Quintiles, IMS Health merge in $9 billion deal, create healthcare analytics, IT giant

IMS Health and Quintiles agreed to merge in a deal valued at about $9 billion in a move that will create an information technology and data powerhouse in the life sciences industry. The goal: Connect clinical trials and drug research to outcomes and physicians.

The merger of equals will result in dual headquarters in Danbury, Conn. and Research Triangle Park, N.C. and aims to streamline healthcare operations, bring products to market faster and make research and development more efficient.

Perhaps the real takeaway is that the combined companies will have a petabytes of data for analytics and healthcare intelligence.

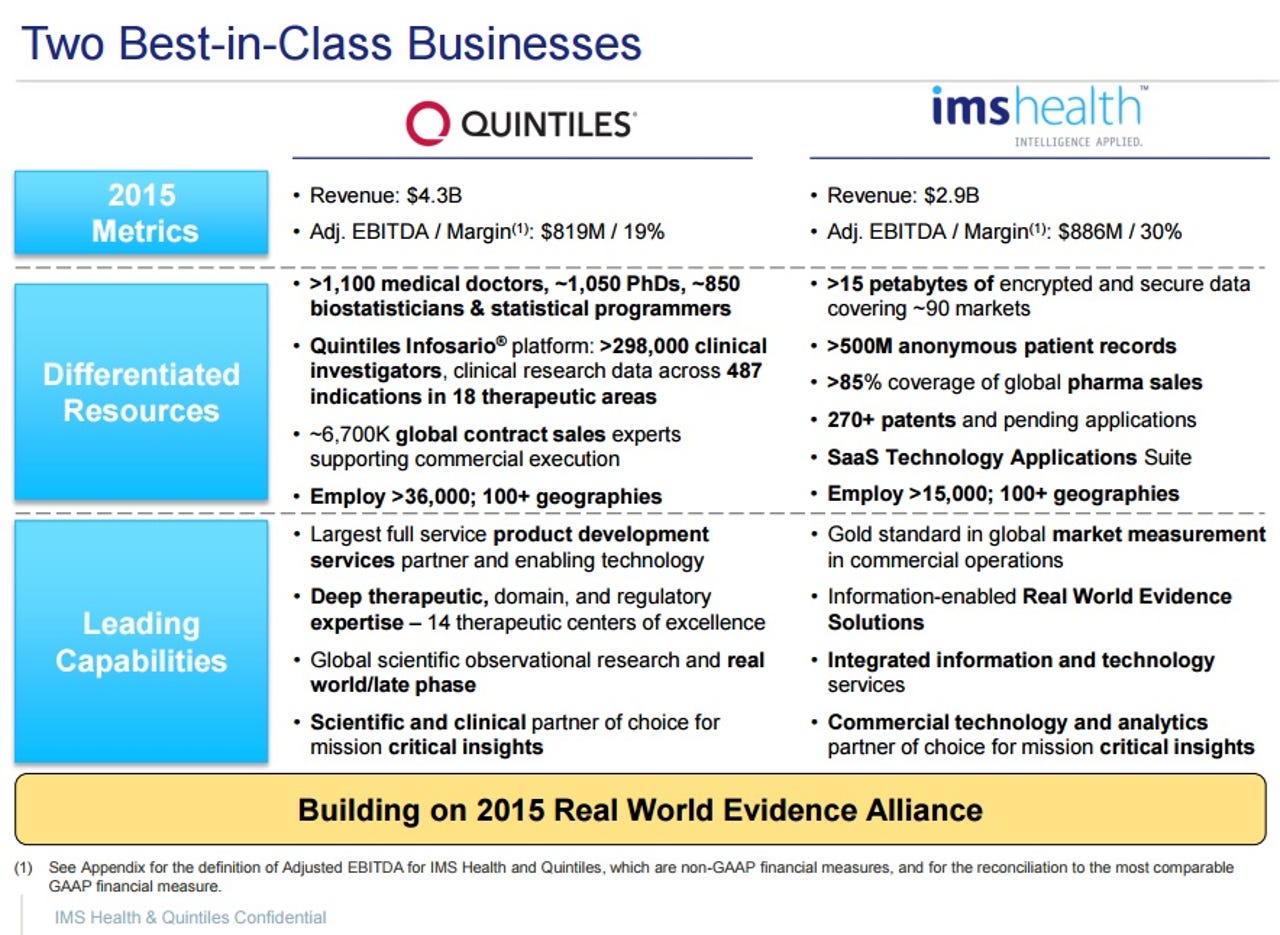

IMS and Quintiles combined will generate about $7.2 billion in annual revenue and future growth will largely ride on the companies' ability to leverage data. The new company will be Quintiles IMS Holdings. IMS Health CEO Ari Bousbib will lead the combined company while Quintiles CEO Tom Pike will become vice chairman.

During a conference call, IMS and Quintiles talked about more annual revenue growth and savings of $100 million a year, but the presentation revolved around data. IMS and Quintiles will combine clinical research software and management tools with anonymous patient records, data collection and research. Quintiles IMS Holdings will also offer analytics and outsourcing services to life sciences companies.

The combination of IMS and Quintiles comes as traditional enterprise vendors are increasingly targeting the healthcare industry. Meanwhile, Apple's ResearchKit is an interesting experiment in clinical trial recruitment. It's possible that the combination of Quintiles and IMS could ultimately reside inside a tech vendor such as IBM, Oracle or SAP.

Pike outlined the rationale for the merger:

With smaller and more stratify patient pools, and increasing complexity of clinical trial designs driving longer studies, the need for further innovation and clinical trial execution is paramount speed to market is critical with $10 million-$15 million of lost product revenue for each month of delay and regulatory approval at an individual product level.

There is an increasing need to demonstrate the value of medicines and measure outcomes. According to the IMS Institute of healthcare informatics, there is an estimated $500 billion of annual healthcare savings available from the more responsible use of medicines, which includes a better product targeting adherence, reduction of fraud and abuse and prevention.

In addition, healthcare stakeholders are rightly demanding continuous evidence of real-world treatment value to support the safety, access, and determine appropriate pricing we have witnessed this in European markets, where the health technology assessment bodies have been increasing rejection rates for new drugs with the managed care and PBMs in the United States as well.

Furthermore we see a need for evidence-based discussion between healthcare stakeholders. This connected market requires the same data and scientific methods that we are applying to Life Sciences today. For example these capabilities will support changes in healthcare payment schemes like pay for value or outcomes.

Bousbib said the merger allows the combined company to be a solutions provider instead of offering technologies implemented on a spot basis. Quintiles IMS Holdings is ultimately looking to be a provider to simplify clinical research and the healthcare system. The current Quintiles and IMS business models will remain. IMS, like other software providers, is transitioning to a software-as-services cloud model.