Nvidia shares up after GPU maker posts results for "turbulent" Q4

Nvidia published its fourth quarter financial results on Thursday, disclosing "a turbulent close to what had been a great year," as CEO Jensen Huang described it. However, shares were up in after-hours trading. Nvidia was able to temper market expectations last month with a downward revision of its Q4 earnings.

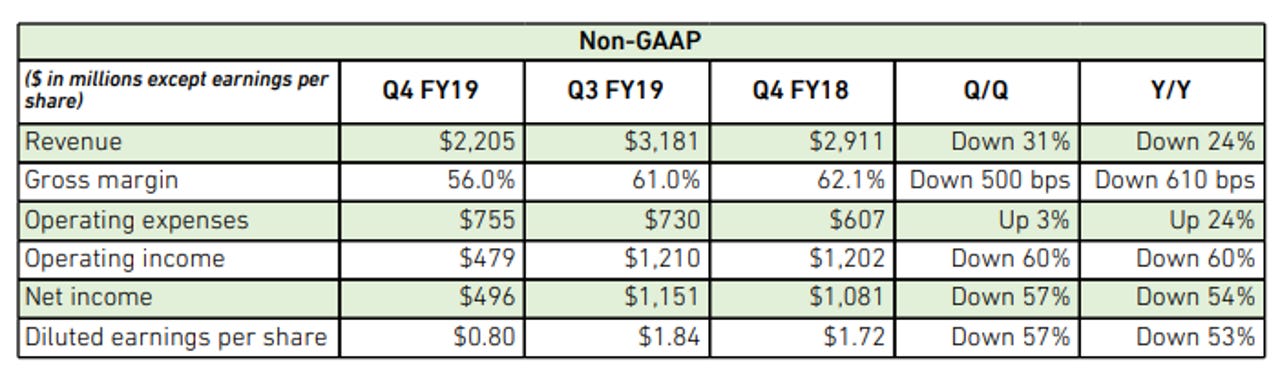

Non-GAAP earnings per diluted share were 80 cents, down 53 percent from $1.72 a year earlier. Revenue came to $2.21 billion, down 24 percent from a year ago.

A few weeks earlier, Nvidia issued a profit warning, saying that revenues would come to $2.2 billion, rather than the previously expected $2.7 billion, due to a graphics processor demand slowdown in gaming, cloud and China.

Breaking sales down by market platform, gaming brought in $954 million in Q4, down 45 percent year-over-year. Data center revenue was $679 million, up 12 percent year-over-year. Professional Visualization revenue was $293 million, up 15 percent. Automotive revenue came to $163 million, up 23 percent. OEM and IP revenue was $116 million, down 36 percent.

For the full fiscal 2019, the GPU maker reported non-GAAP earnings per diluted share of $6.64, up 35 percent from a year prior. Full-year revenue came to a record $11.72 billion, up 21 percent from a year ago. Nvidia noted that it posted record revenue for the full year in Gaming, Datacenter, Professional Visualization and Automotive.

"The combination of post-crypto excess channel inventory and recent deteriorating end-market conditions drove a disappointing quarter," Huang said in a statement Thursday. "Despite this setback, NVIDIA's fundamental position and the markets we serve are strong. The accelerated computing platform we pioneered is central to some of world's most important and fastest growing industries – from artificial intelligence to autonomous vehicles to robotics. We fully expect to return to sustained growth."

On a conference call Thursday, Huang noted the four different growth drivers of Nvidia's data center business: inference, data analytics, rendering and preconfigured systems built with partners.

The T4 Tesla GPU, which recently became available on Google Cloud in beta, is "doing great," Huang said. The T4 can handle machine learning training and inference, and it's the first in Google's GPU portfolio with dedicated ray-tracing processors.

As for analytics, "this is a brand new thing for us," Huang said. Nvidia recently unveiled RAPIDS, a new a set of new open source libraries for GPU-accelerated analytics and machine learning. "Big data and using data to predict dynamics in the marketplace is really important" in a variety of sectors, Huang noted. "There's never been an accelerated approach to solve this problem for people."

Meanwhile, rendering is a new market for Nvidia thanks to its new Turing architecture, Huang said.

Lastly, Huang said Nvidia will be able to reach more enterprises by building preconfigured systems with its network of partners, including Dell, Cisco, IBM and storage vendors.

For the first quarter of fiscal 2020, Nvidia expects revenue to be $2.20 billion, plus or minus 2 percent. For fiscal 2020, revenue is expected to be flat to down slightly.