RIM reports strong Q3, shares soar. What competition?

Research in Motion, the maker of the Blackberry, reported better than expected earnings for its third quarter and offered a bright outlook for Q4, despite rumblings about heated competition in the smartphone space, as well as a widespread outage earlier today. Shares were up more than 12 percent in after-hours trading.

For the third quarter, the company reported net income of $628.4 million, or $1.10 per share, beating the $1.04 eps Wall Street had been expecting. It reported revenue of $3.92 billion, up 41 percent from the year-ago quarter. (Statement)

In addition, the company said it added 4.4 million net new Blackberry subscriber accounts during the quarter, bringing its total subscriber base to about 36 million. It shipped 10.1 million devices during the quarter.

Looking ahead, the company said it expects revenue to be in the range of $4.2 billion to $4.4 billion and eps in the range of $1.23 to $1.31. Wall Street is expecting eps of $1.19 on revenue of $4.24 billion. RIM said it also expects to add 4.4 million to 4.7 million new subscriber accounts.

In a statement, co-CEO Jim Baisillie said:

We are pleased to report record shipments of more than 10 million Blackberry smartphones during the third quarter with higher than expected revenue, earnings and subscriber growth. ROM is experiencing a great start to the holiday buying season and the strong Q3 resulots and Q4 outlook clearly reflect the strength of our diversified product portfolio as well as the success of our efforts to expand into broader customer segments and new geographies while maintaining our strong position in North America.

During a call with investors, Baisillie spent time talking about growth in international markets, including an announcement of an agreement with China Telecom to offer Blackberry products and services to its customers. He had no details today but more information would come in the months ahead. He called China "an important and strategic market for RIM."

Baisillie, asked about relationships with carriers, noted that there's "a lot of turbulence in the ecosystem right now" and that "you can't force love" with partners. Sure, competitors will be courting long-time carrier partners (note: Google-Verizon), as well as enterprise customers. He said that the overall market is changing - and expanding. Different carriers have different objectives and strategies and want to maintain their relevance. RIM, he said, tries to be a good partner, that "represents an element of consistency" and integration.

He was also asked whether growth was focused on the international markets, including China, or whether North America is still part of the game. Baisillie said there's still opportunity in both and said that the entry-level and SMB markets were areas to watch for RIM.

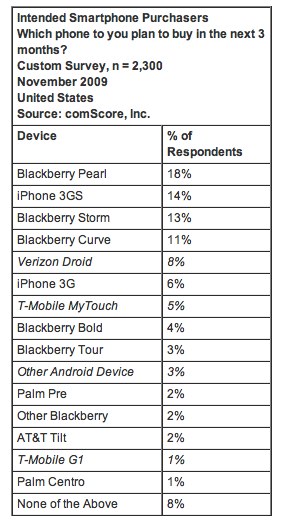

Earlier today, comScore released a report called "Android: Crashing the Smartphone Party," which suggested that the rapid rise in awareness about Android, as well as the continued momentum behind the iPhone, could shift usage patterns. According to the comScore chart (left), 51 percent of consumers eyeing smartphones next year plan to pick a Blackberry device, while 20 percent will grab an iPhone and 17 percent will go Android. That's pretty impressive seeing how Android is in its infancy and has a market share of less than 4 percent.

Critics are correct to point out that the Blackberry software is stale and needs to step up its game if it plans to compete with the others. Likewise, they are aware that the competition is reaching out to RIM's bread-and-butter: the enterprise market.

Previous coverage: Can RIM keep up with Apple and Android?