PayPal expands One Touch checkout service as competition mounts

PayPal said Wednesday it is expanding its One Touch payment service to 13 markets across Europe and Australia.

In addition to the US, Canada and the UK, One Touch is now available in Australia, Austria, Belgium, Denmark, France, Germany, Netherlands, Norway, Poland, Spain, Sweden, Switzerland and Turkey.

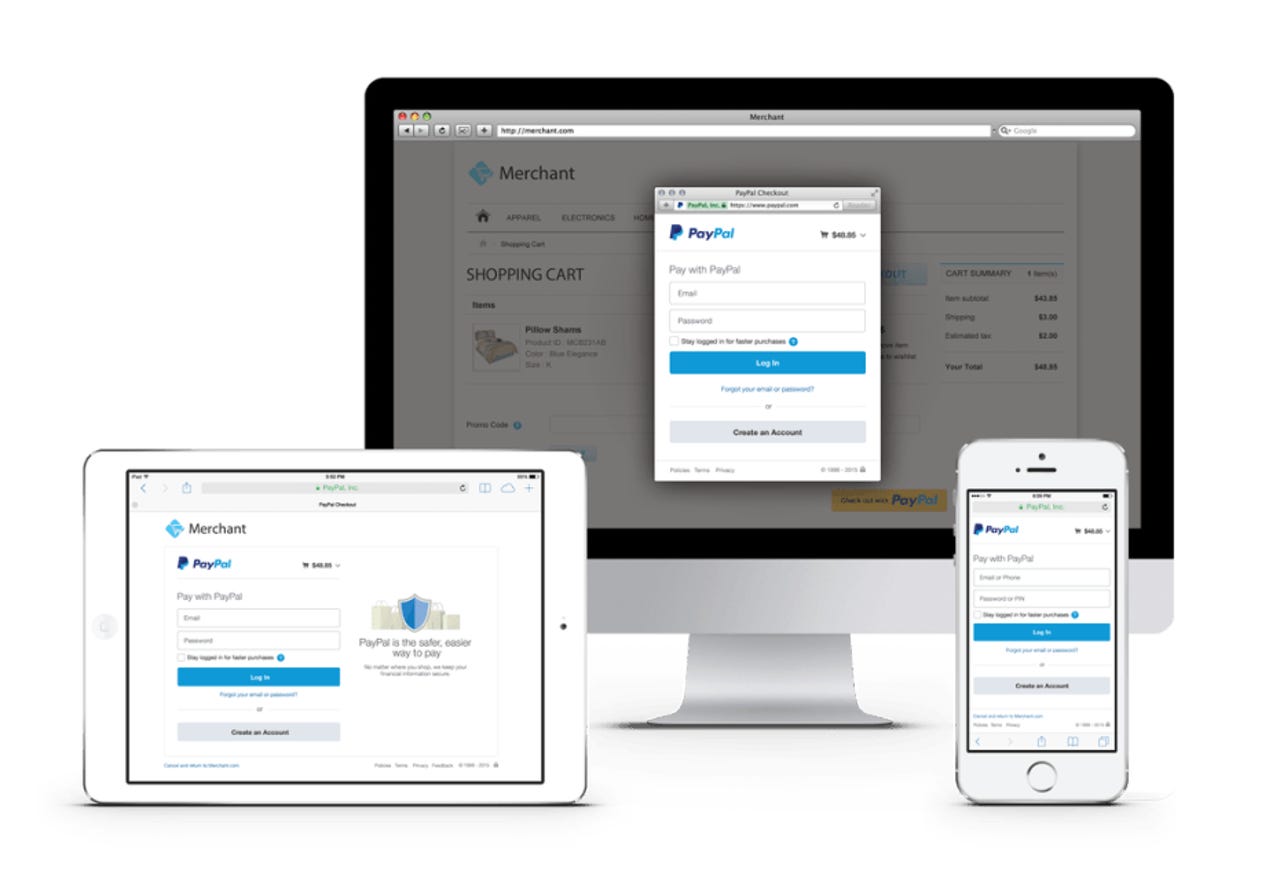

One Touch is PayPal's answer to the often laborious process of making purchases within apps and on websites.

The service originally launched as a native mobile feature to give shoppers the option of storing their account information in order to complete subsequent in-app purchases with just a single click. In April of this year PayPal expanded One Touch availability to websites, allowing more traditional e-commerce purchases to be completed in the same single-click fashion.

A month later PayPal connected the dots even more by linking mobile web and mobile app sessions, which gives a one-click checkout experience on a mobile device without requiring the PayPal app to be installed on that device.

The system hinges on the interconnectedness of PayPal and its processing subsidiary Braintree. Once a shopper enters their payment information upon initial login, that information is encrypted, stored and shared between online stores that are supported by Braintree's platform.

Featured

PayPal was one of the first platforms to dive into one-click payments, but the competition is mounting from all directions.

PayPal has touted the service's success in mobile, saying the in-app iteration led to a more than 50 percent improvement in conversion rates for companies such as StubHub and Airbnb.

But just this week payment giant Visa released an update about its One Touch challenger dubbed Visa Checkout that suggested PayPal's stronghold was starting to slip.

According to data from Visa, compiled by the retail analytics firm ComScore, online shoppers using Checkout are 17 percent more likely to complete their purchases (as opposed to filling an online basket and later abandoning it) than those using PayPal.

Now a year since its launch, Visa Checkout has deployed at retailers including Best Buy, Barnes & Noble, and oddly enough, Taco Bell.

But in terms of users, Visa is a long way behind PayPal. Visa Checkout has 6 million registered users, compared to PayPal's 169 million active user accounts. Granted not all PayPal users have opted in for One Touch, but they are at least in the ecosystem.