PC sales fell in Q1 as tablets trumped netbooks

Both the major PC research companies, IDC and Gartner, have reported a decline in PC sales during this year's first quarter, which was otherwise marked by the Japanese earthquake and tsunami and by the launch of Apple's iPad 2, which may have sold about 2.5 million units. IDC estimates that global PC sales fell by 3.2 percent to 80.6 million units, while Gartner registered a 1.1 percent fall to 84.3 million units.

While the two companies are generally in broad agreement, this time they differ in their view of Acer, which is the world's second largest PC supplier by units, and the biggest supplier of netbooks. It certainly looks as though netbooks took a hit, especially in the US market, where Gartner has Acer Group's shipments falling by 24.9 percent to 1.8 million units, while IDC's numbers are -42.1 percent and 1.3 million units.

It seems that Acer entered the year with 12 weeks of inventory rather than the usual six, according to the Financial Times, which could have limited new shipments. Either way, it is presumably not a coincidence that the Taiwanese company's Italian boss, Gianfranco Lanci, had a disagreement with the board and left at the end of last month.

In its quarterly statement, IDC said:

"Although the forecast for the quarter was already conservative – IDC expected a mere 1.5% growth in shipments – a steady but still cautious business mentality and waning consumer enthusiasm persisted. A spike in fuel and commodity prices and the disruptions in Japan added to the mix, further dampening a market struggling to maintain momentum."

Gartner's principal analyst Mikako Kitagawa said:

"Weak demand for consumer PCs was the biggest inhibitor of growth. Low prices for consumer PCs, which had long stimulated growth, no longer attracted buyers. Instead, consumers turned their attention to media tablets and other consumer electronics. With the launch of the iPad 2 in February, more consumers either switched to buying an alternative device, or simply held back from buying PCs. We're investigating whether this trend is likely to have a long-term effect on the PC market."

It's certainly true that there was little excitement in the PC market except for the Intel Core iX Sandy Bridge chips, which deliver outstanding performance but were hit by a widely-publicised bug. There was even less excitement in the netbook market, where prices have risen but performance generally hasn't. The replacement of Microsoft Windows XP with Windows 7 Starter apparently failed to boost netbook sales, and might even have harmed them.

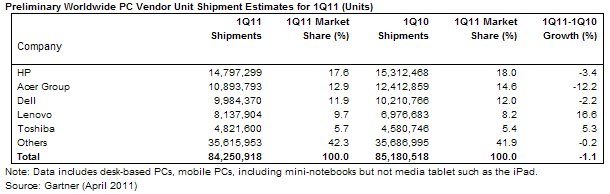

Hewlett-Packard (including Compaq) held on to its global top spot in both Top 5 tables of the largest PC manufacturers by unit shipments. According to Garter, HP shipped 14.8 million PCs -- down by 3.4 percent compared to the same quarter last year -- for a market share of 17.6 percent. It was followed by Acer (10.9m, 12.9 percent), Dell (10.0m, 11.9 percent), Lenovo (8.1m, 9.7 percent) and Toshiba (4.8m, 5.7 percent). IDC's more pessimistic view of Acer dropped it a place, so its Top 5 comprised HP, Dell, Acer, Lenovo and Toshiba.

Lenovo and Toshiba were the only Top 5 PC suppliers to increase shipments compared with the same quarter last year. IDC said: "Lenovo significantly outperformed the market with shipments posting 16.3% growth."

Apple also increased its Mac sales, as it has for the past several years, but it's still not selling enough units to overtake Toshiba globally. However, it's now not far behind Toshiba in the US market, which had a very bad first quarter. According to IDC, US shipments fell by 10.7% to 16.1 million units, while Gartner saw them falling by 6.2 percent to 16.1 million units. Fortunately the US market isn't anything like as important as it used to be….

In the (mainly) Western European market known as EMEA, Gartner reckons PC shipments fell by 2.8 percent to 26.1 million units, with only Lenovo showing an increase. The Top 5 in Europe were HP, Acer, Dell, Asus and Lenovo.

Gartner research director Ranjit Atwal said: "The PC market in EMEA had not exhibited decline since the third quarter of 2009 when the market declined 8.9 percent."

In Asia/Pacific, PC shipments grew by 4.1 percent to 28.2 million units in the first quarter of 2011. Gartner said: "PCs were not high on consumers' shopping lists during the Chinese New Year holiday. In India, consumers were distracted by the Cricket World Cup. They also preferred to upgrade or purchase new TVs or other home electronics."

The PC market in Latin America grew by 5.4 percent to 8.1 million units, and Brazil accounted for over 40 percent, according to Gartner.

In Japan, PC shipments fell by 13.1 percent to 4 million units, with the earthquake and tsunami on March 11 reducing shipments. Gartner said: "The impact of the disaster was most evident in the professional PC market, where the second half of March is the year's busiest procurement period."

Most of the large PC manufacturers are developing tablets, usually running Google's Android operating system, and many are moving into smartphones. Whether those will prove to be financially rewarding remains to be seen, but they are following the market, rather than leading it.