Nutanix beats Q1 expectations with large deals, federal sales

Nutanix reported its first quarter financial results Thursday, beating market expectations.

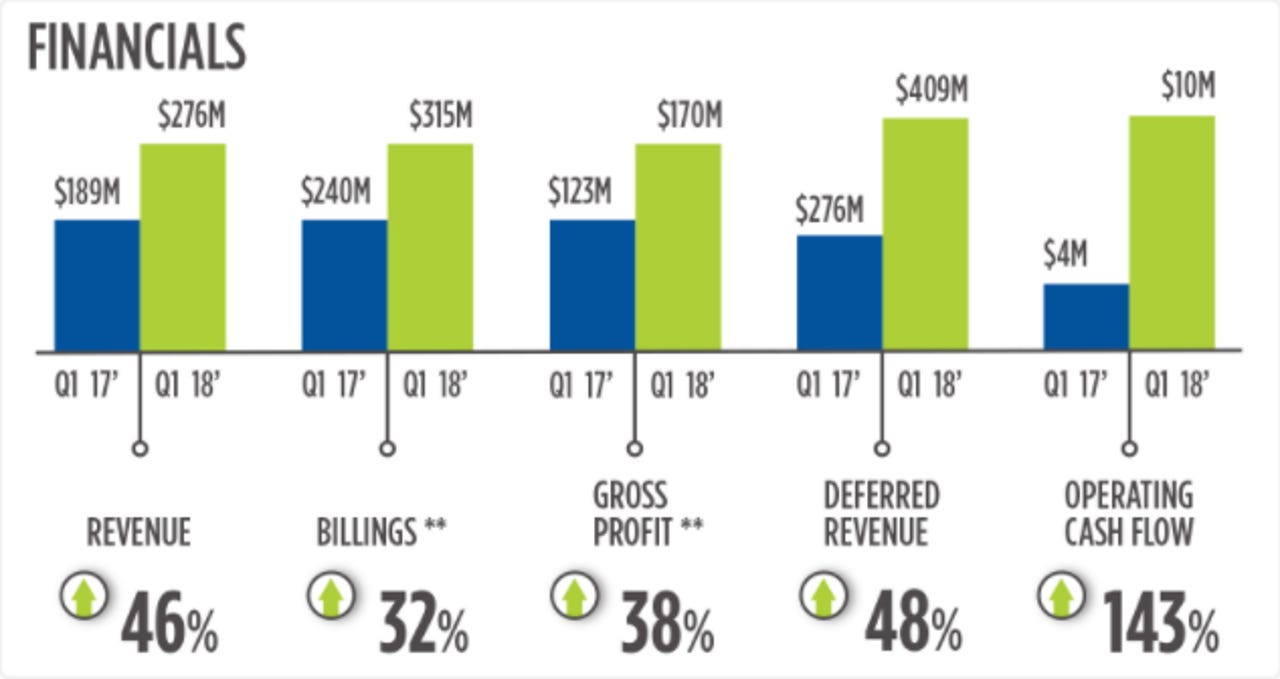

The company reported a non-GAAP net loss of $24.7 million, or 16 cents per share. That's compared to a non-GAAP net loss of $26 million, or 20 cents per share, in Q1 of fiscal 2017. Revenue came to $275.6 million, up 46 percent year over year from $188.6 million in Q1 2017.

Wall Street was looking for an adjusted loss of 26 cents a share on revenue of $266.9 million.

Billings for the quarter totaled $315.3 million, growing 32 percent year over year. Nutanix added more than 760 new end-customers during the quarter, ending Q1 with 7,813 end-customers. The company had 49 customers with deals over $1 million in the quarter, up 36 percent year over year. The company touted its growing federal sales, as well as Q1 wins with major customers like ConocoPhillips, Scholastic and Toyota Motor North America.

In a statement, CEO Dheeraj Pandey touted the company's "strong instinct for go-to-market" and its differentiated roadmap for hybrid cloud.

"Over the coming quarters we will thoughtfully adopt a software-centric strategy," he said. "Customers will continue to experience the same simple purchasing process and high-quality customer service."

For the second quarter of fiscal 2018, Nutanix expects a non-GAAP net loss per share between 20 cents and 22 cents on revenues between $280 million and $285 million.