Tech

Microsoft's Q3: Five things to watch

Microsoft is desperately trying to look hip, but corporate IT pays the bills. The third quarter will be all about the enterprise.

Microsoft's fiscal third quarter results are largely a warm-up act as Windows 8 and Office 15 idle on the runway, but enterprise sales are expected to bolster the financial picture.

Wall Street is expecting Microsoft to report third quarter earnings of 57 cents a share on revenue of $17.17 billion.

Here's a look at the key themes to watch:

- Enterprise results: While everyone is busy talking about Windows 8, Windows Phone and Xbox Live repeat after me: Microsoft is an enterprise technology company. Sure, Microsoft is desperately trying to look hip, but corporate IT pays the bills. Server and tools and Microsoft's business division account for 58 percent of revenue. SQL Server and System Center should fuel results. Corporate demand in EMEA as well as the U.S. were healthy, according to Morgan Stanley analyst Adam Holt.

- PC sales: PC units and revenue were better than expected in the quarter and even though the growth is anemic the results could have been worse. As a result, analysts are relatively upbeat about Windows and Office sales. Wells Fargo analyst Jason Maynard said in a research note: "Applying the revised 1.9% growth reported by Gartner to our forecast would cause Windows/Windows Live revenue to come in about $100-200MM higher than we have modeled assuming consistent unit pricing."

- About those Nokia sales: Nokia said that it sold 2 million Lumia devices. It's unclear how those units impact Microsoft, but analysts expect a good bit of Windows Phone chatter.

- Kinect: Kinect for PCs should be an interesting revenue driver for 2013, said BCG analyst Colin Gillis.

- More online losses: Yes, Microsoft will lose money in its online unit. What else is new? The big question is whether the software giant can pare those losses. Don't hold your breath.

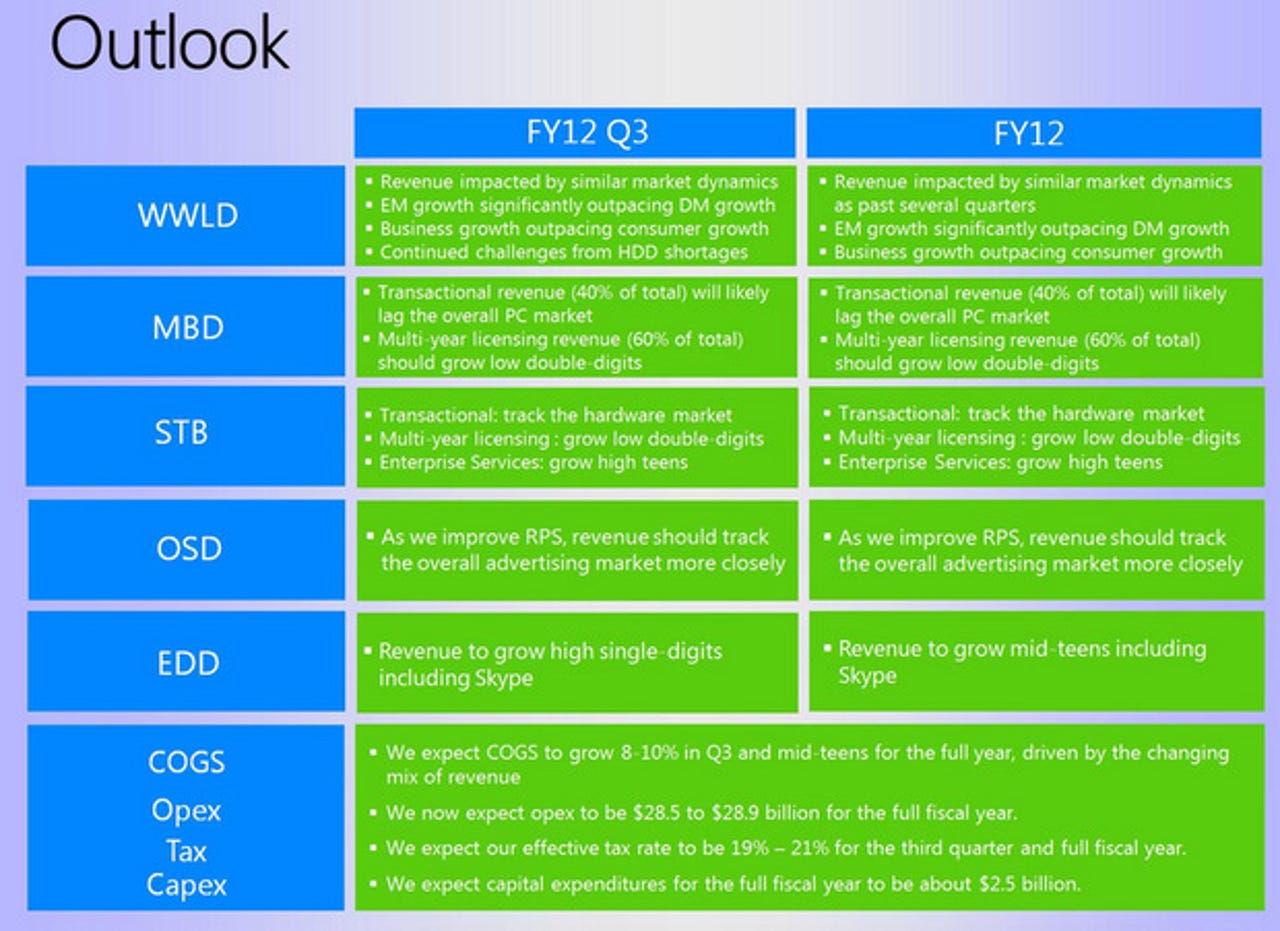

Here's a look at what Microsoft projected for its third quarter back in January: