No good news for media industry in Internet Trends report

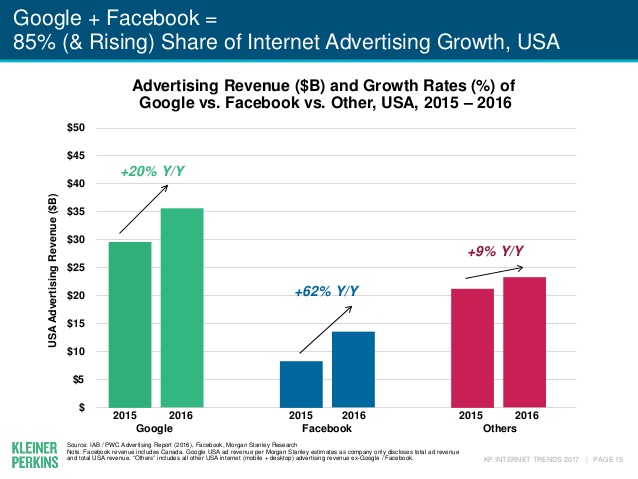

There's no good news for media companies in the latest Internet Trends report from VC firm Kleiner Perkins Caufield & Byers as Google and Facebook share an astounding 85% of all new Internet advertising.

Last year it was 74% - an acceleration that demonstrates the competitive advantage of scale companies have online or as the report's author Mary Meeker succinctly writes: "Big Get Bigger & Go After Other Bigs."

Meeker is a partner at KPCB, one of the first VC firms on Silicon Valley's famed Sand Hill Rd. She was a popular Wall Street analyst during the dotcom boom.

Here are some of the extremely worrying Internet trends for those media companies that are not Google and Facebook:

- Meeker points to an up for grabs $16 billion annual opportunity in mobile ads which should be good news for media companies. However, huge numbers of people with ad blockers are blocking this money. Google and Facebook are less affected by this issue and are making a fortune in mobile ads.

- Meeker warns that tying ad metrics to return on investment is a huge challenge and that there is a "triple-edge" to having accurate data. You might not like what it reveals about the effectiveness of some ad networks.

- Consumers say they want targeted ads but they don't want to be tracked which is a huge problem for publishers. Google and Facebook have a big advantage because they don't need cookies to target users due to logins and owning popular services.

See also

- Media companies cannot compete with additional marketing services from Google and Facebook that can monitor real-time conversations; incorporate location based ads; and demonstrate offline effects by showing retailers how they can drive foot traffic in addition to online visitors. [I called it "Vectors of Engagement" in a 2014 column.]

- In perspective: in 2016 Google and Facebook took $5.67 for each $1 of new business won by other media. It's an accelerating trend: A year ago the duo took $3.17 in new business for each $1 by everyone else. Meeker calls this pace of media disruption "torrid".

Foremski's Take:

"The trend is your friend" is sage Wall Street investment advice but there is nothing friendly about these Internet trends for any media company other than Google and Facebook.

These two giants used to compete aggressively against each other with Google launching its own social media network and Facebook aligning with Microsoft in search. But those ventures were sidelined by the end of 2014 in favor of exploiting growth opportunities in their own areas. Was this done by agreement or in response to market conditions? asks long-time Google watcher Scott Cleland.

This accelerating dominance of Google and Facebook in online advertising is being examined by European Union regulators. However, any regulatory actions will do nothing to help reverse the fortunes of struggling media companies because we still lack a stable media business model accessible to all.

Also, the Meeker report does nothing to address a massive issue for all media companies: online ads continue to lose value. For example, Google reports less money per ad but somehow each quarter it manages to show even more of them and sail past Walls Street analyst estimates.

Greater numbers of less effective ads is not a sustainable business model for any media company including Google.

The media industry apocalypse continues. And as the media sector shrinks companies are having to tell their own stories and become their own media companies, to standout, to make sure they are seen to be seen because if they don't they'll cease to exist. If we had a healthy media sector this wouldn't be needed.