Qualcomm rides 4G wave in Q2, but outlook light

Qualcomm's fiscal second quarter was fueled by strong shipments of 3G and 4G smartphones, but the outlook was light due to supply chain issues.

The mobile chip maker reported second quarter earnings of $2.23 billion, or $1.28 a share, on revenue of $4.94 billion, up 28 percent from a year ago. Non-GAAP earnings were $1.01 a share. GAAP results include the sale of the Qualcomm Strategic Initiatives unit. Wall Street was expecting Qualcomm to report second quarter earnings of 96 cents a share on revenue of $4.84 billion.

In a statement, Qualcomm Chairman Paul Jacobs said the company saw "strong demand for 3G- and 4G-enabled devices across both developed and emerging regions."

On a conference call with analysts Jacobs said:

Although the manufacturing yields are progressing per expectation, there is a shortage of 28 nanometer capacity, and at this stage we cannot secure enough supply to meet the increasing demand we are experiencing. We are working closely with our partners to bring additional capacity online; however, the constraints on 28 nanometer supply are limiting our potential revenue upside this fiscal year. Looking forward, we believe we will see significant improvement in supply in the December quarter, and we will continue to work this issue aggressively.

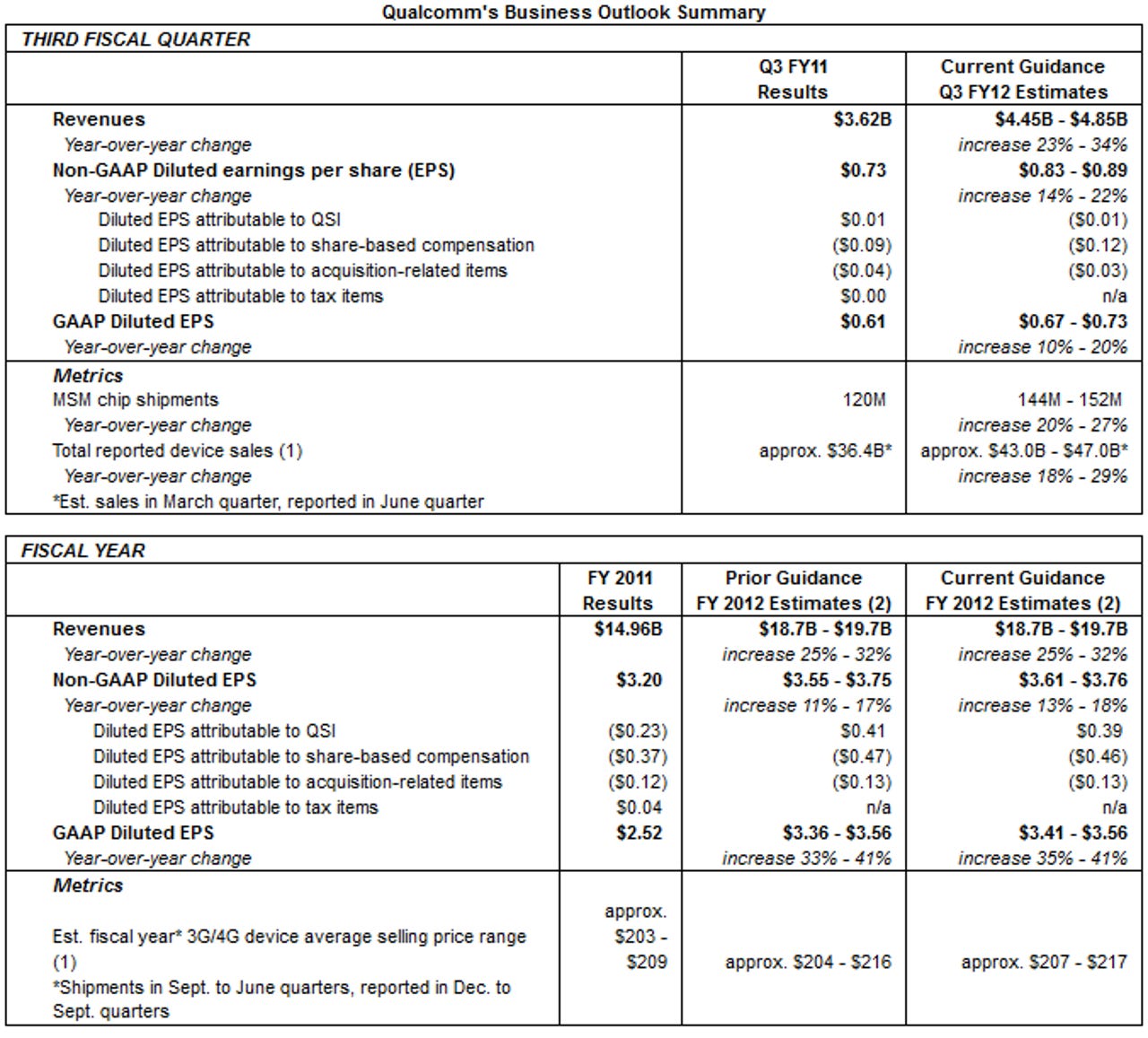

Jacobs added that growth prospects for the Snapdragon platform and Windows 8 tablets on ARM are promising. For the fiscal third quarter, Qualcomm's outlook breaks down like this:

Wall Street was looking for third quarter sales of $4.8 billion with earnings of 90 cents a share.

By the numbers for the second quarter:

- 152 million MSM chip shipments, up 29 percent from a year ago.

- December quarter 3G/4G shipments were 239 million to 243 million units at an average selling price of $211 to $217 per device.

- R&D spending was 17 percent of revenue in the quarter.