MetroPCS shareholders approve T-Mobile deal

MetroPCS shareholders have approved sweetened deal to merge with T-Mobile. The big question remains whether a beefed up T-Mobile can give giant U.S. carriers a scare.

The vote via Reuters comes after T-Mobile parent Deutsche Telekom sweetened an offer. On April 15, T-Mobile upped its bid. MetroPCS shareholders will get $1.5 billion in cash and a 26 percent stake in the new T-Mobile. Deutsche Telekom also cut the net company debt by $3.8 billion to $11.2 billion and cut its interest rate by 50 basis points. Deutsche Telekom also increased its lock up period. MetroPCS said the revised deal increased the value of the company by $3 a share.

Strategically, the T-Mobile-MetroPCS deal had to get done. Deutsche Telekom wanted out of the U.S. and Sprint's merger with either Dish or Softbank required the No. 4 player to bulk up quickly.

With MetroPCS in the fold, T-Mobile has said it can accelerate its challenger positioning and "uncarrier" marketing that revolves around eliminating customer contracts.

For the first quarter, T-Mobile U.S. ended with 34 million customers, but still lost postpaid customers (199,000 left) and added prepaid.

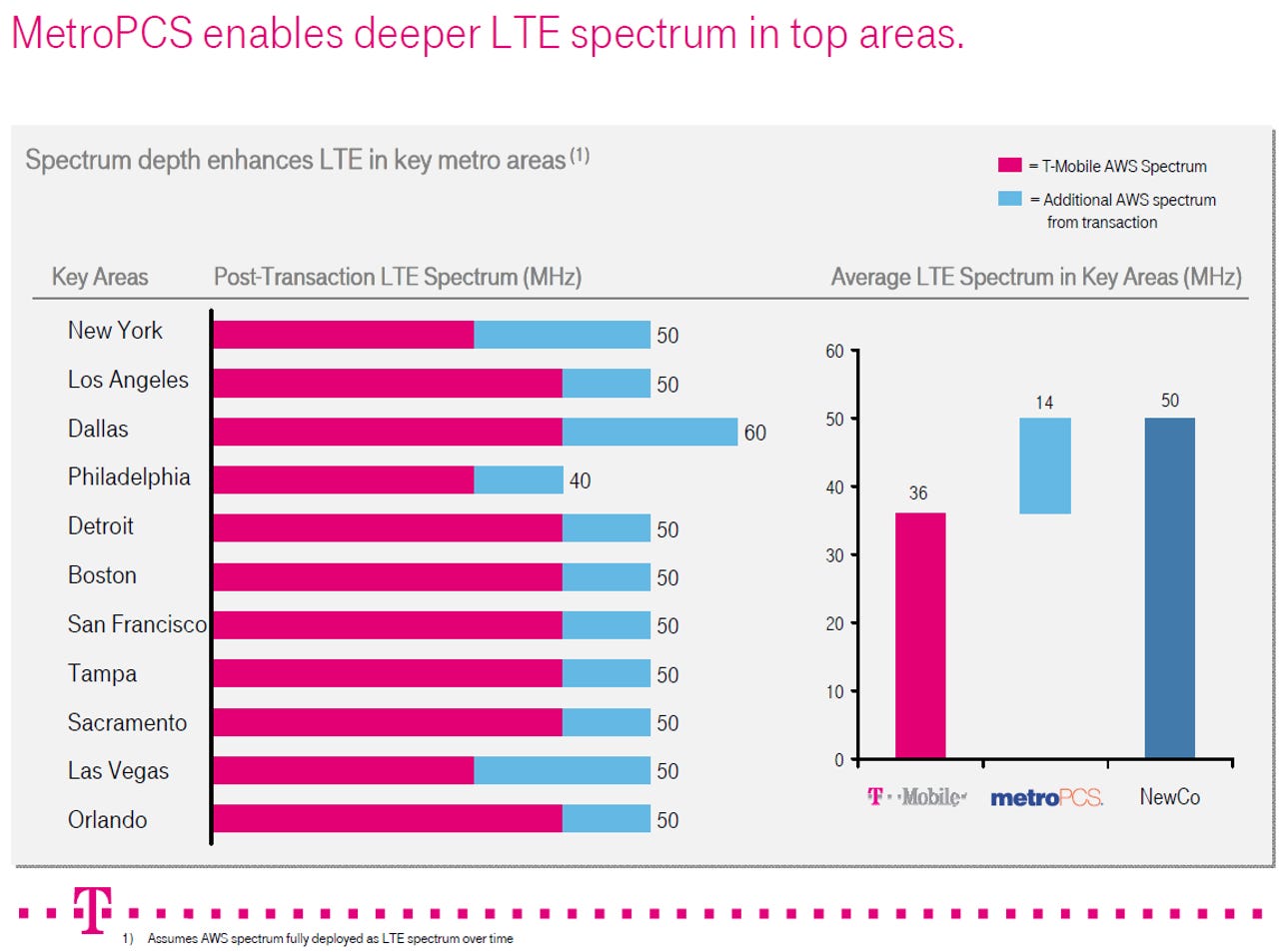

With MetroPCS, T-Mobile will have a more robust LTE 4G network and more wireless spectrum. The problem is that T-Mobile is still largely playing catch up to Verizon and AT&T.

Nevertheless, T-Mobile is aggressive and that's positive for wireless buyers.

Previously:

- T-Mobile draws back customers, adds half a million subscribers in Q1

- MetroPCS pressing shareholders over T-Mobile vote following revolt

- T-Mobile USA kills traditional cell contracts in subscriber boost bid

- T-Mobile, MetroPCS set to merge after regulators give thumbs-up

- T-Mobile, MetroPCS to merge in $1.5bn deal

Sprint bulking up too

- Sprint assembling 'special committee' to review Dish deal

- Softbank, Sprint, Clearwire, Dish: Figuring out this merger mess

- Dish and Sprint: Can they really deliver on a 'unicast' vision?

- Softbank as Sprint's savior: What $20.1 billion does, doesn't do