Nike's purchase of analytics firm Zodiac highlights focus on customer lifetime value

Nike has acquired Zodiac Inc., a consumer data analytics company, in a sign that its digital transformation plans revolve around customer lifetime value.

The athletic shoe and apparel maker, which is in a dogfight with Adidas and Under Armour, has a strategy called Consumer Direct Offense that aims to develop products faster with personalization at scale. Nike also has to focus on selling direct and owning the customer relationship since retail is a messy industry.

In 2016, Zodiac raised $3 million in seed funding to launch predictive analytics tools based on forecasting individual customer lifetime value. The models were developed by Wharton School Professor Peter Fader and a team of data scientists at the University of Pennsylvania.

More fitness, data and tech: Life Fitness launches cloud gym management softwareFitbit tips data, services strategy with coaching, health program app | Spin Class 2.0: When fitness meets the cloud, data and gamification | Does Fitbit have time to pull off its digital healthcare transformation? | | Apple can win electronic medical record game with Health Records in iOS 11.3: Here's 7 reasons why

Zodiac's mission is to understand the value of an individual customer to boost revenue and retention with the right marketing, recommendations and offers.

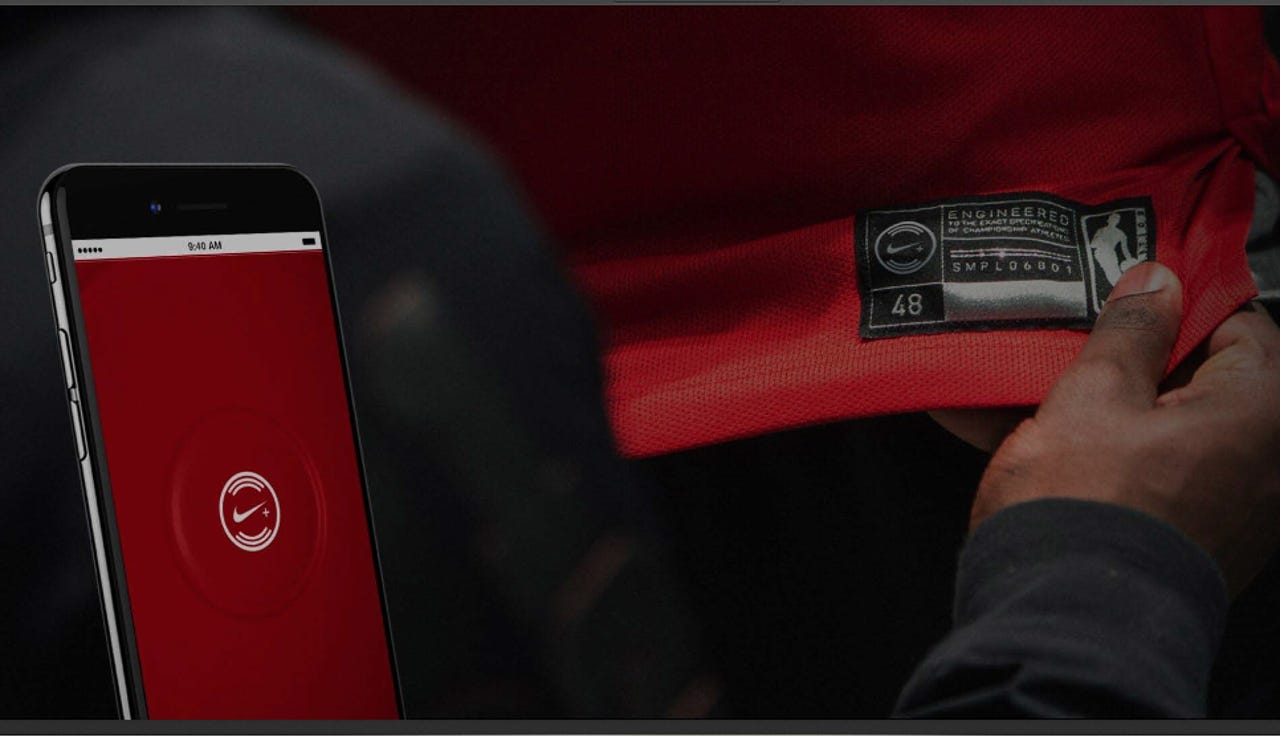

In November, Nike outlined plans to juice its growth in the years ahead by scaling new product platforms quickly and then going direct to consumer via its retail outlets, mobile apps and e-commerce partners.

Mark Parker, speaking on Nike's third quarter earnings conference call, outlined the company's progress across key areas:

- 2X Innovation, which revolves around developing new platforms (types of shoes and technologies).

- 2X Speed, which revolves around investing in digital to serve consumer demand faster. There's also a heavy dose of investment in robotics and automation.

- 2X Direct, which leads with digital channels as well as Nike's own retail outlets.

Parker said digital is the linchpin to Nike's growth and developing a direct relationship with consumers. To that end, Nike has developed the NikePlus loyalty program. He added on the conference call:

While we lead with digital, we don't believe digital and physical retail operate in silos. In fact, more and more, they will intersect and amplify each other. For example, in Q4, we're going to debut a new concept that we call Nike App at Retail at both The Grove in Los Angeles and here in Portland. When you enter the doors, it recognizes you and opens up exclusive products in your app. You can scan for product availability in all nearby NIKE doors or check out and pay through the app with no waiting line. And if you're not in the store, you can reserve product through the app, and we'll hold it in a personal locker so you can try it on before buying. There are a number of other features that'll be phased in as we test, initiate before scaling to our wider fleet of stores.

Analytics will be critical to multiple efforts. Parker added that Zodiac and its "proprietary tools will help us deepen relationships with consumers all over the world with a primary focus on our NikePlus members."

Nike CFO Andrew Campion noted that the company will invest in its data analytics team as well as add talent via acquisitions. "We already have made significant investments in building our NIKE membership team and data and analytics capabilities and are fortunate to have some great talent that's joined our company over the past several years, and bringing on teams like that at Zodiac and some other teams that we've been in discussion with are additive," said Campion.

The company's digital efforts are showing some results. In the third quarter, Nike reported third quarter revenue of $9 billion, up 7 percent from a year ago, with income before income taxes of $1.2 billion, down 12 percent from a year ago. Nike reported a net loss in the third quarter of $921 million due to charges related to the tax changes in the U.S.

Related on data science: