More than half of U.S. student loans aren't being repaid

An inquiry by the U.S. Consumer Financial Protection Bureau into the nation's $1.2 trillion student loan debt has found that fewer than half of loans are in repayment.

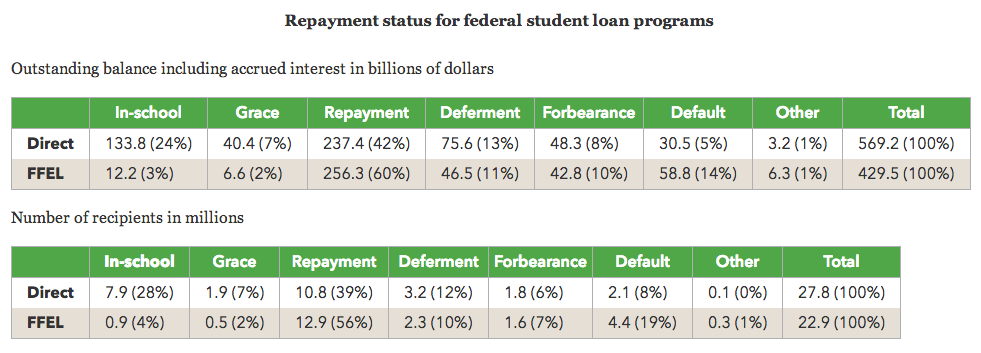

The Bureau published a report on its blog yesterday overviewing the status of loans in its Direct Loan and Federal Family Educational Loan programs (FFELP). FFELP hasn't lent any money since 2010, but $429 billion in loans is owed to the program.

It's worth noting that many Direct Loan recipients (28%) are still in school and don't owe anything - yet. Other reasons for non-payment include deferment (13%), forbearance (8%), and default (5%). That puts 2.1 million Americans in default. Another 4.4M Americans are defaulting under the FFELP program with many millions also in deferment or forbearance for reasons of financial hardship.

That's a total of $212.9 billion between those two programs; $101.3 billion may never be paid due to default (anyone who has taken financial accounting should remember the 90-day write off rule). Loans that aren't being paid accrue interest.

In May, Bloomberg's John Hechinger reported that 11 percent of recent graduates are seriously delinquent on their student loans. That figure was almost 50 percent lower in 2003. 30 percent of 20- to 24-year-olds are unemployed or not in school, Hechinger wrote. New graduates face a greater than 7 percent unemployment rate.

Tuition cost has consistently risen faster than the consumer price index, food and medical inflation since 1978. There has been an especially dramatic increase over the past several years as states slashed their higher education budgets. Overall enrollment has declined since 2010, the National Student Clearinghouse reports.

Student loan defaults in the United States are now at a record high and recent graduates are on average accumulating more debt than ever and the collective debt burden has doubled just within the past five years.

Congress passed a bill to regulate student loan interest at the start of this month.

Maybe it's time for schools to have some skin in the game too.

Image credits: About.com, CFPB

Related on SmartPlanet:

Is the student loan bubble bursting?

This post was originally published on Smartplanet.com