Qualcomm narrowly beats expectations for Q3

Qualcomm just scratched past Wall Street expectations, but the wireless technology developer still posted solid earnings for the third fiscal quarter of 2011.

Qualcomm reported third fiscal quarter earnings of $1.04 billion, or 61 cents a share (statement). Non-GAAP earnings were 73 cents a share on a revenue of $3.62 billion. Wall Street was expecting earnings of 71 cents a share on revenue of $3.6 billion.

The San Diego-based company's CEO and chairman Dr. Paul E. Jacobs said in a statement:

Qualcomm delivered strong year-over-year results again this quarter as our business performed well across all key guidance metrics. In addition, we successfully completed the acquisition of Atheros, positioning us to further expand our opportunities going forward.

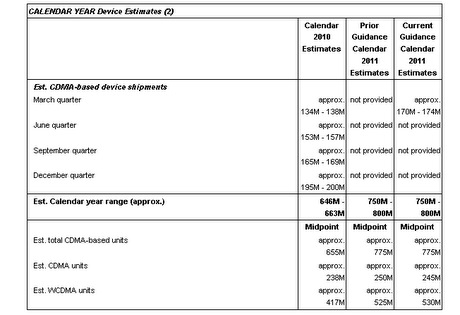

Looking forward, we continue to see healthy growth in CDMA-based device shipments of approximately 18 percent in calendar year 2011, and we are pleased to be raising our revenue and Non-GAAP earnings guidance for the fiscal year, driven primarily by strong global smartphone adoption and the addition of Atheros.

Qualcomm’s projected outlook for the fourth fiscal quarter called for non-GAAP earnings of $3.86 billion to $4.16 billion, or 75 to 80 cents a share. For 2011, Qualcomm’s estimates are non-GAAP earnings of $14.7 billion to $15 billion, or $3.15 to $3.20 a share.

For the fourth fiscal quarter, Wall Street is expecting Qualcomm to report earnings of 76 cents a share on revenue of $3.94 billion. For 2011, Wall Street has slightly adjusted earnings expectations to $3.14 a share on revenue of $14.75 billion.

By the numbers:

- Qualcomm shipped approximately 170 to 174 million CDMA-based device units during the March quarter, retailing for an average of $209 to $215 per unit

- 120 million units of CDMA-based Mobile Station Modems shipped in Q3 FY11

- Free cash flow: $1.16 billion, up 22 percent year-over-year

- Operating cash flow: $1.26 billion, up 33 percent year-over-year

Related:

- Adobe Q2 better than expected; Outlook solid

- Qualcomm gives Adobe's Flash a lift to more mobile devices

- Major mobile players getting desperate thanks to Apple

- NetSuite steps up large enterprise push: Lands Qualcomm, Groupon, partners with Accenture

- Qualcomm's second fiscal quarter earnings beat expectations