Next Insurance launches Facebook Messenger chatbot to replace the insurance agent

Guy Goldstein, co-founder and CEO of Next, said: "70 percent of our customers are buying insurance on their phones."

From IT consultants to personal trainers, therapists, coaches, photographers, and maintenance engineers, the small business sector is vast and expanding.

However, the small business insurance market seems to be dominated by generic policies that do not align with the nuances of each individual type of business.

Chatbot technology is redefining the way we view and engage with some of the largest and most traditional industries, including insurance.

Call centers, websites, and mobile apps are no longer the only means of interaction with brands. Chatbots are fast becoming a business imperative for businesses that want to engage with their customers.

Online chat through chatbots has grown faster than any prior channel. Now, with artificial intelligence and natural language processing, online chat is becoming the preferred way to communicate with the brand for many users who want an on-the-spot answer to their query.

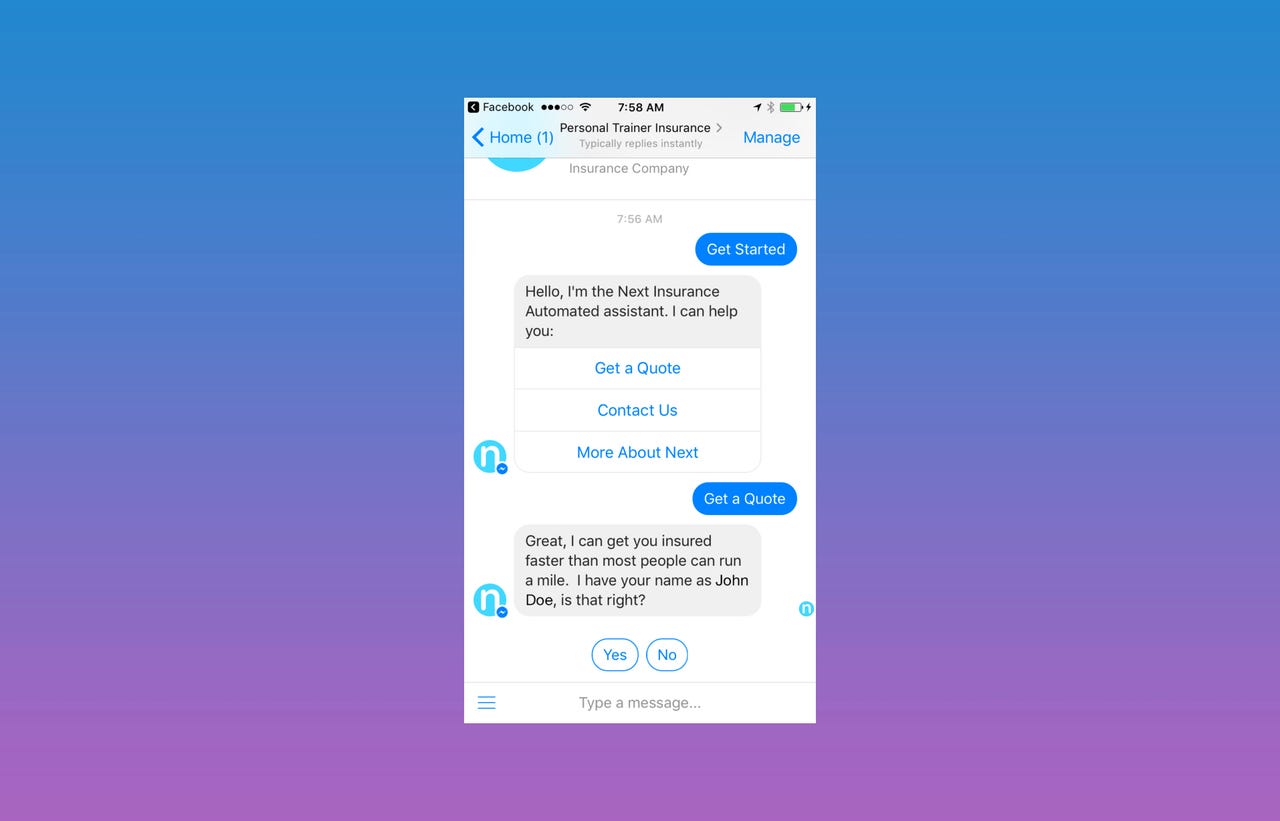

Palo Alto, Calif.-based start-up Next Insurance has launched an insurance chatbot to enable small businesses to quote and buy insurance via a Facebook Messenger chatbot.

It partnered with enterprise-focused chatbot developer SmallTalk to provide tailored insurance policies for small businesses via a social channel.

Smalltalk works with enterprise customers to help them identify where bots can drive new revenue or bring efficiencies to business processes.

The company has been able to create tailored insurance programs built to match the business owners' needs.

It has direct access to its customers through the platform to identify the best policies, prices, and processes that match the customer need whilst ensuring a higher bottom line for insurance companies.

Founded in 2016 by a team of serial entrepreneurs, Next Insurance has received $13 million seed funding from Ribbit Capital, TLV Partners, and Zeev Ventures.

Next reckons that current insurance services on offer are inadequate. Some are improperly priced, or "fail to account for fundamental needs of small businesses," and it said that there is "something broken in small business insurance."

Guy Goldstein, co-founder and CEO of Next, said: "70 percent of our customers are buying insurance on their phones.

Enabling customers to buy insurance through a chatbot on Facebook Messenger brings simplicity, transparency, and easy access. We're making sure that insurance is working for the small business owner and not the reverse."

VIDEO: Facebook now auto-plays videos with sound: Here's how to mute them