Oracle's Sun strategy: What to expect

Oracle on Wednesday will unveil its grand vision for Sun Microsystems in a five-hour powwow with analysts.

Now that Oracle's acquisition of Sun is complete the real work begins. Analysts have been busy trying to figure out Oracle's grand plan. It's clear Oracle CEO Larry Ellison will focus on high margin systems and integrated appliances like the Exadata machine.

In the meantime, Oracle has to stop Sun's bleeding and shed parts that it doesn't want. But Oracle's powwow is likely to be more than just a hardware gab fest. What's the strategy for Java, Solaris and Sun's other software properties?

Also: Oracle's Sun acquisition gets approval from Europe; Strategy session set for Jan. 27 · Oracle lays out its vision for Sun: Will it work?

Cowen & Co. Peter Goldmacher writes in a research note:

We expect Oracle to come out swinging on Wednesday with its usual bravado now that the EU has approved the deal. Oracle has repeatedly touted the merits of the Exadata box and the opportunity for customers to benefit from a pre packaged database appliance. We expect Oracle to go beyond the technical/financial merits of Exadata and broaden the dialogue to include future opportunities around storage and networking in the context of a data center refresh cycle.

Deutsche Bank analysts reckon that Oracle will shed high volume businesses where Sun can't win. As noted by Ellison, competing with HP and IBM's scale doesn't make much sense. Overall, Deutsche Bank thinks Sun will add about $8.2 billion in fiscal year 2011 revenue and an operating profit of $1.5 billion.

Deutsche Bank's team notes:

While we see some attractive growth businesses within Sun (primarily in software but also in areas of systems and storage), the company overall is largely living off its legacy install base with maintenance, services, and existing customer expansion. As such, we would not anticipate the business to show strong organic growth even after potential product rationalizations. Nevertheless, with a heavy concentration in macro sensitive areas (Telco, Financial Services, High-end, and Mid-range systems) Sun could benefit in the near-term from economic recovery and pent-up demand with reduced uncertainty following the closer of the Oracle deal.

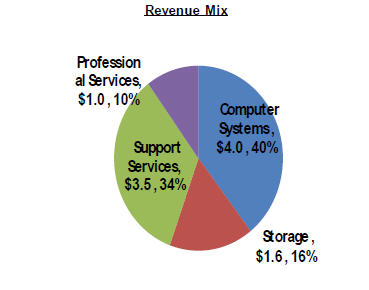

Here's a look at Sun's revenue base for fiscal 2010:

To get to that diversification, Sun completed a bevy of acquisitions that got the company to $10 billion in revenue but provided little to no organic growth.

Meanwhile, the hardware business is likely to be reshuffled, according to Deutsche Bank. For instance, Oracle may not stick around in the volume server business---Sun Fire, Sun Blade 6000 Series---and it's unclear whether mid-range servers (Sun Fire, M-Series 4000, 5000) make sense.

Most analysts agree that Oracle can leverage Sun's open source heft, but note that the company is likely to keep acquiring companies, including quite a few hardware vendors.

Deutsche Bank has a handy chart of companies that may be future acquisitions for Oracle, which will need more than Sun to boost its data center footprint. Possible acquisition targets include EMC, Juniper, Brocade and NetApp. And that's just hardware. Deutsche Bank also has SAP, Symantec, CA and BMC on its list.

Simply put, Oracle's acquisition of Sun is just a stepping stone to more deals in the future. The end state: IT mega vendors. However, Goldmacher strikes a cautious note:

We believe that Oracle’s push into networking and storage is another step down the path towards increased competition with Cisco/IBM/Hewlett Packard as old alliances fall by the wayside and vendors increasingly go it alone. We believe this return to "mega IT vendors" will force Oracle to continue down an M&A path that increasingly takes it further from its roots, compresses margins and heightens execution risk. For all its efforts, we see the end reward as a pricing war because all of these large vendors are spending R&D dollars to tweak legacy technology and compete on price rather than invest in material innovation.