Microsoft: Does a Yahoo proxy war add up?

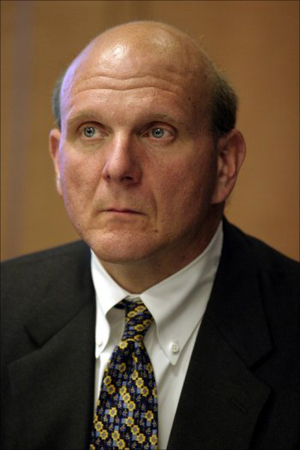

Given that Microsoft's "negotiate or else" deadline passed Saturday the software giant should be making its move soon in what could be CEO Steve Ballmer's most important decision of his career.

Marc Andreessen outlines the case for a hostile takeover and it's a good one: Yahoo doesn't have a staggered board so Microsoft could toss the board all at once. Microsoft doesn't have to win 50.1 percent of total shares just 50.1 percent of the shares that are voting. Yahoo has to hold a shareholder meeting by June 12.

Also see: Another reason Microsoft should give up on Yahoo: Morale

Add it up and Microsoft could win a hostile takeover in just a few short months.Here's Citigroup analyst Mark Mahaney's cribsheet.

But is a fully hostile takeover really that simple? Going hostile would be ugly for both parties. It's a distraction. Yet a proxy war may be Microsoft's only alternative given Yahoo isn't going to budge. According to most observers, a hostile takeover is the second most likely scenario. Factor in intangibles--keeping key workers, maintaining sites and advertiser relations--and a hostile takeover could do a lot of damage.

That's why Ballmer's best choice may be to walk away--currently the second least likely event according to Mahaney's cheat sheet. If Microsoft walks, Yahoo will have to face its own shareholders. Yahoo will have to prove that it can deliver in a slowing economy. Worst case: Microsoft pays up a little bit in a few quarters. Best case for Microsoft: An ad slowdown that crushes Yahoo and makes $31 look like the best option on the planet.

Odds and ends: Remember Capital World Investors? Earlier this month the investment firm reported that it had doubled down on Yahoo in a bet that indicated that the Microsoft purchase was a lock. Think those guys are sweating a bit today?

More reading: