Oracle's earnings: Is Sun getting off the mat?

Oracle's fiscal third quarter results Thursday will be a tale of moving parts. The company is integrating Sun Microsystems as it aims to keep its applications, database and middleware businesses humming.

Wall Street is expecting Oracle to report third quarter earnings of 37 cents a share on revenue of $6.35 billion. As for the fourth quarter, Wall Street is looking for earnings of 53 cents a share on revenue of $9.55 billion.

Analysts said in research notes that Oracle's quarter is likely to be in line with expectations or slightly better. Among the moving parts to watch:

The Sun integration: Analysts will want to hear a lot about how Oracle is integrating sun and whether it will deliver the operating savings. Wells Fargo analyst Philip Rueppel argued that Sun may post surprising results. With the regulatory uncertainty gone, Sun customers may have come back to buy a few servers in a broader upgrade cycle. Rueppel said that Sun could contribute revenue of $693 million, well above consensus estimates of $530 million or so.

Rueppel is on an island with his relatively rosy view of Sun. Jefferies analyst Ross MacMillan said that Wall Street has discounted weak results from Sun.

Market share gains: On the application front, Oracle is facing off with SAP, which has turned over management. Meanwhile, SAP executives have left---or are leaving. This turmoil should have given Oracle a few opportunities, say analysts. Oracle's database business is expected to deliver the typically strong performance.

Exadata 2: How's Oracle's database machine---and CEO Larry Ellison's favorite topic---selling? More importantly, what other integrated machines does Oracle/Sun have in the pipeline.

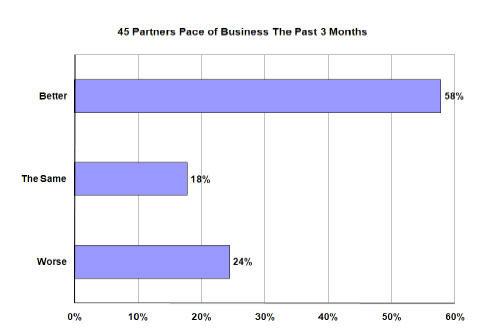

The overall outlook on tech spending: MacMillan said "our work on core Oracle suggests that the company had a decent quarter close and we think activity levels and close rates continue to improve." Piper Jaffray Mark Murphy had a similar finding and said that 58 percent of the Oracle partners he surveyed said business was improving.

Murphy wrote in a research note:

We recently conducted due-diligence checks with 45 of Oracle's partners and found near-term results that were slightly below plan, offset by positive feedback surrounding middleware and Exadata sales activity.