Microsoft's $26.2 billion bet on LinkedIn foreshadows human resources application move

Microsoft's purchase of LinkedIn screams more HR software touch points ahead.

Microsoft and LinkedIn may never be able to deliver on the ambitions outlined in a PowerPoint presentation, but the strategic rationale makes sense. Microsoft gets social heft, a network of business pros, leads for its business and touch points to every person looking to be productive. LinkedIn is a social network hoping to be more of an human resources software company with no real skills to deliver.

On paper, these two companies may just complete each other and equate to Microsoft becoming an human capital management software player on some level. The $26.2 billion bet--and whopping 49.5 percent premium--means that executing on what Microsoft CEO Satya Nadella outlined may be tricky.

Previously: Microsoft buys LinkedIn for $26.2 billion

In a memo to employees, Nadella said:

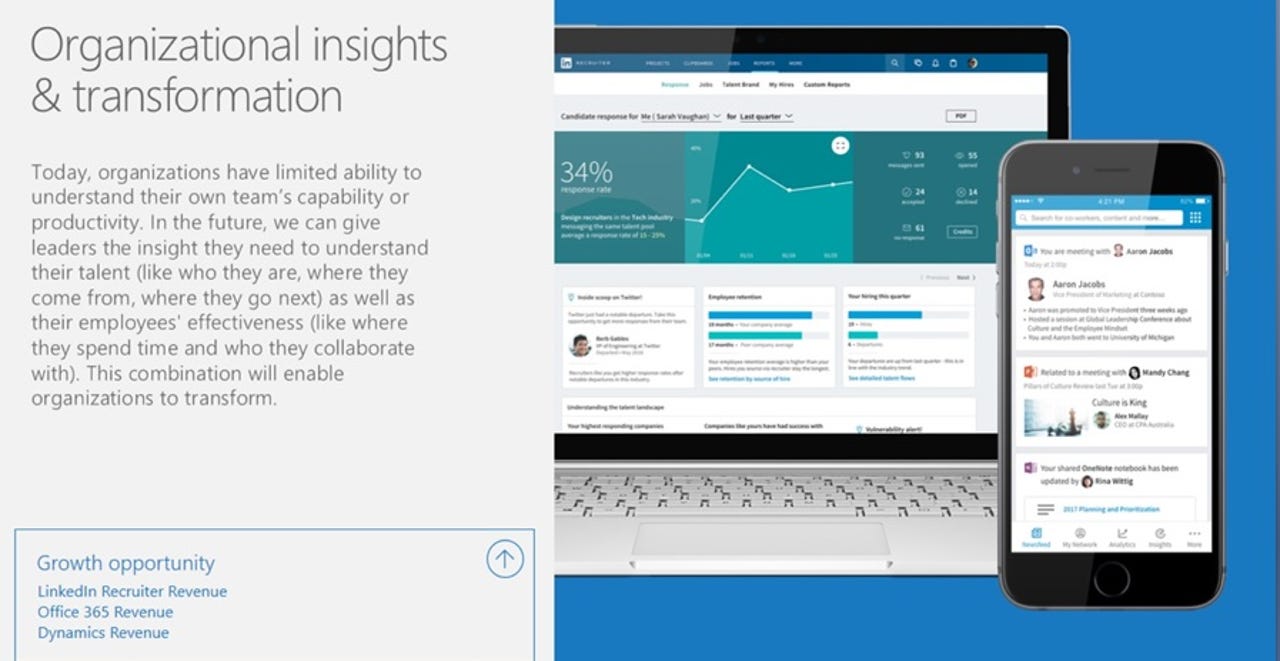

We are in pursuit of a common mission centered on empowering people and organizations. Along with the new growth in our Office 365 commercial and Dynamics businesses this deal is key to our bold ambition to reinvent productivity and business processes. Think about it: How people find jobs, build skills, sell, market and get work done and ultimately find success requires a connected professional world. It requires a vibrant network that brings together a professional's information in LinkedIn's public network with the information in Office 365 and Dynamics. This combination will make it possible for new experiences such as a LinkedIn newsfeed that serves up articles based on the project you are working on and Office suggesting an expert to connect with via LinkedIn to help with a task you're trying to complete. As these experiences get more intelligent and delightful, the LinkedIn and Office 365 engagement will grow. And in turn, new opportunities will be created for monetization through individual and organization subscriptions and targeted advertising.

Notice what Nadella didn't say. Microsoft wants to be more involved in the human resources application food chain. Nadella did hint at HR hooks strongly with a clear cloud twist. For now, Microsoft is justifying a hefty premium on everything from improving Bing to cloud analytics to using LinkedIn data to improve Office, Dynamics CRM and a host of collaboration tools.

On a conference call, Nadella said HCM software was "a very exciting opportunity for us." He added that LinkedIn's economic graph will come in handy for numerous applications.

If you look at the combination of Office 365, LinkedIn and Dynamics that's the core of who we are. And then you combine it -- a cloud asset which is a network asset. We aren't just talking about CRM. It is CRM with social selling. It is not just about HCM, it is HCM with talent management telemanagement solutions and recruiting from LinkedIn. Those to me are the formative things that we can now do.

Pacific Crest analyst Evan Wilson said in a research note:

LinkedIn owns a unique data set. It likely knows where you work, what your job title is and many of the people you know in a professional context. This is a data set that has been missing from traditional CRM, which has historically been an empty database that forces a user to constantly populate themselves. If integrated correctly, this is a huge asset for Microsoft.

But don't lose focus on the big enterprise software picture. Microsoft can help LinkedIn achieve what it wanted to do after acquiring Lynda.com, which offers online training courses via video. When LinkedIn acquired Lynda, CEO Jeff Weiner, who will lead the company after the Microsoft deal, talked about completing an economic graph of how people work and interact professionally. Wilson noted that LinkedIn has been a disappointment because it couldn't diversify its business. "The Street had lost confidence that LinkedIn would be able to significantly diversify its business. A partnership with Microsoft gives us new hope," said Wilson.

In a blog post, Weiner said LinkedIn will have more resources and an ability to compete with the big guns such as Google. He added that the companies have the same goals with different spins.

Weiner's use cases for the combined deal also screamed enterprise HR. LinkedIn sees the enterprise software play, but just doesn't know how to get there. Enter Microsoft. Weiner's joint Microsoft-LinkedIn goals went like this:

Accelerating our objective to transform learning and development by deeply integrating the Lynda.com/LinkedIn Learning solution in Office alongside some of the most popular productivity apps on the planet (note: 6 of the top 25 most popular Lynda.com courses are related to Microsoft products).

Realizing LinkedIn's full potential to truly change the way the world works by partnering with Microsoft to innovate on solutions within the enterprise that are ripest for disruption, e.g., the corporate directory, company news dissemination, collaboration, productivity tools, distribution of business intelligence and employee voice, etc.

Expanding beyond recruiting and learning & development to create value for any part of an organization involved with hiring, managing, motivating or leading employees. This human capital area is a massive business opportunity and an entirely new one for Microsoft.

Simply put, Microsoft and LinkedIn can't get to a new total addressable market without HR software.

Microsoft may not have a specific HR application, but it will have plenty of touch points. Perhaps Office can do a lot of what a human capital management app would. My guess is that Microsoft HCM won't be too far behind.