Palm's good news: The Centro is a hit. That's the bad news too

Palm had a simple message during its third quarter earnings conference call: The Centro is selling. It's a hit. Normally, that would be great news. But when you're biggest product is a $99 smartphone you have a few profit margin issues.

After the closing bell Thursday, Palm said that it lost $17 million, or 16 cents a share, excluding charges. A year ago, Palm (all resources) had a profit of $16.5 million. Revenue was down to $312.1 million in the third quarter from $410.5 million a year ago. Palm's net loss was $31 million, or 30 cents a share. According to Thomson Financial Palm was expected to report a loss of 14 cents per share on revenue of $315.3 million.

First, the good stuff. Here's what CEO Ed Colligan had to say (transcript):

This quarter we report record sell-through of 833,000 smartphones. A huge chunk of that sell-through is the result of the Palm Centro getting off to the best start of any smartphone in Palm's history. We could not be more pleased by the reception of the Palm Centro.

We have consistently sold more than 30,000 Centros per week and as we add carrier partners, that number continues to grow. In fact, the usual pattern with a new product is an initial burst of volume at any individual carrier which fades over time as the product ages. With the Centro, we are seeing the opposite, with volume growing over time. This volume is building our already strong customer base and it is expanding it to new demographics.

Indeed, Palm's Centro units are growing and the company just landed AT&T as a carrier in addition to Sprint. Palm sold 833,000 units in the third quarter, 686,000 in the second and 689,000 in the first quarter.

And the bad news:

Centro's success last quarter did not offset the continued declines in our traditional handheld business and the fact that our Windows Mobile product line is aging. The combination of these factors and a mix shift toward lower margin Centros resulted in revenue of $312 million and a loss of $0.16 a share. As we continue to increase Centro volume and rebuild our product line at the high end, we expect to see a shift back to higher margins and a return to sustained profitability.

You know where this is headed. Palm's success clearly hinges on developing that high end smartphone that can compete with the iPhone, BlackBerry and a bevy of devices that have left the Treo in the dust. The Treo looks downright clunky these days with tired designs and a tired OS.

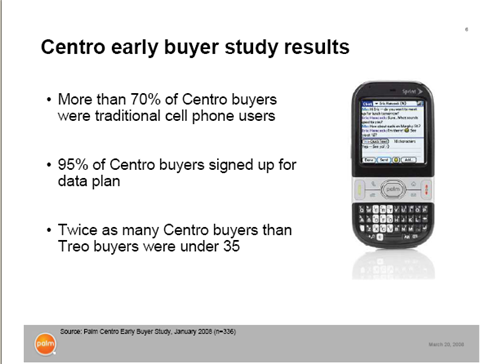

On the bright side, Palm says 70 percent of Centro buyers are traditional cell phone users who are buying a smartphone for the first time. These folks will eventually trade up. Palm's challenge is giving these people something to trade up to.

Other odds and ends:

- Palm is having some trouble getting components for the Centro. Colligan said "there are a couple of components that could constrain this quarter, depending on how much that growth exceeds our expectations, frankly. Right now we are starting to see early demand from carriers that would push right up against the wall relative to today's committed supply."

- Colligan said Palm expects "to refresh our Windows Mobile product line before the end of the summer, with exciting new products which will be targeted at business customers."

- The new Palm OS is "meeting its major milestones."

- Palm's recovery remains a fiscal 2009 story. Until it develops its new platform and launches new high-end phones, it will remain squeezed. Average selling prices were about $331 per unit. "While we expect ASPs to rebound in the first half of next fiscal year as new Treos are introduced, we do expect to see additional declines in ASPs for Q4 as a result of the continued mix shift towards Centros," said Andy Brown, Palm's CFO.