e4 launches virtual ID verification service in Australia

South African regulation technology company e4 on Tuesday launched its virtual biometric identity verification service in Australia.

Virtual verification of identity (VOI) allows lenders and mortgage brokers to verify new customers to relevant anti-money laundering (AML) and counter terrorism financing standards through a cloud-based application.

Latest Australian news

Typically, when consumers fill out a mortgage application online, they will need to visit a bank or post office branch to verify their identity in person.

Stuart Hosford, e4 Australia managing director, told journalists on Tuesday that old-school verification processes are cumbersome for banks and consumers alike.

"If I, as a digital consumer, want to initiate this process online, which a lot of lenders are facilitating now, it's quite frustrating to get to a certain point and then have to break that digital communication to go do something different," Hosford said.

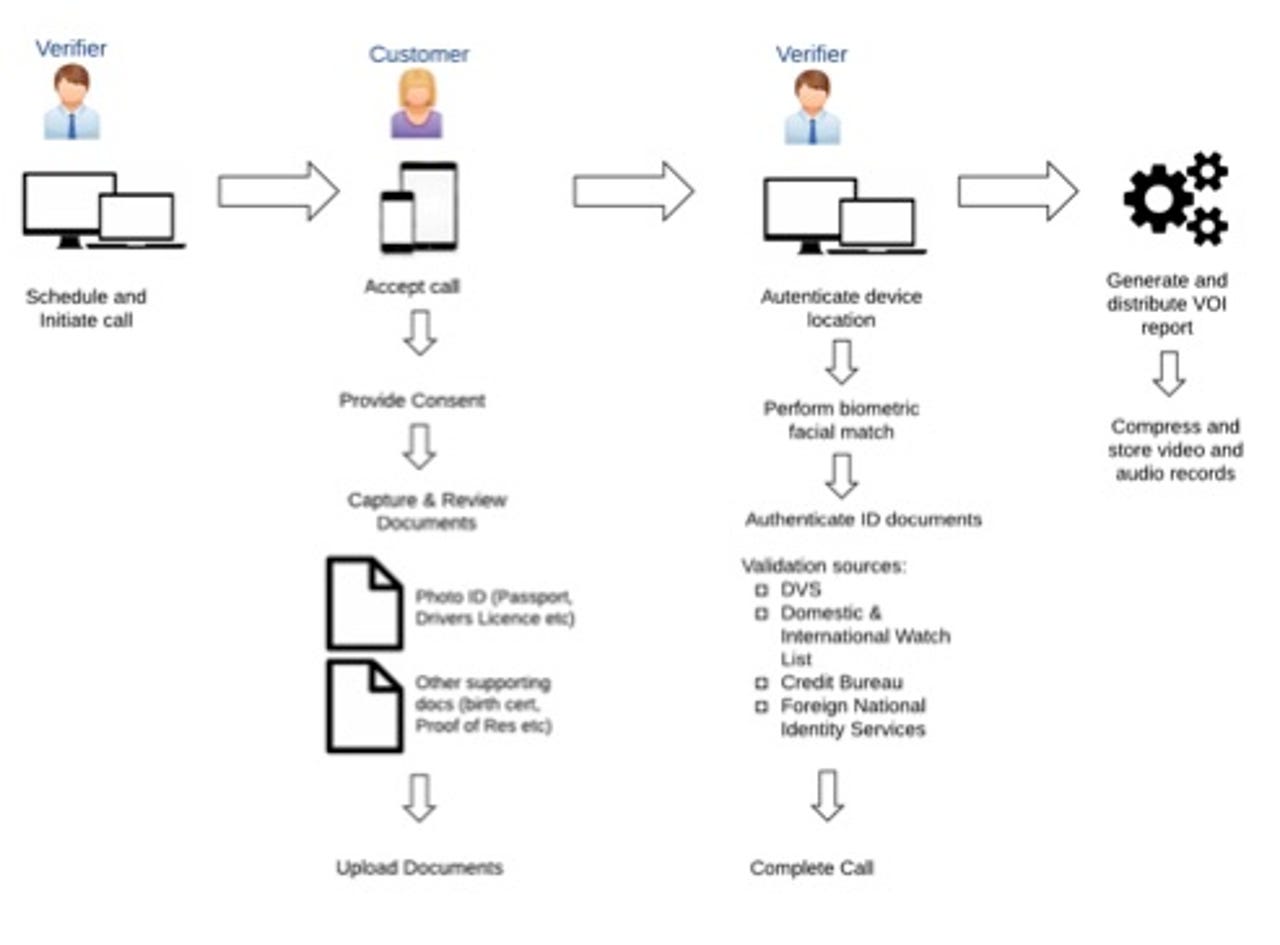

The way that Virtual VOI works is the broker or lender will initiate a video and audio call to a customer, asking them to provide photo identification and other supporting documentation to assist with the verification process.

The customer -- for whom the entire experience is mobile-based -- will take photographs of the documents and upload them for review. Those documents are validated through independent industry data sources including the Australian Attorney General's Department Documentation Verification Service, credit bureaus, foreign national identity services, and the watch lists.

During the call, the broker or lender will also perform a facial match to the ID documentation supplied by the customer, as well as validate the location of the customer.

"The purpose of [these technology components] is not to create any single pass or fail in the process. It's about running a series of checks to build an overall confidence in [the verifier's] understanding of who this person is," Hosford said.

"A very important part of the digital proposition is not to get rid of the interpersonal component. We still want to have the interpersonal component, but we'll do that over a video feed much like Skype or FaceTime."

All components of the interaction -- including the audio, video, and digital documents -- are saved and stored for future reference and proof of due diligence. At the end of the call, Virtual VOI also auto-generates a report.

"If there is an issue later down the line in terms of suspected fraud, it's [the bank's and broker's] obligation to be able to prove they did their due diligence in the identification of this person," Hosford said. "What's really valuable to them is the fact that everything is recorded from start to finish and available to the verifier."

The company is currently focusing on residential mortgage applications, though Hosford said VOI will likely be applied to other financial products in the future.

The target market for Virtual VOI is small to mid-tier lenders, non-traditional banks, and credit unions, Hosford said. The company is currently in talks with ING Direct, Bendigo and Adelaide Bank, HSBC, Credit Union Australia, and Gateway Credit Union.

However, initial distribution will be through aggregator groups such as Australian Finance Group, Aussie, Connective, and HashChing.

While Aussie is owned by Commonwealth Bank, Hosford said he is deliberately not engaging with the big four -- at least not yet.

"The big four banks are not necessarily incentivised or motivated to keep people out of branches ... They like to get people in the branches because they can cross-sell, they can maintain a relationship. It's not really in their interest to keep people out of branches," Hosford said.

"Like anything fintech, the big four will engage when they're forced to engage ... As soon as they start to get pressure from the smaller to mid-tier [banks], then they do have to jump on board."

Virtual VOI currently works on Android and iOS devices. The company will integrate Touch ID in the next iteration, with iris scanning and voice recognition also a possibility in the future, according to Hosford.

Coinciding with the rise of digital wallets such as Alipay, Apple Pay, Samsung Pay, and Android Pay, Capgemini Australia banking practice lead Phil Gomm predicted there would soon be a shift from the concept of "card present transactions", where the card is presented physically at point of sale, to the new idea of "card holder present", confirmed through the use of smart device access verification via biometric and PIN options.

In February, Commonwealth Bank announced that it had partnered with Airtasker to provide the task outsourcing company with an identity verification function for its online platform, with the pilot expected to run for some months.