RIM earnings: Solid financials expected, but nagging questions remain

Research in Motion's fourth quarter financial results should be impressive and analysts are upbeat. However, RIM is likely to field questions about the long run, new products and what happens if Apple's iPhone turns up on Verizon Wireless' network.

It's quite the balancing act. Some analysts are wary about RIM even though they have heady targets for fiscal 2011. RIM reports earnings later today with a conference call at 5 p.m. EDT.

- For the fourth quarter, RIM is expected to report earnings of $1.28 a share on revenue of $4.31 billion. For fiscal 2010, RIM is expected to report earnings of $4.43 a share on revenue of $15.2 billion. Gross margins are expected to top 43 percent for the fourth quarter and year.

- For the first quarter of fiscal 2011, RIM is expected to report earnings of $1.18 a share on revenue of $4.3 billion.

- For fiscal 2011 ending Feb. 28, RIM is expected to report earnings of $5.06 a share on revenue of $18.99 billion. Gross margins throughout fiscal 2011 are expected to range from 43 percent to 42 percent.

Add it up and analysts expect RIM to tell a few positive tales:

- Strength in international sales.

- Enterprise spending is on the rebound.

- Strong unit sales---roughly 11.03 million devices shipped in the quarter.

- Average selling prices likely lower than the $320 expected.

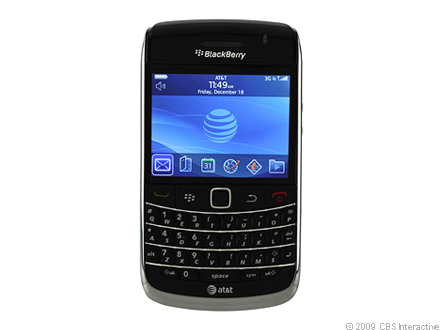

- Strength at all major carriers, notably Verizon and AT&T.

- The company is the U.S. leader in smartphones and holding share.

- Strong sales of the Bold and Tour point to momentum.

But amid those positive data points sits a general question mark about RIM's prospects. Macquarie analyst Phil Cusick captures the RIM conundrum:

In 2010 we expect RIM's developed market consumer smartphone share to see continued challenges from players like Motorola and Apple and to hear increasingly about Nokia's consumer email solution pressuring RIM's growth in Europe and Asia. We also expect marginal incursions into the enterprise space from Apple, but for the most part for RIM to retain its dominance and may even benefit from an enterprise rebound in coming quarters.

What RIM really needs is a new product cycle. Stifel Nicolaus analyst Sanjiv Wadhwani said in a research note:

Looking ahead, the biggest risk could be the August quarter with a plethora of smartphones to be released from Nokia, Samsung and a new iPhone from Apple (potentially coming to Verizon after September). However, China (China Telecom launches in the summer) could help offset the competitive pressures.

These rival smartphones could present a problem for RIM, which could unveil new devices---or at least highlight them---at its analyst day April 26. RIM and Android devices have a roughly 50-50 split of sales at Verizon. It's unclear whether that split can hold with a constant barrage of Android devices hitting the market and the potential arrival of the iPhone at Verizon.

The larger question is whether RIM---a carrier and enterprise favorite---needs the sex appeal that some of the other devices are generating.

Related: