Microsoft Office is dead meme revived

My friend Steve Gillmor has been bloviating about the death of bloated Microsoft Office for years. Google's cloud-based apps are poised to put a stake in the heart of Microsoft's Office business, which accounted for the majority $16.37 billion in revenue for Microsoft Business Division in the fiscal year ending June 30, 2007.

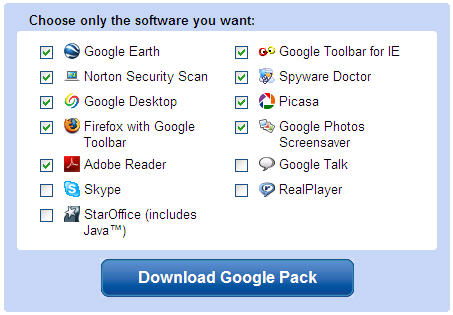

Mary Jo Foley speculates on Google and Adobe disrupting Microsoft's 90 percent-plus share of market. It's not just new cloud-based applications, such as Google Docs & Spreadsheets, but the venerable OpenOffice/StarOffice, acquired by Sun in 1999. Google is now offering StarOffice (over 200 megabytes), which like Microsoft Office is a client-based application, as part of Google Pack for free.

A next step would to have further integration between Google Docs & Spreadsheets and StarOffice, creating more of an online/offline hybrid. Google and Sun are also interested in pushing the Open Document Format as a universal, alternative to Microsoft's proprietary formats. Sun has a free ODF plug in for Microsoft Office for importing and exporting to ODF. Adobe is also supposedly cooking up productivity suite, based on its AIR (formerly Apollo) technology.

But is StarOffice, Google Apps or whatever Adobe, Zoho, Zimbra, ThinkFree and others are doing a game changer, massive disruptors that will eviscerate Microsoft's super-profitable Office business and free users from .doc and .xls tyranny?

If you presume that Microsoft will stand still, stagnate and become even more proprietary over the next five years, while the above-named continue to innovate and adopt more subscription-based business models, then the answer is 'yes.' Over a decade, OpenOffice/StarOffice has not challenged Microsoft's supremacy, and a free, unsupported version from Google won't have much impact.

Afterall, the latest big news about StarOffice is Singapore Airlines using the suite as part of it Boeing 777-300ER KrisWorld inflight entertainment system.

It's not a zero-sum game. In five years, Microsoft won't have 90 percent of the market with Office, but it won't have zero or less than 50 percent. Microsoft's most important asset has been its culture of winning, sometimes at whatever financial or piss off the regulators, play unfair cost.

For Google and Sun to 'defeat' Microsoft's Office, they have to offer something that is orders of magnitude better--not just free. Otherwise, what is the incentive to switch, and don't think that Microsoft can't play the free/advertising-based software game or that Google can afford to offer business users ad-free, supported productivity apps in perpetuity for no cost.

Google and Sun have been challenging Microsoft to move faster, which is indeed a big challenge given the size of the company, aging warriors and pressure to preserve the existing business model based on selling Office to enterprises and bundling deals. The company may not dominate post 2010 at it did in previous decades, but it's hard to imagine a repeat of what happened with search and advertising in the Office space.

Microsoft has a lot of willpower, even with Gates removing himself from day-to-day activities next year.

Chief software architect Ray Ozzie has boasted regarding software and hosted services that will enhance the current Office suite and generate more revenue from advertising-supported service, "We are the only company with a platform DNA to viably delivery this kind of highly leveraged platform approach to services and we're certainly one of the few companies that has the financial capacity to capitalize on this sea change."

Microsoft has platform DNA, but it will take all the financial resources and more to compete in an environment in which the Web, not the Windows, is ultimately the 'platform' for applications. For now, the client is still alive, and Microsoft's hybrid approach to integrating online and offline in Office will keep out of the dead pool.