Business

Most successful venture capitalists have never founded a startup

No startup experience — no problem in the VC world — where even long years of VC experience aren't needed to be successful

The majority of today's successful of venture capitalists have never founded or run a company -- or even have long years of VC investing experience.

Dan Mindus and Maxwell Wessel examined the bios of the Top 100 VCs reported by CB Insights.

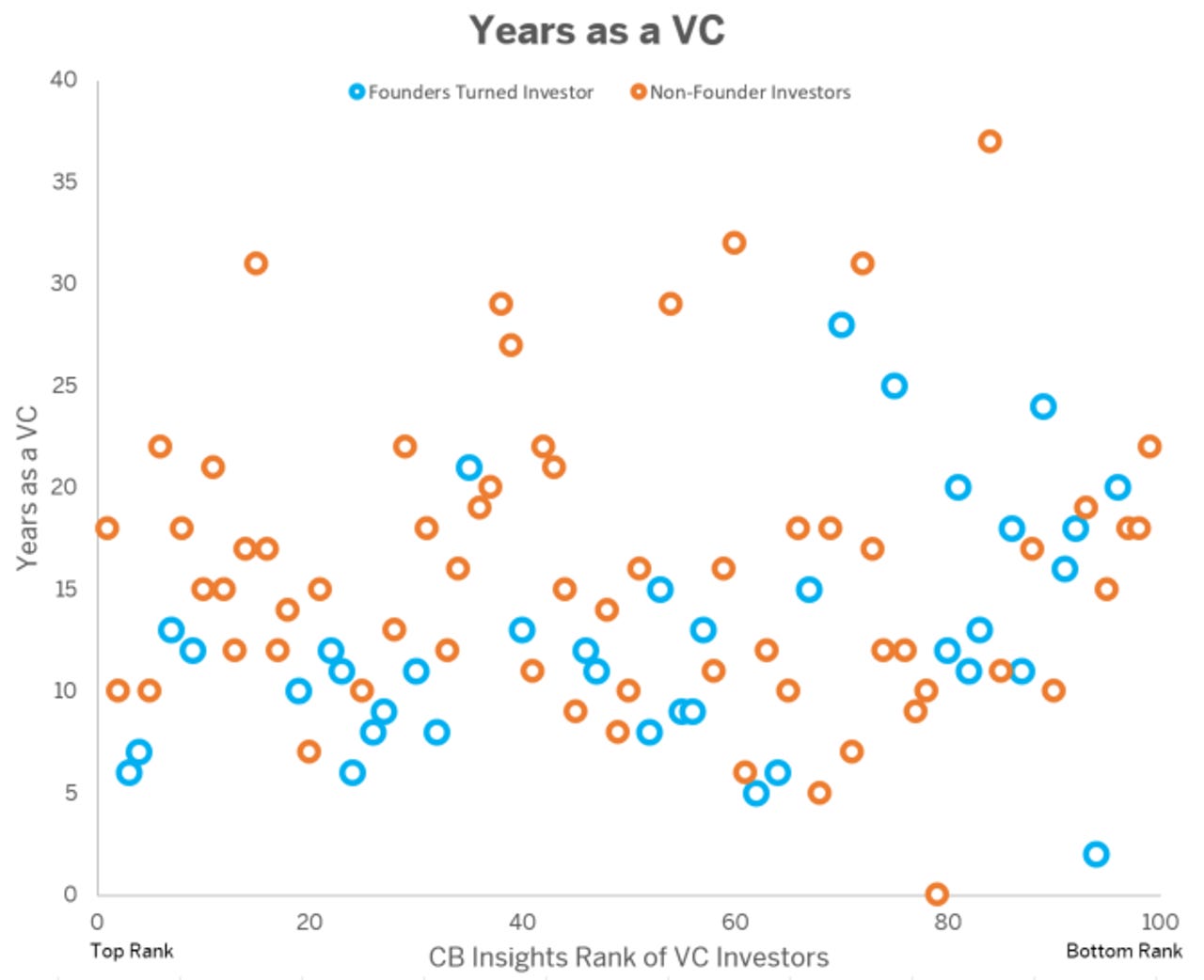

The data doesn't support the "founders make the best VCs" idea. Rather, VCs' rank within the top 100 had no relationship to whether they were former founders, or found their way into VC another way.

Interestingly, there was also no relationship between investors' years of experience as a VC and their rank on the list.

Do Ex-Startup Founders Make The Best Venture Capitalists?

If they don't know that something is impossible they might figure out a way anyway.