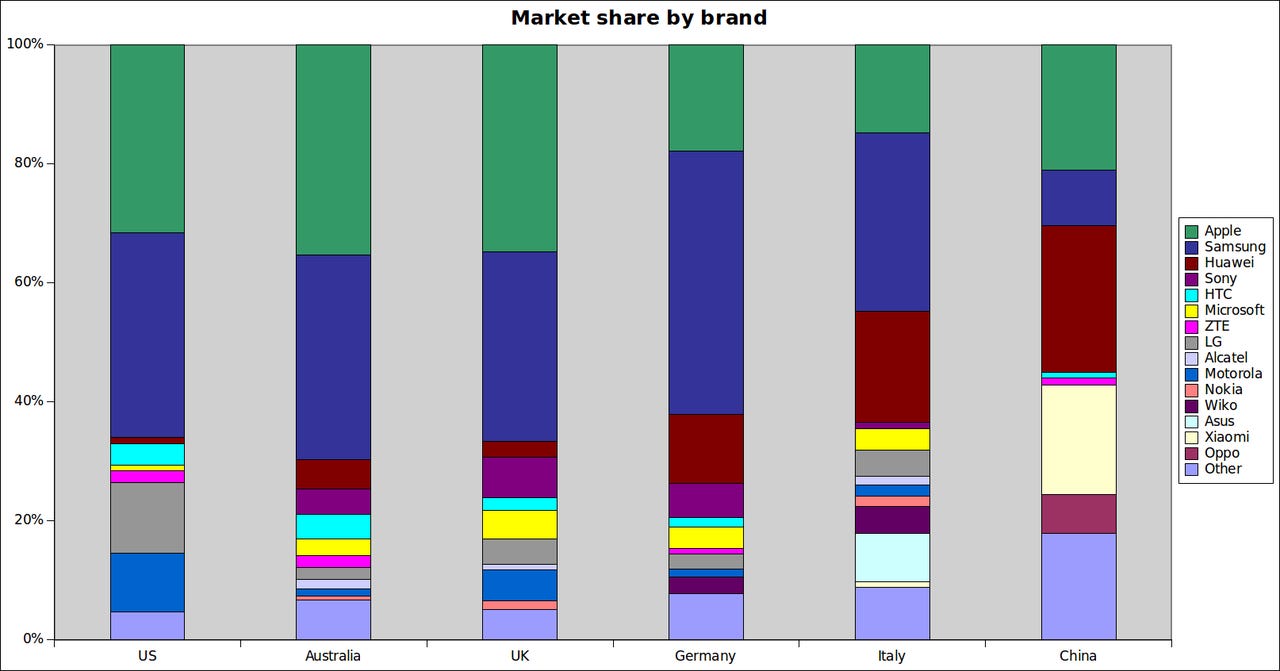

While the headline numbers from the latest Kantar Worldpanel ComTech survey show Android gaining at the expense of Windows Phone and iOS, within those numbers lay some interesting trends.

If you thought Samsung would be the main beneficiary of all that movement towards Android, think again.

Of the half-dozen areas ZDNet examined -- the US, the UK, Germany, Italy, Australia, and China -- Samsung only saw large gains in the US and the UK. In Germany and Australia, Samsung was steady in overall purchasing intention, but made up a lesser amount of Android purchasing decisions. In China and Italy, it was bad by all measurements for the Korean giant.

Across the board, though, Huawei has seen its numbers over the past year only head in an upward direction. The Chinese networking company now finds itself besting Xiaomi for first place in its homeland; selling more units than Apple in Italy, and trailing only Samsung; replacing Sony as number three in Germany; and doing a similar trick to HTC to land third place in Australia.

Huawei has yet to crack the US or the UK, but nevertheless still experienced percentage point growth in a tough market.

On the other hand, HTC is representative of how harsh the smartphone market can be.

Despite once again releasing another solid flagship in form of the HTC 10, it's more a question now of when HTC is gobbled up than if it will happen.

HTC posted yet another quarterly loss, NT$4.8 billion, and saw its sales drop by 64 percent compared to last year.

The plight of HTC is reflected in Kantar's numbers: HTC dropped from 5.8 percent in March 2015 to 2.2 percent this March in the UK; China handed HTC a 0.3 percentage point drop to 1 percent; Germany reduced HTC's share from 2.7 percent to 1.6 percent; HTC was still healthy in Australia last March, with 5.5 percent, but is now reduced to 4.1 percent; and the company couldn't even hit 1 percent in Italy, and in 15th place overall did not reach the reporting threshold.

The sole non-negative result for HTC was the US, where it was stable with 3.7 percent of the smartphone market, but saw its share of Android phone shrink from 4.8 percent down to 3.8 percent.

While times are tough for the Taiwanese manufacturer, compatriot Asus surprised in Italy to almost quadruple its market share over the past 12 months. The company is now the third most popular Android phone seller as it lays claim to 8.2 percent of the market.

Fourth in Italy is Chinese-French smartphone maker Wiko, with 4.5 percent. In Germany, it is also the fourth most popular Android handset, up 0.9 percentage points to 2.8 percent, but behind Samsung, Apple, Huawei, Sony, and Microsoft in overall terms.

Italy threw in another curveball, with Xiaomi popping up at 0.9 percent, its only entry beyond China, where it is now third with 18.4 percent.

Outside of China, ZTE experienced growth in Germany, Australia, and the US, while seeing its market share drop from 2.1 percent to 1.2 percent in its native country.

As the smartphone market matures and growth is halted, buyers are turning to the cheaper, Chinese fast-follower devices.

According to figures from Strategy Analytics, while Samsung and Apple saw lower handset shipments, Huawei and Oppo experienced significant growth, while Xiaomi had a slight decline in shipments to maintain fifth place.

Unless Apple or Samsung can come up with a compelling reason to upgrade a smartphone, buyers are increasingly going to go with the more economical, "good enough" option out of China.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on the Monday Morning Opener:

- Stratoscale bets UX, simplicity can democratize the data center

- Beyond the iPhone: Where does Apple go next?

- Perhaps there is a cyber-point to this innovation claptrap

- Tom Siebel's C3 IoT looks to expand, slay giants

- Big data's biggest problem: It's too hard to get the data in

- Do not touch this one Android setting and most malware will leave you alone, mostly

- How Apple became Samsung, and why Steve might have approved

- Open Compute Project: Gauging its influence in data center, cloud computing infrastructure