Mint.com offers close-to-home peek at economy's impact

There are some forms of number-crunching I hate - which reminds me that it's time to start gathering up receipts for my tax accountant. And then there are "fun" types of number-crunching. Take, for example, the guest post on TechCrunch this morning by Mint.com's CEO and founder Aaron Patzer.

Mint.com, the online personal finance program, is one of my favorites. (The iPhone/iPod Touch app rocks!) I have been using it faithfully since I made a money-management resolution for the new year and love how it breaks down my financial situation from so many different angles.

Clearly, Mint.com knows what's happening in my life - how much money I bring in every month. how much credit card debt I have, how much I spend on groceries and how badly my 401(k) tanked and what's happened to my savings account. And since Mint.com has signed up nearly 1 million subscribers (actually, 900,000 is more like it), it also has a sampling of data that's better (and likely more reliable) than any other survey-taker out there.

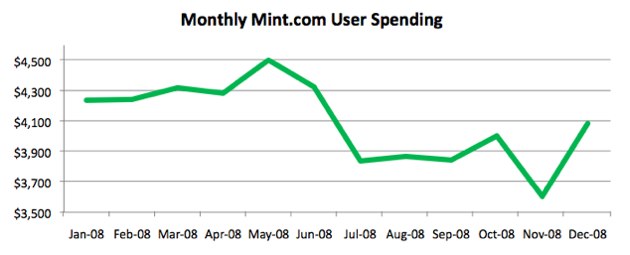

So what do they know? Well, we know that somewhere around the summer months, consumer spending tanked to the tune of about $400 per month and that it took another dip just before the holidays, decreasing by about another $200.

Looking at categories, entertainment, travel and even fuel - which probably goes hand-in-hand with travel - are all down. Interestingly enough, the amount of money spent on financial advisors went up. (I guess when times are bad, we need professionals to tell us how to reinvest to recover.)

And finally, a peek at account balances paints another picture. From early August to mid-December, our investment balances tanked while our loan balances shot up. Credit card balances remained flat but our savings accounts were slashed in half.

(images from mint.com, via TechCrunch)

I don't know if I feel better knowing that 1) I am not alone or 2) there are others worse off than me. I also don't know how this compares to the days of the Great Depression, for example.

What I do know is that consumer spending has dropped by $600 per month since the summer and that savings accounts are half of what they used to be. And for me, that sort of data drives home the point far better than a TV news anchor using percentages to tell me about the declines on Wall Street.