Oracle's fourth quarter: What to expect

Oracle's fourth quarter is expected to be strong and analysts expect the company to continue to fuel growth via its warpath on hardware rivals and SAP.

The software giant is expected to report fourth quarter earnings of 71 cents a share on revenue of $10.75 billion.

There are a few worries that Oracle will cut its outlook a bit, but the company is expected to keep chugging along.

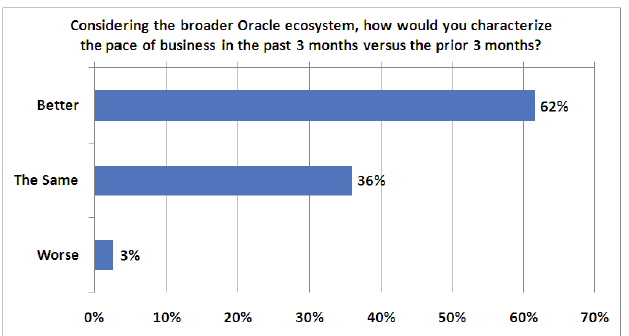

Indeed, Piper Jaffray analyst Mark Murphy said that his checks with 39 partners "indicate solid results." Apparently, Oracle is still seeing a pop from pent-up demand from 2009 and 2010. In other words, large deals are being closed.

Among the mileposts to watch:

The outlook: Wall Street is expecting fiscal first quarter earnings of 46 cents a share on revenue of $8.28 billion. For fiscal 2012, Oracle is expected to report earnings of $2.39 a share on revenue of $38.87 billion.

Color on Fusion: Oracle's Fusion applications are being rolled out, but enterprises are testing the waters only, said Murphy. "Our checks indicate that although Oracle continues to make progress on Fusion applications, it still requires significant integration work, and therefore only enterprises are testing the waters at this point," said Murphy. "It is not yet "plug and play" ready, nor is it as close to being truly Web 2.0 as an application from NetSuite or Salesforce.com. That said, resellers generally believe Oracle has the correct vision regarding Fusion.

Hardware health: Oracle's Exadata appears to be the real deal and analysts estimate that 100 customers have the machines in production environments. However, Oracle is discounting Exadata, analysts said. That discounting is on par or better than rival hardware discounts. Barclays Capital analyst Israel Hernandez projected hardware sales of $1.29 billion for the fourth quarter, up 5 percent from a year ago. The big question is whether Oracle can continue to grow its hardware business as the low hanging fruit of the Sun acquisition is plucked.

Pockets of strength in applications: Analysts are expecting Oracle to cite strength in business intelligence, CRM and vertical applications. Large ERP deals will be more muted.

Can Oracle continue to expand margins? You have to wonder how Oracle can continue to expand margins via maintenance increases, but analysts think profits will continue to get better. Oppenheimer analyst Brad Reback said:

We believe investors are still overlooking the near-term leverage in Oracle's model. We feel there is still plenty of low-hanging fruit (rationalizing vendors, lowering reseller rebates, operational efficiencies, etc.), which should enable Oracle to expand its operating margins >200 basis points in FY12...These factors, coupled with a strong, highly profitable and growing maintenance base, lead us to believe that ORCL can continue to augment its margin profile for some time to come.

Recent headlines:

- Oracle wants billions from Google over Android: And just might get it

- HP sues Oracle over Itanium support: Does the lawsuit make sense?

- Google pans Oracle damages argument: Java was fragmented well before Android

- HP vs. Oracle - From ugly to uglier as HP takes to the Courts

- Oracle on the rack over Itanium

- Oracle acquires FatWire, aims to bridge marketing, CRM, e-commerce