RIM's new BlackBerry sell-through 'lackluster' as QNX phone rushed, says analyst

Research in Motion has decent BlackBerry OS 7 sell-in to the channel, but the actual sell-through to consumers is "lackluster," according to one Wall Street analyst.

Jefferies analyst Peter Misek said in a report that RIM is seeing lackluster BlackBerry OS 7 devices and older models aren't selling. Misek made his claims based on Jefferies quarterly handset survey.

Meanwhile, RIM is rushing its QNX-based handsets to market so they can launch at CES in January and the Mobile World Congress in February.

In a research report, Misek said:

We believe RIM management strongly desires to have a QNX phone in time for the Consumer Electronics Show (Jan) and Mobile World Congress (Feb). In an attempt to meet this deadline and to meet guidance of an early 2012 launch, we believe the phone is being rushed and features are being stripped. Most importantly, the integration of BES/BIS email/calendar is proving difficult, and we think a QNX phone without these would be a disaster. Alternatively, RIM might launch an incremental BB OS update (OS 7.5) in H1:12 followed by a full QNX phone in H2.

These moving parts indicate that RIM's fiscal second quarter ending Aug. 31 is probably ok as new BlackBerry devices offset tanking sales of older models. Misek is predicting that RIM will report earnings of 77 cents a share on revenue of $4.4 billion. That's off from Wall Street estimates calling for earnings of 87 cents a share on revenue of $4.5 billion.

In a research report, Misek said that RIM will predict that it will ship 14 million to 15 million units in its fiscal third quarter, but ultimately fall short. He cut his estimate on RIM from hold to underperform.

Amid these moving parts, analysts are torn between hopping on the RIM bandwagon for a quarter or so and panning the company's long-term prospects. For instance, UBS upped its RIM price target to $32 on the bet that the new BlackBerry devices will help the quarter. Misek's price target is $25.

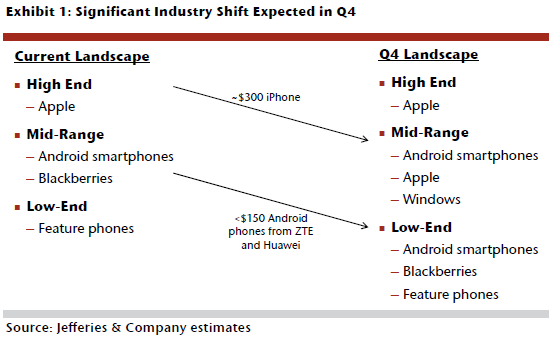

Misek argued that RIM is facing tough competition from Android phones from ZTE and Huawei going for less than $150.

Related: