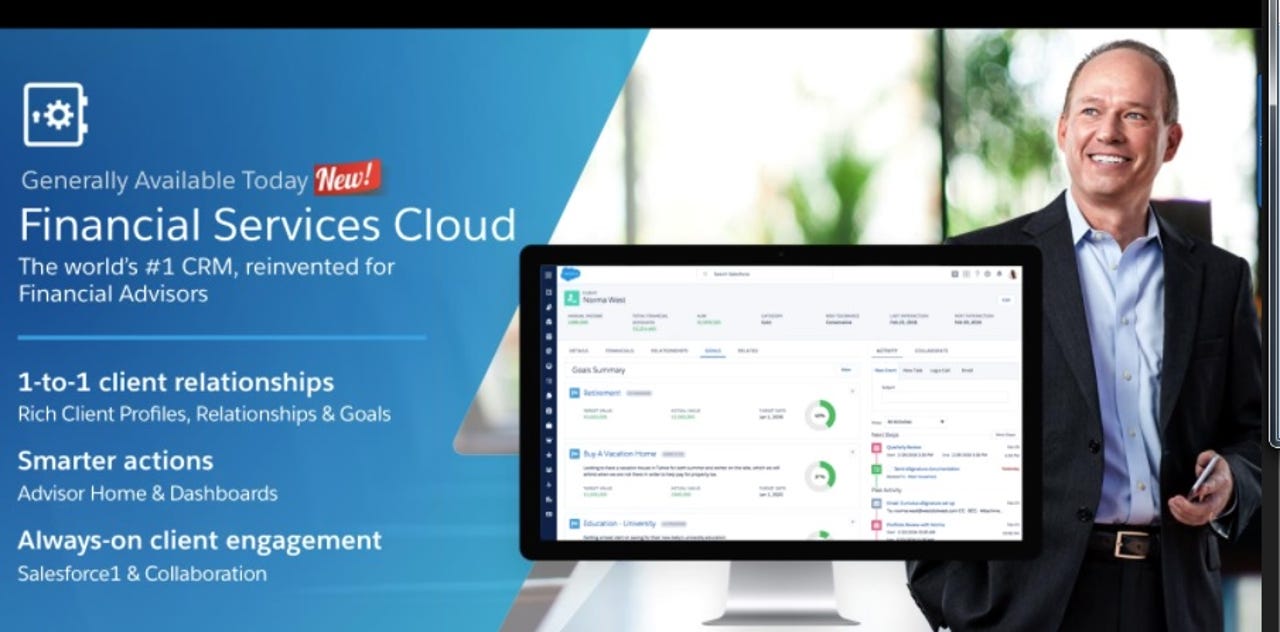

Salesforce's Financial Services Cloud kicks off: Can personalized money guidance scale?

Salesforce's Financial Services Cloud is now generally available and one of big questions is whether the effort can scale personalization of wealth management enough to court Millennial investors.

For Salesforce, the financial services push is partly a repackaging of existing tools with a heavy emphasis on growing accounts and assets under management for customers. The other thread with the financial services effort is that Salesforce is targeting industries more.

According to Salesforce, the Financial Services Cloud will start at $150 a month per user. More than 20 technology and integration partners were also announced to further the effort.

Simon Mulcahy, general manager of Salesforce's Financial Services Cloud, outlined how investors are dissatisfied with their advisors and want more collaborative advice on finances and goals.

"The process needs to be personalized," he said. "Clients want advisors to step up to personalized guidance." Salesforce is attempting to blend its traditional service desk capabilities with advisors who have to do more to add younger clients and their assets.

Also: Can Salesforce continually expand, become relationship operating system?

The Financial Services Cloud initially seems to be aimed at large firms that are looking to bag more assets and improve productivity by eliminating the need to toggle between systems. Firms would in theory also be able to focus on the most profitable clients.

Mulcahy didn't have data on how investors felt about advisors who work on commission vs. fee only. I'd argue that the sales guy meets advisor shtick is part of the reason clients are dissatisfied. Salesforce's argument is that banks and insurance companies are all boosting their collaborative approaches.

And although large financials services firms were touted initially, Mulcahy said that small advisories could also benefit from the outreach and Financial Services Cloud tools.

The features of the financials services effort include:

- Client Profiles and Client Households, which give advisors a view of each client and network. The aim is to build 1:1 relationships.

- Wealth Home Page automates admin tasks so advisors can be more productive.

- Collaboration tools to consult with investors on an ongoing basis.

To accomplish this personalization and advice at scale, Salesforce plans to use a mix of automation, analytics and engagement. What's unclear is whether face-to-face meetings will be enhanced by the ongoing communication.

"An advisor would be able to manage more clients day-to-day and grow that book of business," said Mulcahy.