Microsoft vs. Google: The view from the Office 365 trenches

Microsoft's Google-compete campaign, increasingly orchestrated by Mark Penn and team, has been focused heavily around Redmond's "Scroogled" messaging.

But in the trenches, Microsoft and partners are focused on much more mundane realities. In the Office 365 vs. Google Apps arena, specifically, the battle is pitched and nasty.

During last week's Worldwide Partner Conference (WPC) in Houston, Microsoft Chief Operating Officer Kevin Turner reiterated something he said at the previous year's partner conference: That Microsoft and partners should not lose a single potential Office 365 sale to Google. (A year ago, Turner even offered to personally help and intervene if need be.)

This year, there were a number of public sessions for the 14,000 or so WPC attendees about selling Office 365. And there seemingly was at least one (though likely more) private one. The "Winning with Office 365 Every Time: Resources and Approach" -- despite the fact it was clearly marked "Do Not Publish," somehow made it onto Microsoft's Web site.

The description of the session described it as how to win against Google in the U.S. by "exploiting Google’s weaknesses around security, privacy, and compliance." The summary of the session coninued:

"Google has emerged as a formidable competitor to Microsoft Office 365, but what customers don’t know is that using Google puts their intellectual property at risk. Make no mistake: Google is in the productivity business to get access to information that it can index. It’s in Google’s contract: “When you upload or otherwise submit content to our Services, you give Google… a worldwide license to use, host, store, reproduce, modify,… publish,… publicly display and distribute such content .” The Office 365 product team and corporate legal team will talk about how Office 365 is engineered and managed with security, privacy, and compliance in mind. You will learn how to use those issues as opportunities to enlighten and advise your customers. You will gain Microsoft’s content and expertise in having these conversations, and see how this conversation fits into the new Office business-value conversation."

However, the content of the session, which I watched on demand from the public-facing WPC site, didn't mirror this description.

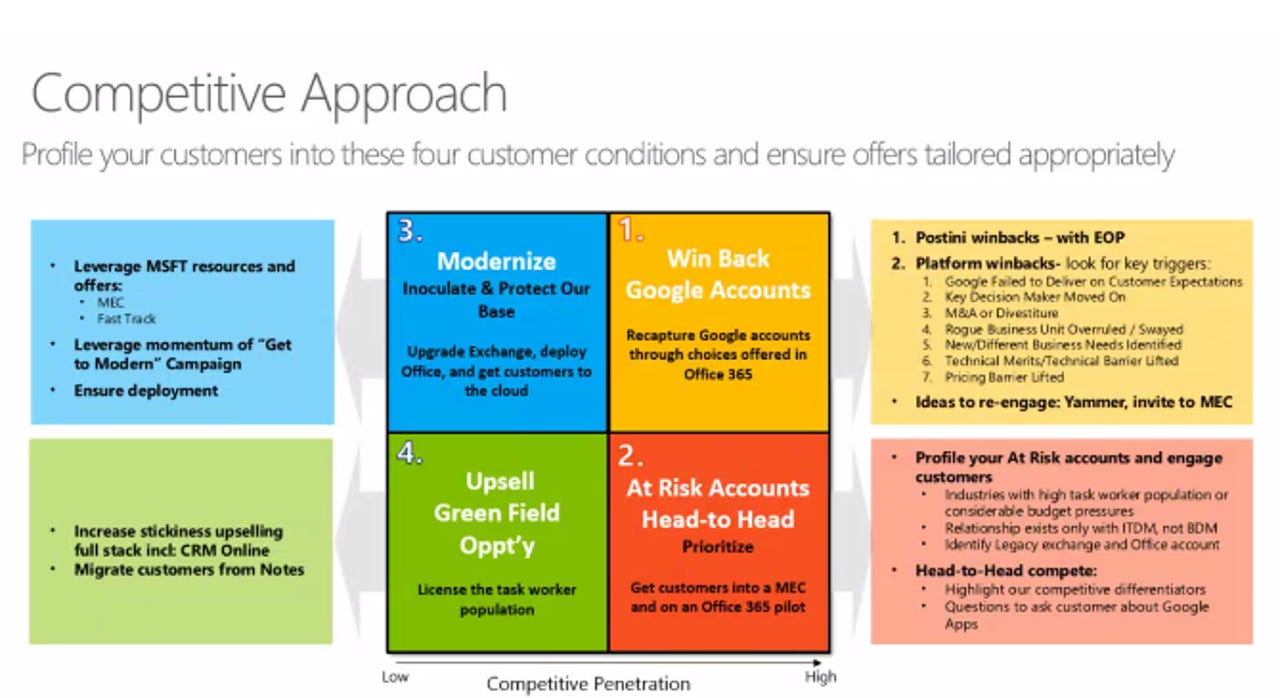

The reasons Microsoft loses to Google, according to Therese Connor, Office 365 Senior Product Marketing Manager, revolve around reasons such as the fact that many Exchange and Office customers are running very old versions of these products, making it easy for Google to swoop in and offer something that looks significantly better, feature-wise. Microsoft's partners need to prevent Google from setting the conversation by being proactive and getting in there first, said Connor.

Connor noted that it can be very costly for Microsoft to lose out to Google and then try to re-win the deal. She acknowledged that "in some instances, we had to buy out the contract" in order to regain a key customer from Google. (These kinds of tactics are why I almost never write about customer win stories; it's almost always impossible to really know why customers went with a particular vendor over its competitor, in spite of what the customers say/are allowed to say publicly.)

Losing to Google when it's pitching Postini -- Google's email security and archiving services which are now part of the Google Apps platform -- is, from Microsoft's view, "equivalent to a platform loss," Connor acknowledged. As a result, migrating users off Postini to Microsoft's head-to-head competitor, Exchange Online Protection (EOP), is a top priority.

Microsoft is advising its partners to "lead with value, not price," which isn't too surprising, given Google's lower base price for its Apps service when compared to Office 365. While Google is offering a "one-size fits all" SKU, that's not necessarily a bad thing, Connor admitted.

Though more Office 365 SKUs means more flexibility, it also means more complexity. "We have a host of SKUs -- it's actually dizzying," she said, especially when you look at all SKUs, pricing, flavors. (One partner who spoke up during the session said Google's pitch of $50 per user per year to get rid of users' pain was easy and effective. He said Microsoft partners need a 30-second pitch as to why Office 365 beats Google.)

Microsoft officials allowed Exoprise Systems, which makes CloudReady Monitor, a Google-compete tool (also known as a "Google kill kit," Expoprise officials joked), to present during the session. The tool is designed to help partners build the business case for Office 365 more quickly and "show how much pain users will feel by Going to Google," officials said during the session. Exoprise allows users to see calculations of parameters such as the number of document attachments in email, the amount of storage a user is deploying for certain apps/data, and other similar information.

It's worth noting Microsoft is taking steps to try to help partners sell Office 365. Last week during WPC, company officials announced plans to add migration SKUs and more Microsoft-hosted apps to set of deliverables its Office 365 resellers can carry. Microsoft also launched in April its Office 365 FastTrack program, designed to get Office 365 pilot systems running in an hour, rather than taking days for full deployments.