Pure Storage, NetApp quarters highlight data center shift to flash storage

Pure Storage said it's on track to be cash flow positive in the second half and deliver $1 billion in revenue for 2017 as flash storage systems gain momentum.

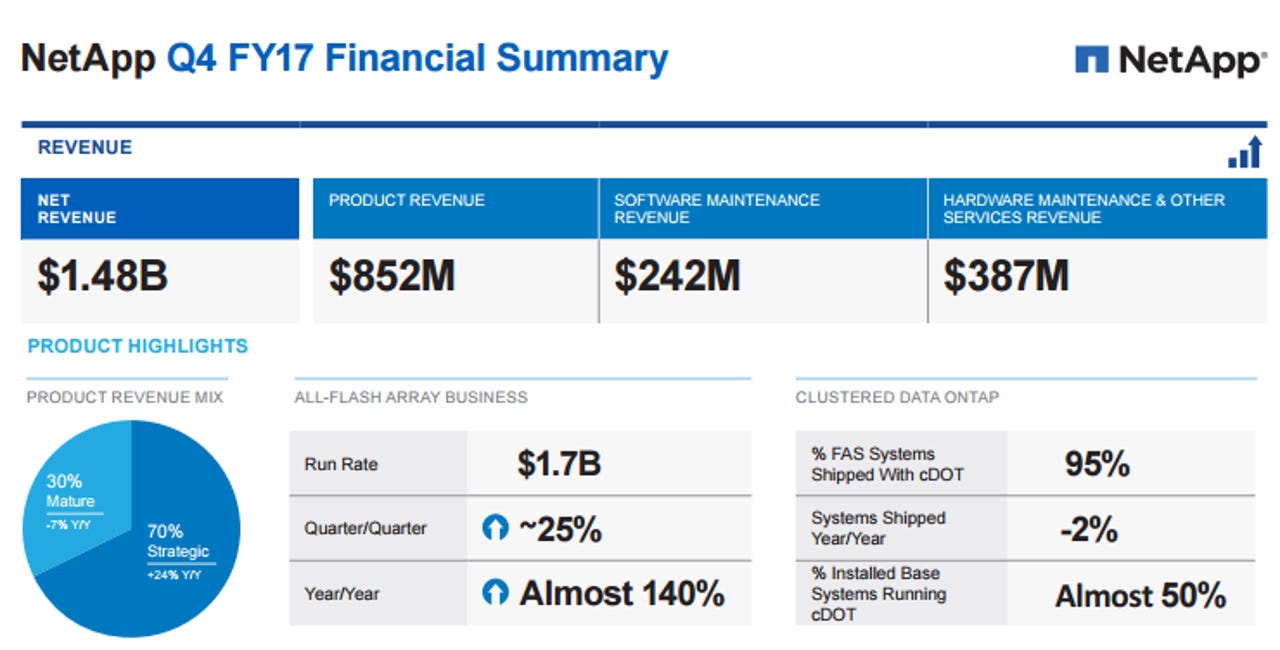

Meanwhile, NetApp said its all-flash portfolio is on a $1.7 billion annual run rate.

The upshot is that the storage market is running to flash storage for cloud (public and private) deployments. NetApp reported fourth quarter net income of $190 million, or 68 cents a share, on revenue of $1.48 billion. Non-GAAP earnings and sales topped estimates, but the first quarter outlook was light.

NetApp said it saw revenue of $1.24 billion to $1.39 billion with non-GAAP earnings of 49 cents a share to 57 cents a share.

On a conference call with analysts, NetApp CEO George Kurian said:

We are winning with flash and expanding our intellectual property in this market, positioning us for success in the multi-year transition from disk to flash. In 2016 NetApp was the fastest growing of the leading SAN suppliers.

Funny that Pure Storage had a similar refrain, but the conclusion was the same: Flash is the de facto standard in the enterprise. Pure Storage reported a first quarter net loss of $62.4 million, or 30 cents a share, on revenue of $182.6 million, up 31 percent from a year ago. Non-GAAP first quarter earnings were 14 cents a share, 8 cents a share better than estimates.

As for the outlook, Pure said second quarter revenue will be between $214 million to $222 million. For fiscal 2018, Pure projected $975 million to $1.02 billion in revenue.

On a conference call, Pure CEO Scott Dietzen said:

Pure is benefiting from or becoming a preferred choice for 3 growth markets; the data platform for clouds 4 through 1,000; next-generation data-driven application, including AI and machine learning; and bringing our cloud capable platform to enterprise IT.

He added that Pure's data storage systems are being used for multiple growth markets. A quarter of Pure's business is selling to cloud providers as well as software as a service players.

Dietzen noted that Pure won deals against Dell-EMC, HPE and NetApp and added:

Our legacy competitors simply can't deliver on the promise of the cloud. Their solutions are too labor-intensive, too difficult to scale, require customers to rebuy the same storage over and over and to disruptively migrate data. While we occasionally compete with the big 3 public clouds in all 3 of our markets, our business will continue to thrive as our customers use Pure's data platform in conjunction with the public cloud, particularly for data sets that are too large to move across the internet.