MNF plans geographic expansion across APAC

Australian retail and wholesale voice-over-IP (VoIP) provider MNF Group has detailed its plans for the upcoming financial year, saying it will continue to push growth through geographic expansion in the Asia-Pacific region.

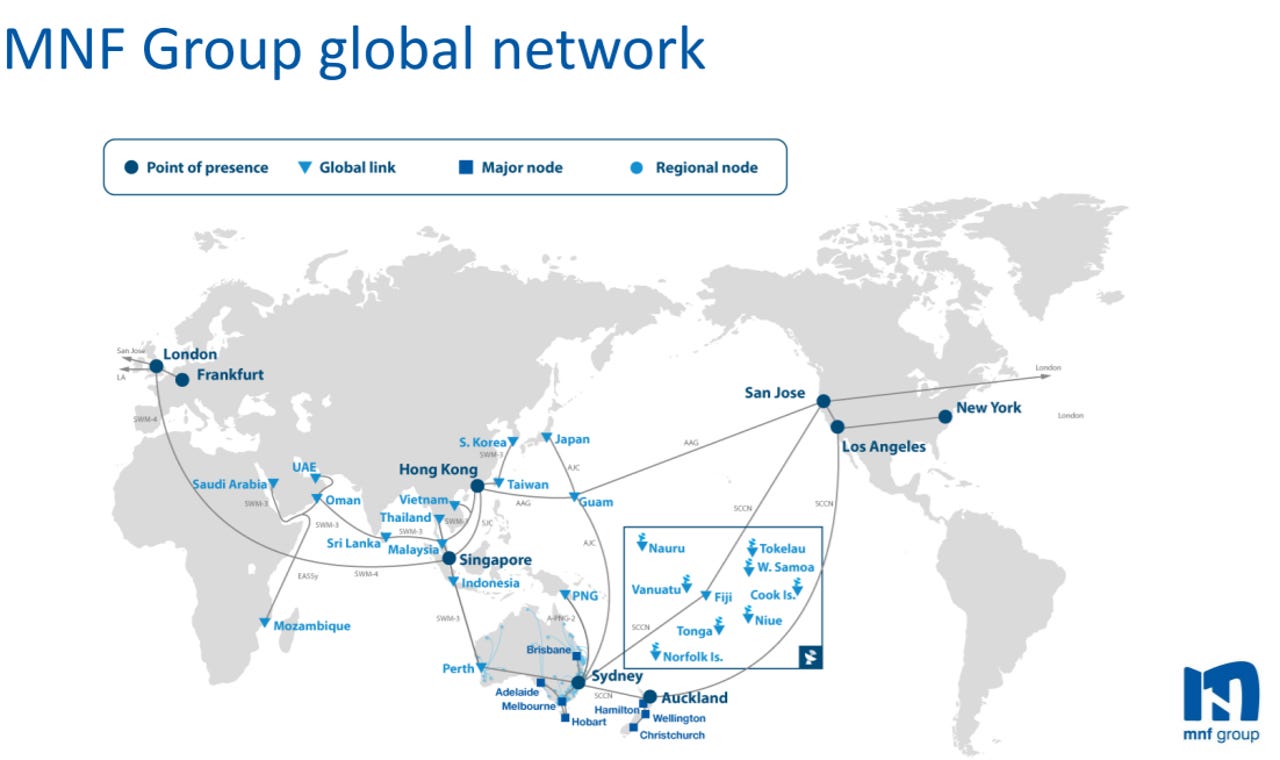

Such expansion will be driven by its Global Wholesale segment, MNF said, as it invests in further network assets.

MNF's "four-dimensional growth strategy" will also involve enhancing its software capabilities and expanding its series of communications software services and products; customer acquisition through the purchase of more wholesale, enterprise, and government customers; and customer expansion, which involves organic growth through its current wholesale customers.

The company's full-year financial results for FY17 saw net profit of AU$12.1 million, up 34 percent, and revenue of AU$191.8 million, up 19 percent.

Earnings before interest, tax, depreciation, and amortisation (EBITDA) were AU$23.9 million, up 34 percent.

These figures included five months of contributions from Conference Call International (CCI) and 12 months of Telecom New Zealand International (TNZI) US.

MNF CEO Rene Sugo again attributed the company's success to "organic growth".

"Our performance this year is largely a result of organic growth within all three segments of the business: Domestic Retail, Domestic Wholesale, and Global Wholesale," Sugo said.

"The business, as a whole, has been focused on growing our more valuable high-margin products with recurring revenue, and moving away from some of the lower-margin usage-based products.

"The company expects this transformational trend to continue well into the future as consumers and businesses quickly act to embrace our new MNF-powered applications, driven by rollout of the NBN."

During the year, MNF's Domestic Retail residential data services increased by 8 percent to reach 12,900, with its National Broadband Network (NBN) subscribers growing by 137 percent.

"However, MNF is yet to market NBN aggressively due to customer experience and delivery issues inherent with the NBN," the company added.

MNF's Domestic Retail small and medium business (SMB) segment saw virtual PBX grow by 5 percent, with 3,400 new services in operation thanks to its new bundled offers. MNF also pointed towards its telco contract win with the Victorian government.

Domestic Wholesale also grew, with wholesale service provider customers increasing by 21 percent to 287 and numbers ported reaching 645,000 as of June 30. MNF now hosts 3.1 million numbers across the domestic network, while its iBoss wholesale aggregation service grew by 83 percent to 5,500 services in operation.

MNF said its AU$17.5 million acquisition of conferencing provider CCI is "progressing well", with the company having reached all of its project milestones during the financial year.

"These include staff integration, finance integration, network integration, and number porting to our network," MNF explained.

"The CCI business is itself performing well, meeting all pre-acquisition expectations for the first five months."

MNF had acquired audio conferencing and collaboration services company CCI in early February thanks to a "heavily oversubscribed" institutional and sophisticated investor share placement and share purchase plan offer.

"The acquisition of CCI provides MNF a significant entry into the audio conferencing and collaboration market in Australia and the region. These applications generate high-margin recurring revenues, with potential for consistent long-term growth and innovation potential," Sugo said at the time.

"These applications are an excellent fit with the current MNF business, enterprise, and government sub-segment, as well as a high-value synergy with the group's domestic and global network assets."

MNF had also purchased New Zealand telco Spark's international voice business, TNZI, for NZ$22.4 million back in April 2015, completing the purchase in June last year after receiving approvals from the United States government.

TNZI sells voice, data, mobile, and digital services throughout Europe, North America, Asia, and Oceania.

In March last year, MNF then announced that it would be constructing a nationwide voice network in New Zealand through its IP voice communications provider Symbio Networks, which it will wholesale to service operators and over-the-top (OTT) providers.

MNF additionally signed a mobile virtual network operator (MVNO) deal with Telstra Wholesale in October to push into 4G and 3G mobile offerings and offer its customers a "complete communications solution".

Mobile services are offered across its Domestic Wholesale business, with mobile services to be added to its Domestic Retail division later in FY17.

MNF operates in three segments: Australian domestic retail; Australian and New Zealand domestic wholesale; and global wholesale.