Net2Phone belongs with MySpace- but IDT may go to the mat

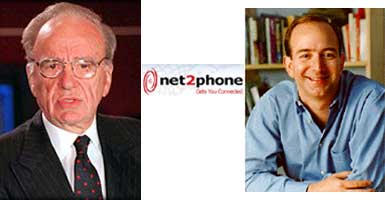

That's Rupert Murdoch, boss of News Corporation, which now owns MySpace.

And of course, Jeff Bezos, CEO of Amazon.com.

Why have I Photoshopped these gents in a canvass with the Net2Phone logo in the middle?

Well, let me tell you.

So I've been reading the latest tender offer on the part of IDT Corporation's NTOP ACQUISITION, INC. for the portion of iconic Internet telephony services provider Net2Phone it doesn't already own.

The $2.05 a share offer, which has not exactly been a smash hit with the Independent Committee of NTP shareholders, barely passed on Monday, I'm told. But it apparently didn't get enough shares to bypass the requirement that the Independent Committee approve (90%; IDT intended to get to that 90% by converting Class A shares (10 votes) to retail shares, and thus owning 90% of all shares, including shares tendered.

When I read the NTOP Acquisition filing with the Securities and Exchange Commission, lots of things jumped out at me.

Most interestingly, the estimated "Transaction Valuation" for such an offer is cited as $ 94,605,978.90.

Now, you should understand that Net2Phone has about 100,000 subscribers in the U.S., as well as a reseller business tied in to IP telephony service provider contracts with several cable companies and other broadband providers.

So not even factoring in the contractual valuations, that offer for Net2Phone comes out to less than $1,000 a subscriber.

But then I see financial analysts kicking around a hypothetical $2,000 a sub valuation for Vonage- should they ever decide to put themselves up for acquisition. That's based on a rumored $2 billion price tag for slightly more than one million accounts.

Granted, that might be a bit high, but as fellow VoIP blogger Andy Abramson writes, $1,400 a sub might be a bit more in the ballpark for other projected transactions.

So then I see an offer for less than $1,000 a sub, and I just have to wonder if Net2Phone couldn't do better.

I keep on thinking about Net2Phone as a component of MySpace.com. What a shot in the arm for social networking! And because MySpace is owned by News Corp., I envision the conglomerate's powerful multimedia marketing machine really pushing Net2Phone, driving subs and valuations higher.

Or Amazon being the owner, as a counterpart to eBay-Skype and as I've written before.

Well, maybe it won't happen so easy. Read between the lines from the tender offer filing I have been citing:

Because we are no longer conditioning the Offer on our beneficially owning 90% of the Shares upon consummation of the Offer, it is possible that we will consummate the Offer but will not be able to effect a short-form merger immediately following consummation. We remain committed, however, to acquiring all common stock of Net2Phone owned by the unaffiliated stockholders at the Offer Price as soon as practicable. This could take some time, however, and we could face obstacles in our efforts to do so. For example, IDT does not control the Net2Phone Board, which is staggered.

While we could act as a stockholder of Net2Phone and eliminate the provision in Net2Phone’s bylaws that requires a majority of Net2Phone’s disinterested directors to approve a merger with IDT, this may be insufficient as a majority of the Net2Phone Board could still oppose such a merger and it could take time before we could elect a majority of directors whom we believe would be in favor of such a merger (subject to the exercise of their fiduciary duties). Also, the settlement that we have negotiated with the plaintiffs in the pending stockholder litigation only applies to the Offer and a short-form merger and would not apply to a long-form merger.

In any of these circumstances, we will explore all options available for the purpose of consummating the backend merger and may in the future pursue options that are different than or in addition to those set forth in the Offer to Purchase in order to effect the Merger. However, at the present time we are not considering any options other than those set forth in the Offer to Purchase.

This sounds to me like we could force this down Net2Phone's throat if we really want to, but we will play nice hold off for now. But when I read language like "all options available for the purpose of consummating the backend merger..." that sounds to me like IDT does not envision giving up.

But what about if Rupert or Jeff shows up with a wheelbarrow of cash?

This is going to get real interesting, people. And quite possibly legally messy, too.