Oracle: Sun integration 'better than expected;' Exadata pipeline swells

Oracle's fiscal third quarter earnings had a little bit of everything: The Sun Microsystems integration is going well; Exadata is a hit; SAP took its lumps; and the bottom and top lines topped Wall Street expectations. For good measure, Oracle threw in a dividend.

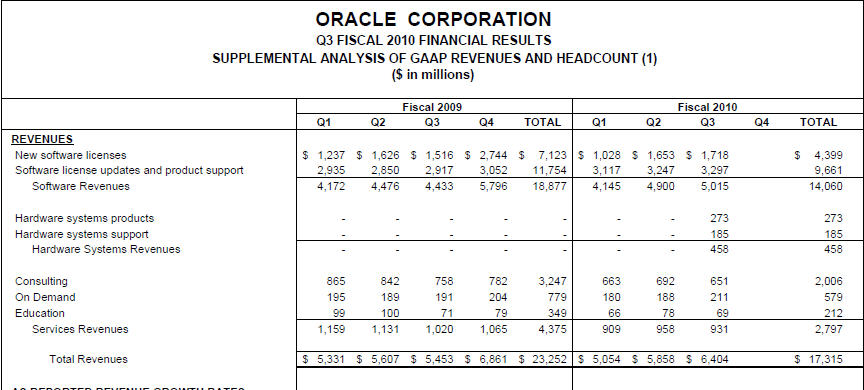

The company reported third quarter net income of $1.2 billion, or 23 cents a share, on revenue of $6.4 billion, up 17 percent from a year ago. Non-GAAP earnings were $1.9 billion, or 38 cents a share. Wall Street was expecting Oracle to report third quarter earnings of 37 cents a share on revenue of $6.35 billion. Excluding Sun, Oracle delivered revenue growth of 7 percent.

Meanwhile, new software license revenue for the quarter was up 13 percent to $1.7 billion. Software license updates and product support revenue was up 13 percent to $3.3 billion.

On a conference call, Oracle president Safra Catz put revenue for the fourth quarter will rise 36 percent to 41 percent from a year ago. That's roughly in line with Wall Street's $9.55 billion target. Earnings will be between 52 cents a share and 56 cents a share. That's a bit higher than the 53 cents a share expected by analysts.

Among the key themes in Oracle's statement (preview):

Exadata's pipeline is approaching $400 million with fourth quarter bookings nearing $100 million. Oracle is clearly aiming at IBM's high-end systems as a target.

CEO Larry Ellison took aim at SAP---again. Ellison said:

"Every quarter we grab huge chunks of market share from SAP. SAP's most recent quarter was the best quarter of their year, only down 15%, while Oracle's application sales were up 21%. But SAP is well ahead of us in the number of CEOs for this year, announcing their third and fourth, while we only had one."

Ouch. Technically I have three CEOs for SAP. Leo Apotheker stepped down and he was replaced by two co-CEOs (Bill McDermott and Jim Hagemann Snabe). Perhaps Ellison was referring to SAP Chairman Hasso Plattner.

Oracle declared a dividend of 5 cents per share outstanding as of April 14.

Sun's health unclear. Unfortunately, a stub quarter for Sun---the deal closed during the quarter---doesn't give us a complete picture of the company's hardware sales. Oracle said hardware systems revenue was $458 million, or 7 percent of revenue. There's no comparison to the year ago quarter. Hardware systems products and support expenses add up to $322 million in the quarter. Catz said Sun will crimp profit margins. On the bright side, Oracle won't sell systems at a loss like Sun did. Also see: Oracle-Sun's great society vision: Will customers bite? Oracle-Sun: Strategy set; Will buyers go for the integrated stack?

Database and middleware revenue was up 11 percent in the third quarter to $1.24 billion. Applications revenue was up 21 percent to $477 million.

Here's a look at Oracle's trending revenue: