Microsoft's Q2: Enterprise shines, Surface details scant

Microsoft's second quarter results were a mixed bag relative to estimates as its enterprise products fared well, but details about Surface units, hidden within the Windows division, were largely missing in action.

The second quarter was all about Windows 8 sales and the Surface, but in the end enterprise was Microsoft's biggest strength. Products like Windows Server may not garner the headlines, but drive Microsoft's results.

The company reported second quarter earnings of $6.38 billion, or 76 cents a share, on revenue of $21.46 billion. Wall Street was looking for earnings of 75 cents a share on revenue of $21.53 billion.

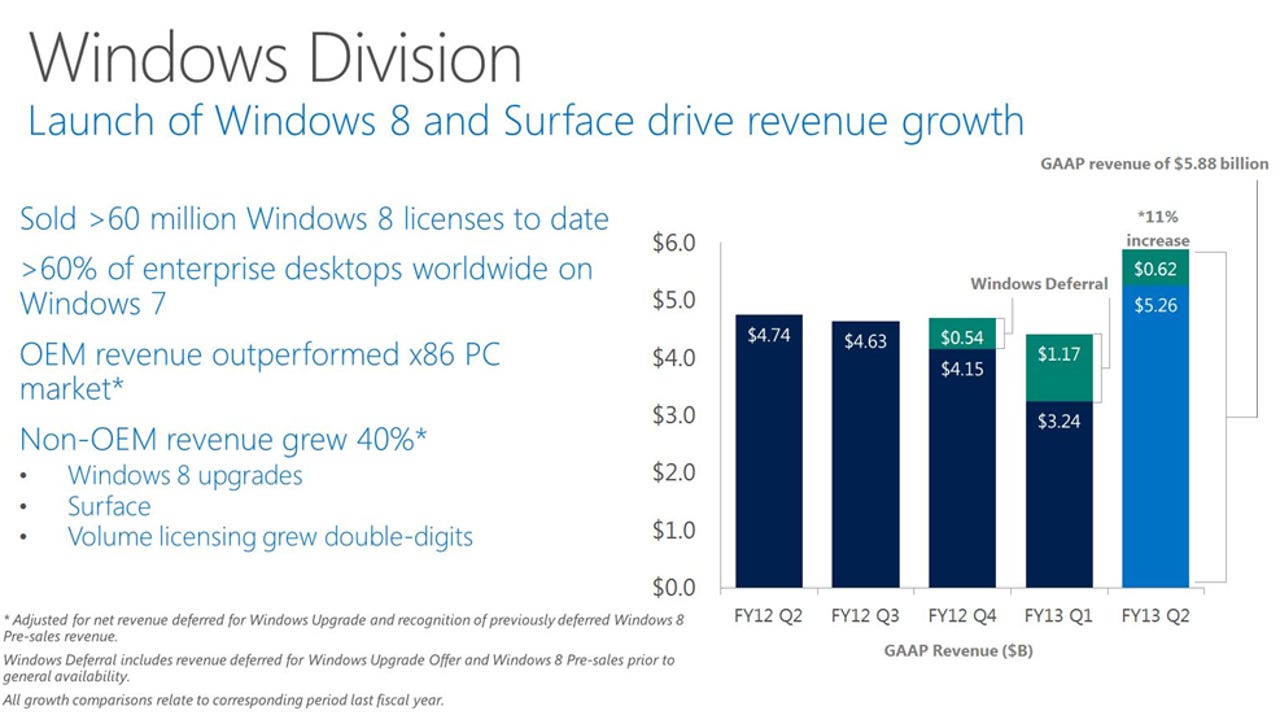

In a statement, Microsoft CEO Steve Ballmer noted that there was "growing enthusiasm" about Windows 8, Windows Phone 8 and Surface. However, the Windows division's revenue growth---excluding deferred revenue from Windows 8 pre-sales was 11 percent. Including deferred revenue the Windows division's sales were $5.88 billion, up 24 percent.

However, most of the strength for Microsoft was with enterprise products. SQL Server revenue was up 16 percent from a year ago, and System Center sales gained 18 percent.

As for Surface, Microsoft only said that non-OEM revenue was up 40 percent. That revenue line includes the Surface, but also Windows 8 upgrades. The latter was obviously larger.

In addition, Microsoft's outlook talks about the potential for Surface and Windows 8's addressable market, but falls well short of any unit predictions.

On a conference call with analysts, Microsoft largely danced around various questions about the Surface. Key points from Microsoft CFO Peter Klein:

- The company saw growth in developed markets and mid-teens growth in emerging markets.

- Skype had 138 billion minutes of calls on its network this quarter, up 59 percent from a year ago.

- Cost of goods sold increased 1 percent due to Nokia payments, the launch of Surface and cloud and infrastructure spending.

- "While the number of apps in the Windows Store quadrupled, we clearly have more work to do. We need more rich, immersive apps that give users access to content that inform, entertains and inspires," said Klein.

Here's a look at the relevant slides:

As for the outlook, Microsoft said its fiscal 2013 expenses would be in line with its previous outlook of $30.3 billion to $30.9 billion. A deep dive indicates that Microsoft can't guess where the PC market is headed.

In its outlook, Microsoft said it would work with partners to reimagine Windows and there was a massive market. Other divisions, however, offered concrete growth estimates. Servers and tools would see low-teens product revenue growth and enterprise services growth in the mid-teens in the third quarter.

The business division also had growth estimates. Add it up and Microsoft may be flying a bit blind in the post-PC era.

By the numbers:

- Microsoft's entertainment and device division delivered second quarter operating income of $596 million on revenue of $3.77 billion, down from $4.24 billion a year ago.

- The online services division pared its operating loss by a wide margin in the second quarter. The unit had a second quarter operating loss of $283 million on revenue of $869 million, up from $784 million. Microsoft cited stronger advertising and Bing market share gains.

- Microsoft’s business division is the cash cow of the company with second quarter operating income of $3.65 billion on revenue of $5.69 billion. The Windows division had operating income of $3.3 billion on revenue of $5.88 billion.

- Servers and tools had operating income of $2.12 billion in the second quarter on revenue of $5.18 billion.