Salesforce splurges on Quip: What to make of the deal

Does Salesforce really need to duel in the document management space?

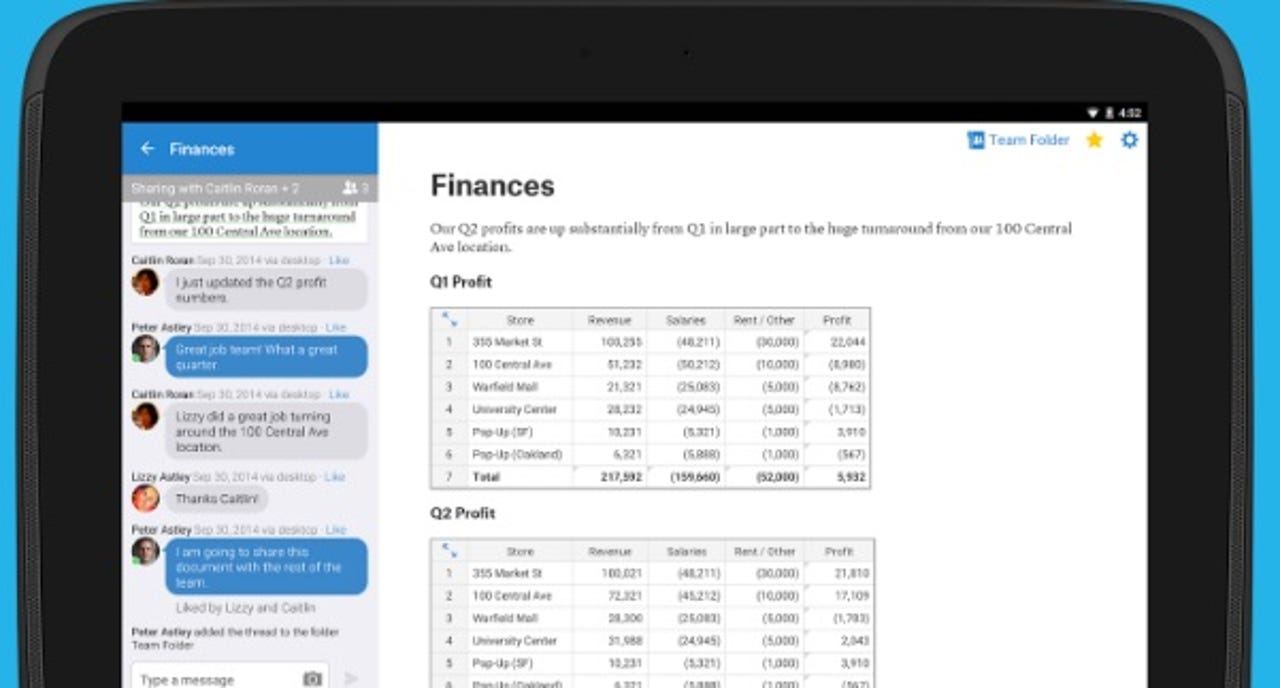

Salesforce has acquired Quip, a collaboration tool akin to Google Docs with a dash of Slack, in a deal valued at $582 million not including the stake Salesforce Ventures already holds.

The big question: Why?

Now it's clear that collaboration is a key part of everything. Document management and swapping comments is key. Workflow, bots, and project management are also critical. But does Salesforce really need to duel in the document management space. Won't Microsoft Office and Salesforce commingle nicely -- as will Google Docs?

Meanwhile, Microsoft and Saleforce already outlined a tight integration with Office and CRM via Lightning components.

So, what should we make of the Quip deal? Here are a few thoughts.

- Everyone needs a 'we're like Slack' story. Slack has grabbed a lot of mind and media share on the collaboration front. Quip gives Salesforce something to talk about on the Slack envy front.

- Does document management help keep customers or differentiate Salesforce? Remember Do.com? It's hard to argue that there's any value in getting into the Microsoft Office and Google Docs scrum.

- What does Quip bring that Chatter didn't for real-time collaboration? Salesforce's real-time collaboration vision is on target, but it has largely nailed it. It's unclear whether Quip will add beyond incremental functionality.

- Microsoft: friend or foe? Salesforce lost LinkedIn to Microsoft. And now Salesforce starts playing with documents. It may be coincidence. Or not. Macquarie Research analyst Sarah Hindlian summed it up well in a research note:

While there are many directions Salesforce can take Quip, we believe this acquisition positions Salesforce, should it choose, to offer some business productivity tools (a market historically dominated by Microsoft's Office), while the collaboration, communication, and workflow management tools may address growing enterprise demand for centralized collaboration tools demonstrated by the rapid rise of collaboration start-up Slack. For example, Quip can enable sales teams/managers to collaborate on sales pitches, deals and more. We find the purchase of a vendor that fits nicely with business process tools - the market where Microsoft leads with Office - particularly interesting following the competitive bid between the two companies over LinkedIn, which we believe was motivated by the need for more sophisticated/machine learning empowered lead generation tools for both Salesforce and Dynamics CRM Online. It begs the question: is Microsoft friend or foe? We can see either, and while it remains to be seen, we are certainly seeing some early signs of cross-pollination.